We are starting our Income Tax Return (ITR) filing services for the Financial Year 2022-23 now , pertaining to the income received by you during the period 1st April 2022 till 31st March 2023.

1. Our Income Tax services are meant ONLY FOR HUM FAUJI INVESTORS.

2. The Income Tax portal is yet not accepting filing of ITR. We are right now only accepting your information and document scans from you for feeding it in our ITR Filing software and getting your ITR ready for filing. Actual filing of ITRs is likely to start only from about 10th June 2023 onwards, going by our past experience. We will be filing the ITRs on first-come-first-served basis. Please send your complete documents preferably by 31st May 2023 so that they can be well scrutinized, shortfalls made up and your ITR filed at the earliest when IT portal opens.

3. Income Tax Dept processes the ITRs purely on first-come-first-served. So, it is in your own interest to get your data completed with us at the earliest so that refund, if any, also comes fastest to you.

4. We would request you to send your ITR filing payment at the earliest since our CA would be able to go ahead with processing of your ITR only after your ITR Filing Fee is received.

Documents required to be sent to us

(Email ID: incometax1@humfauji.in)

by you are as follows:

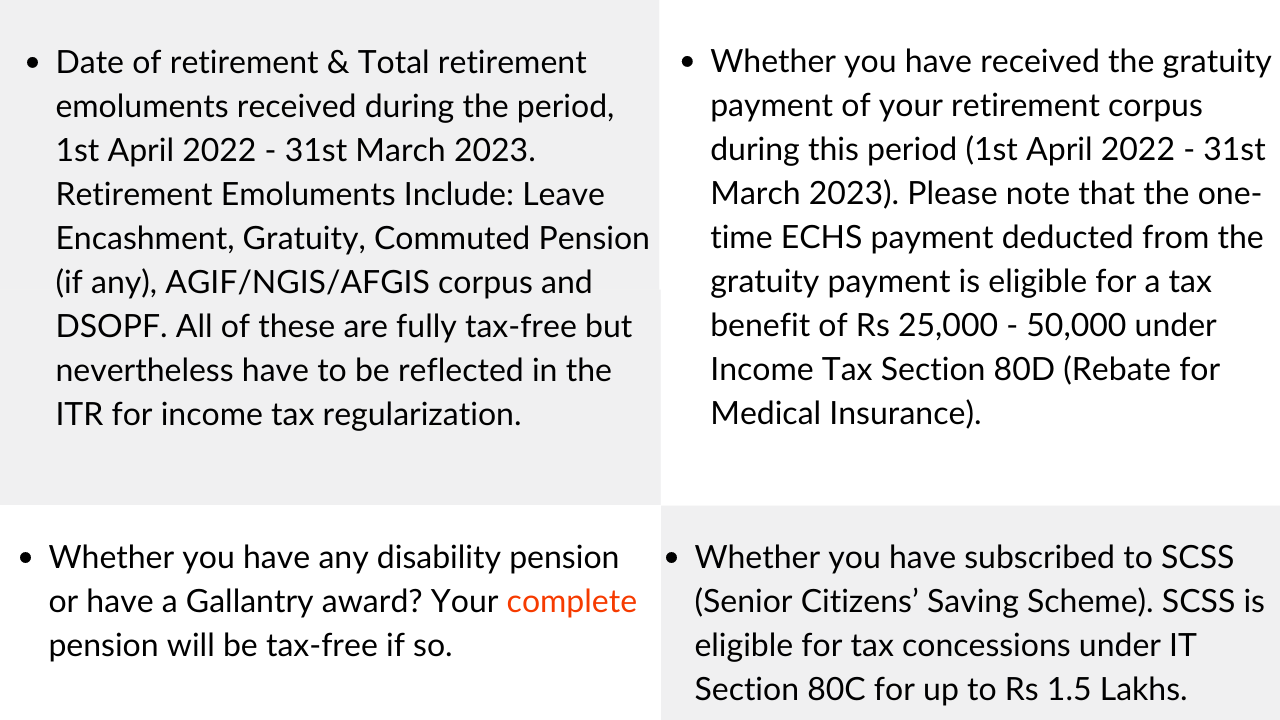

1) Form 16 for FY 2022-23 (1st April 2022 till 31st March 2023) along with the latest 2 months’ salary slips (if you are getting HRA).

2) Any house rent Paid and/or received from 1st April 2022 till 31st March 2023. Also, state the place the house is located (Non-metro or metro city).

