RBI’s Latest Monetary Policy: What It Means for Investors and Borrowers

The Reserve Bank of India has hit the pause button again! In its October 2025 policy, RBI kept the repo rate unchanged at 5.50% — a sign that our economy is growing steadily and inflation is finally calming down.

💡 Repo rate is simply the rate at which RBI lends money to commercial banks — it decides how expensive or cheap loans become for all of us.

So, why are prices still rising a little? Mostly due to higher fuel costs and festive season demand, though they’re expected to ease soon as supplies improve and GST rates are rationalised.

Here’s what this means for you 👇

For Borrowers

No surprise jump in your EMIs this month! Home, car, and personal loans remain stable. But if you have a floating-rate loan, stay alert — a future rate hike could raise your EMI by ₹1,200–₹1,500 on a ₹30 lakh loan.

For Investors

Debt funds look steady, equities have room to grow, and fixed deposit rates stay unchanged. It’s a good time to diversify—spread your money across equity, debt, and gold for stability.

RBI’s move reflects confidence in India’s growth story — steady, strong, and sensible.

(Contributed by Riya Bhandari, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

The 50/30/20 Rule: Simplifying Budgeting for Financial Freedom

Managing money can feel confusing — bills, goals, and temptations all fighting for your pay check. But what if there was a simple way to bring balance?

Enter the 50/30/20 rule — a stress-free method to plan your finances without complicated maths. Here’s how it works:

- Needs (50%): This covers life’s essentials — rent, groceries, electricity, transport, and insurance. These are your non-negotiables that keep life running smoothly.

- Wants (30%): This is the fun part! It’s for dining out, Netflix, travel, or hobbies — all the things that make life enjoyable. Spending here guilt-free keeps your budget realistic and balanced.

- Investment and Saving (20%): This portion builds your future — creating an emergency fund, investing in mutual funds, or saving for retirement. It’s what turns your income into long-term security.

The beauty of the 50/30/20 rule lies in its simplicity and flexibility. It helps track spending, encourages mindful financial choices, and creates a foundation for financial freedom. Whether you’re just starting out or looking to regain control of your finances, this rule is a powerful starting point for building a healthier money mindset.

(Contributed by Anjali Tomar, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

Have You Forgotten Your Money? Discover It Through RBI’s UDGAM Portal!

Have you ever changed banks, moved cities, or simply lost track of an old savings account or fixed deposit?

You’re not alone. Thousands of Indians have unclaimed deposits lying idle with banks — often due to inoperative accounts, unclaimed term deposits, or funds left untouched after account holders move or pass away.

To address this issue, the Reserve Bank of India (RBI) launched a Centralised Web Portal — UDGAM (Unclaimed Deposits – Gateway to Access Information) on August 17, 2023.

What does UDGAM do?

This initiative aims to simplify the process of tracing and claiming forgotten or unclaimed deposits across multiple banks, all in one convenient place.

Through UDGAM, individuals can easily search whether they have any unclaimed deposits with participating banks, without needing to visit each bank separately. The portal provides transparent access to information and promotes financial awareness, helping people reclaim what is rightfully theirs.

How to Use It?

Visit the RBI UDGAM website, register with your basic details, and enter your name or PAN. The system will show any unclaimed accounts linked to you and guide you through the claiming process.

This initiative is a big step toward financial inclusion and digital empowerment. So, take a few minutes today — who knows, you might just rediscover some forgotten wealth waiting for you!

(Contributed by Aditya Bhola, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

What did our clients ask us in the last 7 days

Question – Can you explain how LTCG (Long Term Capital Gains) and STCG (Short Term Capital Gains) taxes are applied to Gold and Silver Mutual Funds? How does their taxation differ from that of physical Gold and Silver transactions?

Our Reply

Gold and Silver investments can be owned either through Mutual Funds (Fund of Funds) or by purchasing Physical Gold/Silver directly. While both aim to capture the same underlying asset performance, the taxation treatment primarily depends on the holding period and mode of investment.

