Financial planning is a process through which an individual can chart a roadmap to meet expected and unexpected needs in life. The intention is to take necessary steps to ensure that the individual is equipped to accomplish financially what he has set out to achieve and is prepared to deal with contingencies as well.

Two factors are responsible for the importance of financial planning – inflation and changing lifestyles. Financial planning can ensure that one is equipped to deal with the impact of inflation, especially in phases like retirement when expenses continue but income streams dry up. The second factor is changing lifestyles. Financial planning has a role to play in helping individuals both upgrade and maintain their lifestyle.

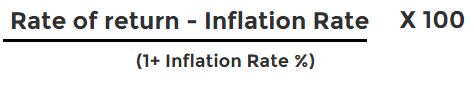

Ultimately, effective financial strategizing empowers the investor to effortlessly address unexpected circumstances, safeguarding their economic stability. At its core, financial planning is not a very difficult task. All it takes is discipline and religious adherence to the principles of financial planning. At each phase of the financial journey, discipline plays a crucial role – from defining goals to implementing the necessary strategies to accomplish them. The foundation of sound financial planning lies in establishing objectives, aligning investments with one’s risk tolerance, and determining appropriate asset allocation. Moreover, it is vital to factor in tax and inflation rates when making investment decisions to accurately calculate the real returns, as these might substantially deviate from the nominal rates provided. The simple formula for calculating the Real Rate of Return (RRR) more precisely is:

What this means is that you won’t be right to go merely by the coupon rate on your investment. Look instead at the real rate of return.

How to Get Started?

Alice: Which road is the right one to take?

Mad Hatter: Depends on where you want to go?

Alice: I do not know!

Mad Hatter: Then any road will get you there!

“If you don’t know where you are going, any road can take you there”

~ Lewis Carol, Alice in Wonderland

Without a clear destination in mind, reaching your desired financial goals becomes a daunting task. These objectives may span a wide spectrum, including purchasing a vehicle, saving for your children’s education and marriage, and ensuring a secure retirement. The trouble is that most individuals tend to ignore the “What” part i.e. what do you want to achieve? Instead, they concentrate on the “How” part i.e. how will you achieve the same? This, in turn, leads to an ad hoc and directionless investment pattern that may not yield the desired results.

There are some pointers that must be borne in mind when you are setting objectives: Firstly, at any point in time, you are likely to face multiple objectives. For example, assume that you are a 35-year old individual with a 5-year old child and are yet to own a house property or provide for your retirement. Then, providing for the child’s education, accumulating a corpus for buying a house property, and retirement planning are some of the pertinent objectives. The crucial step ahead is to prioritize your goals diligently. Additionally, you may encounter circumstances where even with well-defined objectives, the resources at your disposal might not be sufficient to meet all of them. The key lies in starting off as early as possible with the investible funds that you have and making up for the shortfall at a later date when hopefully there are more funds at your disposal.

Finally, setting objectives should not be influenced by external factors like your friends, relatives, or peers. This principle is of utmost importance, as the objectives you establish will inevitably determine the outcomes you ultimately attain.

Connect with a planner.

Connect NowHow to Get There?

Having discussed how to set objectives, let’s now take a look at how you should go about achieving an objective of becoming a crorepati in the next 30 years. We shall assume three scenarios, wherein investments made to achieve the stated objective (becoming a crorepati), yield returns of 12% pa, 15% pa, and 17% pa.

Clearly, becoming a crorepati isn’t as difficult as it is made out to be!! In conclusion, getting your objectives right and having the necessary investment plans in place will ensure that you are on a sound footing to achieve your goals – and that’s a fact, not just a cliché. To cater to the investment styles of different persons (since we all are so different from each other), a suggested custom plan for allocation amongst various investment avenues are as given in a parallel link (Broad Custom Plans as per Life stage). Another link, Investing and Giving, gives out the plus and minus points of each investment avenue, as also the noble cause of Charity, which is actually an investment in your country’s future.

Finally, It’s All About Your Risk Appetite

Put bluntly, the risk is the amount of money that the investor can afford to lose in the interim in his quest for a certain return on his investment. If an investor can afford to lose only a moderate amount of money, then his risk appetite is on the lower side. Below are highlighted some of the key points to keep in mind while evaluating your own risk appetite:-

- Make risk assessment a priority when choosing investments, as risk and returns are directly proportional. Higher risk leads to higher potential returns. Determine your risk appetite as the guiding factor, rather than solely focusing on investment opportunities.