3) Premiums paid for life insurance policy and/or health insurance policy from 1st April 2022 till 31st March 2023, if any.

4) Details of any charitable donations made during the period of 1st April 2022 till 31st March 2023.

5) Capital Gains report of your investments, if any. Also forward details of any other capital gains generated

from any other investments, sale of a property, dividend etc.

6) Details of other income earned , if any, like interest on Saving Bank/FDs, agricultural income, payment from a

builder, etc. (Interest certificate for the period 1st April 2022 till 31st March 2023 must be attached)

7) PAN number and Income Tax login Password, if your last year income tax return was not filed by Hum Fauji

Initiatives. If it was filed by us, just let us know this fact

8) Details of Flat/House sold during the period of April 2022 to March 2023, if any –

Sale & Purchase Value of Flat including date of sale

Name and PAN of the person who purchased the house

9) Certificate for interest paid on housing loan for FY 2022-23 (1st April 2022 till 31st March 2023)

10) In case of any professional income, please specify the nature of the profession and the income.

11) Please mention any other special points pertaining to your case.

12) Let us know if you have any carry forward Capital Gains losses from the last or previous years.

IMPORTANT

Please correspond with us through emails only. Please do not contact us on phone unless it is an EMERGENCY, which generally is not there in most cases.

We also request you to send complete documents to us at the very earliest at one go in scanned form (No physical copies or pictures on email or whatsapp accepted please) and not in bits and pieces. We will process your ITR filing only after we have received your filing fee (if any) and all the documents.

Please remember – if there is any tax due from you, there would be a penalty at the rate of 1% per month or part there of if you file your IT Return after 30 Sep 2023, in addition to the penalty of late filing imposed by the Income Tax Dept. Also, late returns cannot be revised, once filed. Therefore, please try to send your documents to us at the earliest along with the payment so that returns can be filed by us in time.

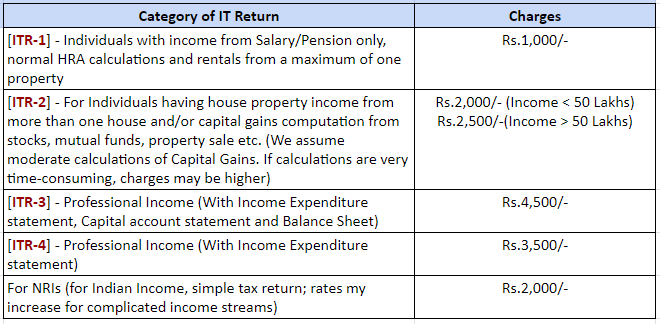

Charges for ITR Filing

The charges indicated below are only for filing the ITR. There may be separate charges in case you would want us to undertake subsequent rectifications or any other ITR-related work.

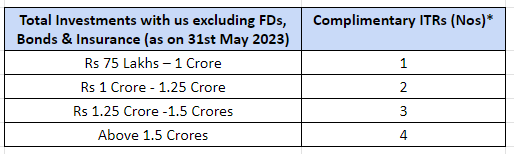

Complimentary ITR filing by us for our special clients:

For the clients who have entrusted us with their large savings, we wish to show our gratitude to them by offering the following complementary services to them as given in the table below:-

Note:

* Complementary ITRs will only be of ITR-1 or ITR-2 categories. The difference would be chargeable for other categories of ITR if filed for you or for any of the other complimentary ITRs as applicable. The free ITRs are only available for family members (Self, Spouse and children).

After the payment is done, please inform us of your payment details by an e-mail to office@humfauji.in with cc to incometax1@humfauji.in and incometax@humfauji.in so as to be able to link the payment to you.

Disclaimer

The Income Tax Return (ITR) is being filed by us on your behalf solely on the basis of the data supplied by you. It will be assumed by us that you have the supporting documents in original or as required by the Income Tax authorities for all the data (income, investments, savings, tax payments etc) that you send to us for filing your IT Return. Its correctness also remains your sole responsibility. In case of any inquiry from the Income Tax Dept, you would be required to produce such proof as no attachments are allowed with IT Returns filed online.

We are responsible for the correct filing of your ITR on the basis of your given data and our role is limited to that function. We have no role or influence in getting your refunds timely, early, or at any stage since the ITRs are being filed online. In fact, the timeliness of refunds, if any, largely depends on your ITR Verification either by e-Verification or your physical ITR-V reaching Central Processing Centre (CPC), Bangalore at the earliest after being signed by you.