Here’s a quick comparison 👇

Though taxation is the same, Gold & Silver Mutual Funds offer higher liquidity, lesser purchase costs, requirement of lower minimum purchase value and easier transactions — making them a much smarter and hassle-free choice.

💡 Our Suggestion:

For investors who prefer flexibility and transparency without worrying about storage or purity, Gold & Silver Mutual Funds are the smarter long-term choice.

(Contributed by Team Arjun, Hum Fauji Initiatives)

Want to include precious metals smartly in your portfolio? Connect with Hum Fauji Initiatives for expert guidance today!

November 6th, 2025How NRIs Can Cut Taxes on Indian Income

Are you an NRI earning from India?

Here’s a smart move: you can reduce or even eliminate taxes on your Indian income — legally and easily!

If you live outside India for 183+ days a year, you qualify as an ‘NRI’. That brings you some powerful benefits:

🔹 NRE/FCNR Interest is 100% Tax-Free – NRE and FCNR are bank accounts in India where your foreign earnings grow without tax. FCNR earns interest in foreign currency — safe from exchange rate changes!

🔹 Lower or Zero Tax on Dividends & Capital Gains — thanks to international tax treaties (called DTAAs).

🔹 Zero Tax on Mutual Fund Gains under certain treaties (like India–Singapore DTAA).

💡 New Smart Move – Section 115F

Sold shares or foreign assets bought with NRE funds? Reinvest that amount in similar assets within 6 months — and your Long-Term Capital Gains can be tax-free! Just hold for 3 years. Do this repeatedly and keep saving.

How to Claim Benefits

- Tax Residency Certificate (TRC): From your country.

- Form 10F: Submit with TRC to Indian tax authorities.

- DTAA Provisions: Match income with applicable DTAA clauses.

- Timely Reinvestment: Crucial for Section 115F benefits.

Even for exempt income, TDS may apply; ensure correct paperwork to avoid excess deductions. Combining DTAA advantages with Section 115F reinvestment allows NRIs to achieve near-zero tax on Indian earnings.

Why pay more when smart planning helps you save?

(Contributed by Aditya Bhola, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

Is Your Retirement Corpus Battle-Ready for Your Financial Goals?

Retirement isn’t the end—it’s your next mission. And like every mission, it needs planning, preparation, and the right gear. With increasing life expectancy and rising living costs, your retirement savings must be strong enough to support you for 25 to 30 years or more.

Before Retirement: Build Your Base

In your working years, you balance EMIs, children’s needs, and lifestyle costs. But don’t lose sight of the future.

Want ₹75,000/month after 60? You’ll need around ₹2.5–₹3 crore, depending on inflation.

Start early. Small SIPs (Systematic Investment Plans) in mutual funds grow big over time.

After Retirement: Income Must Continue

For Armed Forces personnel, pension is a strong foundation. But is it enough? Medical costs, inflation, and unforeseen needs demand more. Strengthen your income with Tax-efficient Mutual Fund SWPs – Create a second monthly income with inflation protection.

Inflation is the Silent Enemy

Your monthly expenses of ₹50,000 today = ₹1.3 lakh in 20 years.

If your plan isn’t inflation-proof, even a big fund may fall short.

The Winning Strategy

Pension + steady income + smart investing = stress-free retirement.

Save regularly, invest wisely, review often, and mix growth with safety. That’s how you make your retirement corpus battle-ready.

(Contributed by Riya Bhandari, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

Gold and Silver Surge: Is It Time to Invest? If so, How?

With global tensions and fears of economic slowdown, gold and silver are making a comeback—and smart investors are paying attention.

Gold & Silver MFs (Mutual Funds) let you invest in these precious metals without buying physical jewellery or coins. They’re simple, secure, and easy to buy or sell anytime.

Why Should You Consider Investing in Gold and Silver MFs?

- Inflation Protection – Precious metals often hold value when prices rise.

- Portfolio Diversification – They don’t always move with stocks, reducing risk.

- Crisis Shield – Tend to do well in market crashes or geopolitical tension.

- No Storage Hassle – Easy to buy/sell like any other mutual funds.