- Timing plays a crucial role in investment risk. Many investors face losses when they invest in opportunities that have already peaked. Stay mindful of the timing and avoid chasing investments that have already had significant gains.

- Risk diminishes over time. Equities are perceived as the riskiest in the short term but become safer over the long term. For long-term goals, consider investing in equities, while debt products are more suitable for short-term goals.

- Adjust your risk exposure as you age. As retirement approaches, consider shifting a major portion of your assets from equity to debt to mitigate short-term volatility and align with a decreased appetite for risk.

Basic Mantras of Saving Money

- Spend wisely and live within your means to have funds for savings.

- Create a budget to track income and expenses, identifying areas for improvement.

- Cut unnecessary expenses like dining out and unused subscriptions.

- Make saving a priority by allocating a portion of your income to savings.

- Automate savings to ensure consistent contributions.

- Track your spending to understand patterns and make adjustments.

- Compare prices and seek discounts for cost-effective purchases.

- Avoid impulsive buying and prioritize needs over wants.

- Save on utilities through energy conservation.

- Plan for the future by establishing emergency funds and contributing to retirement accounts.

And, the Basic Mantras of Making Money

“Compound interest is the eighth wonder of the world. Patience is the ninth wonder of the world”

~ Albert Einstein

One of the key principles for successful investing is to start as soon as possible, recognizing the potential of compounding. By initiating your investments early and consistently reinvesting your returns, you can benefit from the power of compounding growth. The longer you remain invested and the higher the interest rates, the more rapidly your wealth can accumulate. Time and compounding work hand in hand, so it is essential to take action promptly to make the most of this wealth-building strategy.

Research and history indicates these golden rules for all investors:-

- Set Clear Financial Goals: Define your investment objectives to guide decision-making.

- Diversify Your Portfolio: Spread investments across different assets to minimize risk.

- Invest for the Long Term: Focus on long-term growth and benefit from compounding.

- Understand and Manage Risk: Assess and mitigate risks associated with investments.

- Conduct Thorough Research: Make informed decisions based on comprehensive analysis.

- Avoid Emotional Decision-Making: Stick to your strategy and avoid impulsive actions.

- Stay Disciplined: Maintain consistency in your investment approach.

- Continuously learn and adapt: Stay updated, learn from experiences, and adjust strategies.

- Regularly Monitor and Review: Track performance and make necessary adjustments.

These golden rules provide a framework for successful investing, helping investors make informed decisions and navigate the complexities of the financial markets.

Research and history also indicate these common investment mistakes:-

- Lack of Diversification: Failing to diversify your investment portfolio increases vulnerability to risk.

- Emotional Investing: Making decisions based on fear or greed can lead to poor outcomes.

- Timing the Market: Attempting to predict market fluctuations is challenging and unreliable.

- Lack of Research: Failing to thoroughly research investments leads to uninformed decisions.

- Chasing Hot Tips and Trends: Relying on rumors, tips, or media hype without conducting due diligence can result in impulsive and uninformed choices.

- Overconfidence and Lack of Risk Management: Overconfidence in investment abilities can lead to excessive risk-taking.

- Neglecting Long-Term Goals: Focusing solely on short-term gains without considering long-term objectives is a mistake.

- Failure to Rebalance: Neglecting to regularly review and adjust your investment portfolio can result in an imbalanced allocation.

By avoiding these common investment mistakes and adopting a disciplined and well-informed approach, you can increase your chances of achieving your financial goals while managing risks effectively.

In a Nutshell

- Inflation, i.e. a rise in the general price level, is one of the major factors that necessitate financial planning.

- Financial planning aids individuals to upgrade and maintain their lifestyles and also helps meet contingencies.

- Setting objectives is the first step in the financial planning process. To secure success, every goal necessitates a dedicated and tailored investment strategy.

- When faced with multiple objectives, prioritize and start off with the most pressing one.

- Start early and make up for any deficit at a later stage. Don’t delay the investment process on account of a small shortage of funds.

- Always evaluate the risk in an investment opportunity before the return. Invest in line with your risk appetite, not the expected return.

- Market-link investments like equities get less risky with the passage of time. In fact, Mutual Funds investing in Equity (shares) are the least risky if the investment horizon is beyond 5 years!!

- Risk is a very personal thing; there is no formula to calculate it.