- Affordable Start – Invest with just a few hundred rupees.

But Consider the Flip Side:

- No Regular Income – Unlike FD or bonds, MFs don’t pay interest.

- Price Fluctuation – Prices can fall when global fears ease.

- Not a Standalone Strategy – Over-allocating to metals can hurt long-term growth.

🔁 Ideal Allocation: 5–10% of your portfolio—enough to cushion risk, not derail goals.

Gold and silver won’t make you rich overnight—but they can protect what you’ve worked so hard to build.

(Contributed by Anjali Tomar, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

What did our clients ask us in the last 7 days

Question – I jointly own a house property with my wife, and we plan to sell it this year. Should the sale proceeds be received entirely in my bank account, or should they be split between my and my wife’s bank accounts? Also, how can we both claim the capital gains exemption under Section 54EC if we invest in eligible bonds?

Our Reply –

This is an important aspect of property sale planning. Here’s what you should keep in mind:

- Sale Proceeds – How Should They Be Received?

- If the property is jointly owned (e.g., between spouses) on paper, the sale amount should be split as per ownership in which the price of purchase was contributed by the two owners. Merely mentioning it in the property documents as joint is not the proof of the ratio in which ownership will be counted.

- Each co-owner should receive their share directly into their own bank account, where they are the primary account holder even if the bank account is jointly held.

❌ Avoid transferring the entire amount to one person—it can trigger tax issues or scrutiny.

- Rationally calculate what is a better way for tax planning of Capital gains?

- The seller(s) can either pay the tax at prevailing rates and invest the amount in good investment avenues; Or invest the Capital Gains in specified Capital Gains Bonds (under Tax Section 54EC like NHAI, REC CG Bonds); Or invest in another residential property.

- Suit which method, or a combination of methods is best in your case as per requirements and tax saving purposes.

- The tax exemptions are individual, not joint—each co-owner’s capital gains part needs to be treated separately.

A well-planned sale doesn’t just save tax—it protects your wealth. If you’re unsure about the next steps, we’re here to ensure every rupee works in your favour in such cases.

(Contributed by Team Arjun, Hum Fauji Initiatives)

📞 Need help planning your capital gains strategy on sale of a property or any other asset? Reach out—we’re here to help you in each aspect of your asset sale journey.

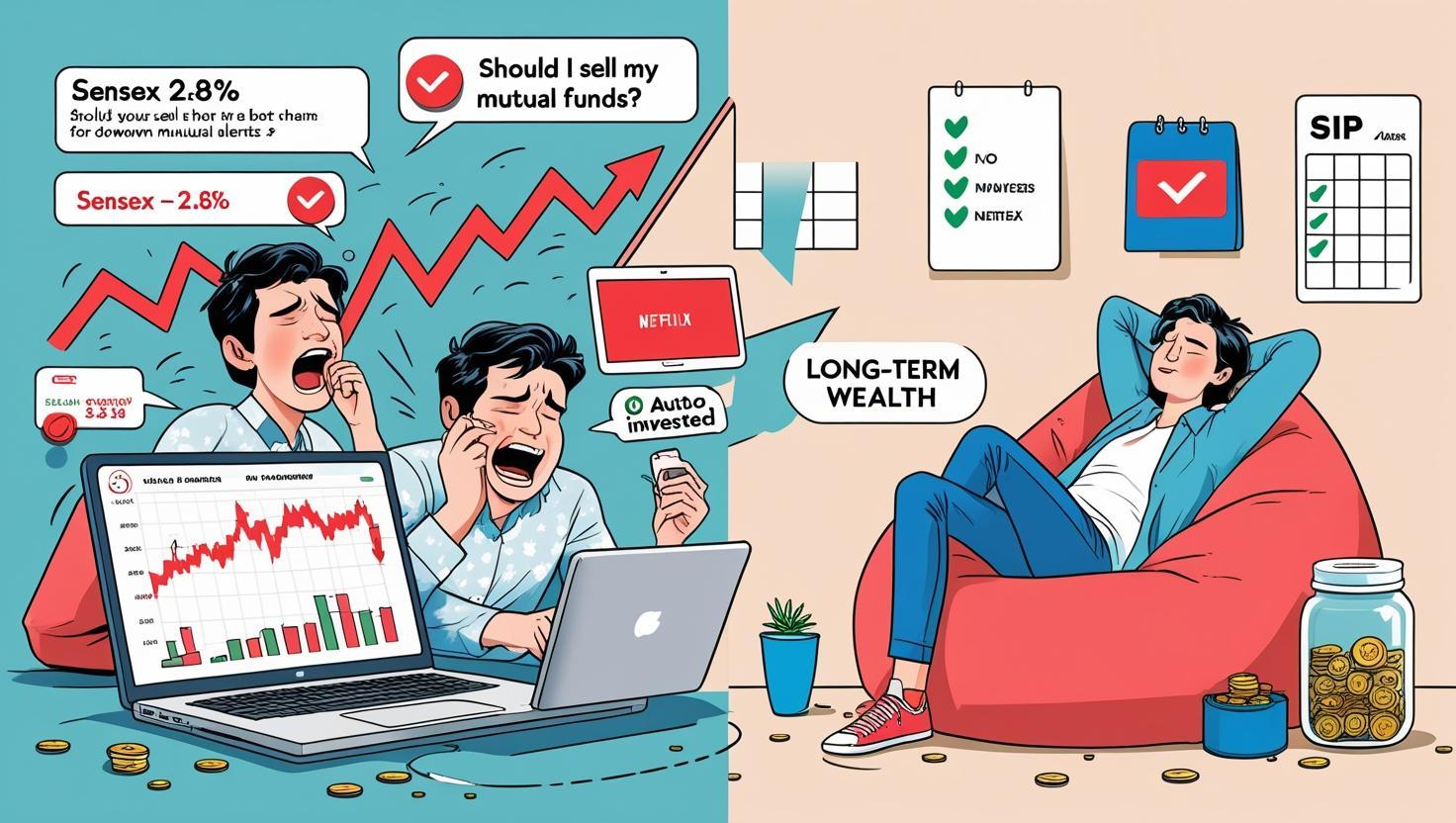

June 25th, 2025Why “Doing Nothing” Might Be the Best Thing for Your Money Right Now

Stuck in traffic – you shift lanes hoping to move faster.

Suddenly, your old lane zooms ahead—and you’re stuck again.

That’s exactly how many people treat their investments.

Jumping around too often, hoping for better returns, but ending up worse off.

Welcome to the world of impulsive investing.

So, what should you do instead?

Sometimes, the smartest financial move you can make is… nothing at all!

No buying. No selling. No chasing the news. Just sitting tight.

The Psychology of Panic

Markets go up and down—like your mood after reading the news. Selling in panic is like throwing away your raincoat because it’s raining.

Slow and Steady = Wealthy

Money loves patience.

Wealth isn’t built by reacting to every headline. It’s built by compounding, which only works if you give it time.

Wealth grows quietly.

The real winners don’t jump at every news update. They follow a plan, invest regularly (SIPs!), and let compounding do its work.

What You Can Do Instead:

- Review, don’t react. Check your portfolio, but don’t panic.

- Stick to your plan. If your goals haven’t changed, why should your strategy?

- Automate and chill. SIPs (Systematic Investment Plans) are your best friends.

Sitting tight doesn’t mean you’re ignoring your money—it means you’re letting it grow.

So, the next time markets wobble, don’t reach for the “Sell” button. Reach for a cup of chai instead.

(Contributed by Aman Goyal, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

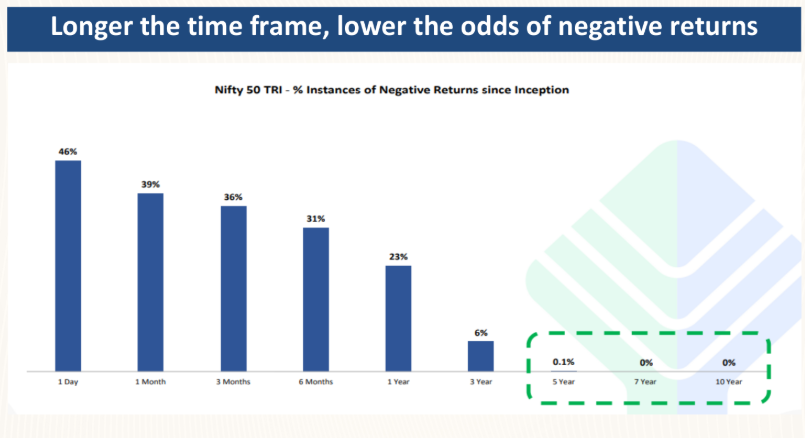

Still Worried About Losses in Equity? Here’s What 10 Years of Data Says!

When markets dipped earlier this year, many panicked. WhatsApp groups buzzed, news channels screamed, and some investors rushed to exit.

But guess what? Those who stayed calm and stayed invested are smiling now — because the markets recovered.

That’s the magic of time.

Let’s take a look at what the Nifty 50 index tells us over 10 years:

Image Courtesy Funds India

The image above demonstrates the percentage of instances where investors experienced negative returns across various timeframes, based on historical Nifty 50 TRI data. Here’s what it reveals:

- If you invested for just 1 day, you had a 46% chance of seeing a loss.

- Over 1 month, this chance reduced to 39%, and to 23% over 1 year.

- But once your horizon stretches to 3 years, the probability drops drastically to just 6%.

- Beyond 5 years, the chances of loss are negligible — 0.1%.

- And here’s the clincher: over a 7-year or 10-year horizon, there were zero instances of negative returns.

So, the next time the markets shake a little, remember: reacting quickly often hurts more than it helps.

✅ Invest with long-term goals

✅ Don’t act on fear

✅ Diversify to stay steady

✅ Talk to your advisor

If you planted a mango tree today, would you dig it up tomorrow to check its roots?

Let it grow. Wealth is the same.

(Contributed by Prerna Pattanayak, Relationship Manager, Team Sukhoi, Hum Fauji Initiatives)

When Today’s Fun Eats Tomorrow’s Fortune: Present Bias

An officer once told me:

“I’ll start investing after this year. Just bought a car, my kids’ school fees are due, and there’s a family trip coming up.”

Sound familiar? That’s not poor planning — that’s Present Bias in action.

It’s our tendency to prioritise today’s comfort over tomorrow’s gain. The problem? That “later” keeps pushing wealth-building further out of reach.

Let’s look at the Real Cost of Delay

🔹 If you invest ₹10,000/month at 10% return starting at age 30, you’ll have:

→ ₹76 lakhs by age 50

→ ₹2.3 crores by age 60

🔹 If you delay by just 5 years (start at 35):

→ ₹45 lakhs by age 50

→ ₹1.3 crores by age 60

🔻 That 5-year delay costs you ₹1 crore by retirement time!

Why does this happen?

Because when you start early, compounding has more time to grow your money. Delays shorten the compounding window — and long-term wealth shrinks drastically.

✅ What You Can Do:

✔️ Start small — consistency matters more than amount

✔️ Automate your SIPs so that emotion doesn’t interfere

✔️ Link investments to future goals: kids’ education, retirement, that dream home

✔️ Reward yourself for staying on track — not for postponing

The future only gets better if you start preparing for it today.

Remember Discipline beats desire — every time.

(Contributed by Avantika Agarwal, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

What did our clients ask us in the last 7 days

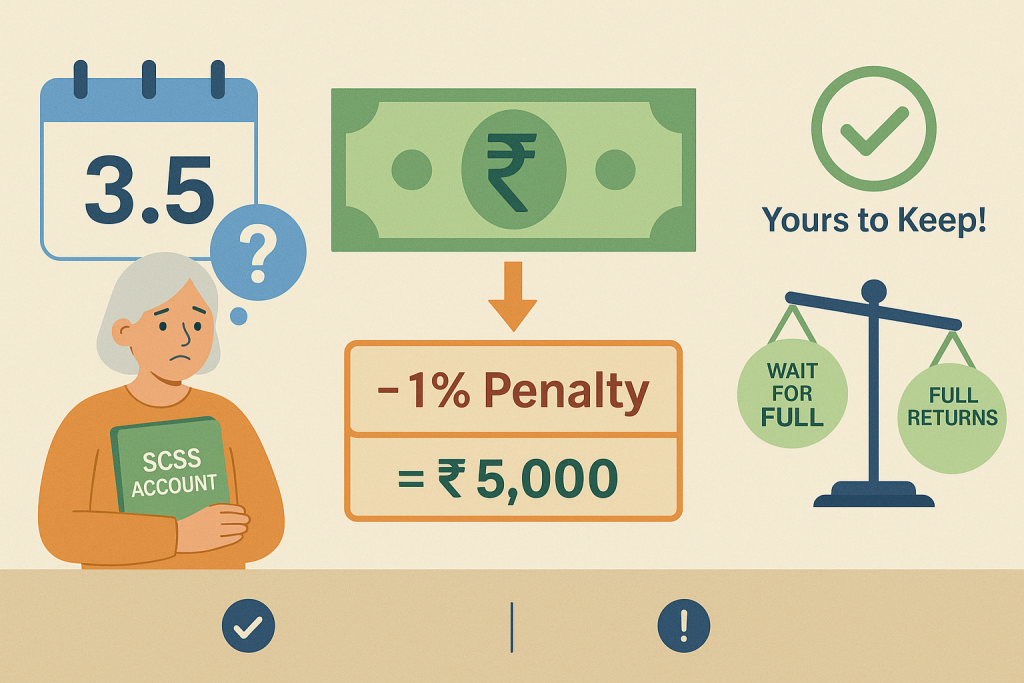

Question – I am retiring shortly. All my course mates and fauji groups are recommending me to invest the maximum allowed money in a SCSS (Senior Citizens Savings Scheme) account. Is it a good decision? I do not need any monthly income and I’m also scared of the high tax that I will pay on it.

Our Reply: The Senior Citizen Savings Scheme (SCSS) is definitely a trusted retirement product — but calling it the best for everyone might be stretching it a bit.

Yes, SCSS offers:

- A government-backed return of 8.2% p.a.

- Quarterly interest payouts, ensuring regular income

- Safety of capital and Section 80C tax benefit at the time of investments

But there’s a catch most people miss:

There is no compounding in SCSS. The interest is paid out every quarter — whether you need it or not, and it is fully taxable. So, your money doesn’t grow on its own beyond what’s being paid out. Over time, this can limit wealth creation, especially if you’re not using or further investing that income.

Now compare this with a conservative mutual fund (say, a hybrid or balanced fund) that gives an average return of 10% p.a. with compounding.

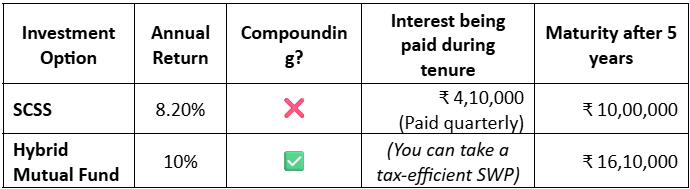

5-Year Investment Comparison (₹10 Lakhs invested; no withdrawals)

A better approach?

Invest in a good Hybrid Mutual Fund instead of SCSS. If you don’t need regular income (most retired services officers don’t need it anyway), then the Hybrid MF will compound your money smartly. If and when you need a regular income, take the Systematic Withdrawal Plan (SWP) from the mutual fund for whatever period you need it. This route will be far more tax-efficient, flexible and adjustable to your personal requirements.

SCSS is primarily meant for those retirees who will not get any pension. Armed Forces retirees investing in it may not really be a good use of their life-time savings.

(Contributed by Team Sukhoi, Hum Fauji Initiatives)

📌 Need help building a smart mix of income + growth options? Let us help you decide.

June 18th, 2025