Registration vs. Mutation – What’s the Difference?

Buying or selling a property? You’ll come across two key steps: Registration and Mutation. They may sound alike but serve different purposes. Let’s break it down!

Registration is the legal proof that you own the property. When you buy a property, you must register it with the government. The process includes:

✔ Signing a Sale Deed – A legal record of the sale.

✔ Paying Fees – Stamp duty and registration charges.

✔ Submitting Documents – Identity proof, sale deed, etc.

✔ Government Approval – Your name appears in land records.

✅ Why is it Important?

- Confirms you as the legal owner.

- Prevents fraud.

- Allows you to sell or mortgage the property later.

What is Property Mutation?

Mutation updates the property tax records in your name after purchase. It does not prove ownership but ensures tax payments are correctly recorded. The process involves:

✔ Applying to Local Authorities.

✔ Submitting Documents – Sale deed, tax receipts, etc.

✔ Verification and Approval.

Why is Mutation Important?

- Keeps tax records accurate.

- Helps in avoiding legal issues.

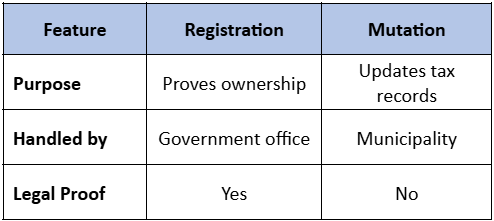

Key Difference at Glance

💡 Bottom Line:

Registration = Ownership ✅

Mutation = Tax Updates 🏡

Both steps are crucial for a smooth property transaction!

(Contributed by Abhilash Rana, Relationship Manager, Team HNI Desk, Hum Fauji Initiatives)

Common Myths About Women & Life Insurance – What You Need to Know

When it comes to life insurance, women often find themselves surrounded by myths that hold them back from securing the financial protection they truly deserve. Whether you’re a working professional, a homemaker, or somewhere in between, it’s time to bust some outdated beliefs.

🚫Myth 1: Only breadwinners need life insurance.

Truth: Whether you earn or manage the home, your role is priceless. If something happens to you, replacing childcare, household help, or emotional support can be costly. Insurance ensures your loved ones aren’t left struggling.

🚫Myth 2: It’s too expensive.

Truth: Many affordable plans exist—especially if you’re young and healthy. Term life insurance, for example, gives solid coverage at a surprisingly low cost.

🚫Myth 3: I don’t need it if I don’t have kids.

Truth: Life insurance isn’t just for parents. It covers loans, funeral costs, and ensures your loved ones aren’t financially burdened.

🚫Myth 4: Women with no income cannot get life insurance.

Truth: Insurers recognize a homemaker’s financial value. If you run the house, your spouse can insure you, or you may qualify based on family assets.

What to do:

✅ Evaluate your financial needs.

✅ Compare policy options.

✅ Talk to a financial advisor.

Life insurance isn’t about income—it’s about security. No matter your role, you deserve protection!

(Contributed by Gautam Arora, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

Heirs Across Borders: Crafting Seamless Succession Plans for Global Families

For Non-Resident Indians (NRIs) with family in India, passing on wealth isn’t just a financial decision—it’s about securing your family’s future. But when assets are spread across countries, a simple will isn’t enough. Conflicting inheritance laws, tax complications, and legal hurdles can create delays, disputes, or even financial losses.

The Global Inheritance Challenge

What happens when an NRI passes away with assets in India and abroad? Indian inheritance laws differ greatly from those in the US, UK, or UAE. Without the right plan, your family could face unexpected legal battles, frozen assets, or heavy taxes.

Building a Borderless Legacy

A strong succession plan starts with clarity:

✔️ List where your assets are held.

✔️ Identify potential legal conflicts.

✔️ Consider setting up a family trust for seamless wealth transfer across borders.

The NRI Advantage

Under the Foreign Exchange Management Act (FEMA), NRIs can structure their wealth transfer efficiently while staying compliant with RBI regulations. Understanding these rules can help your family avoid unnecessary delays and penalties.

Beyond Legalities: Avoid Family Disputes

Inheritance isn’t just about paperwork. Misaligned expectations can cause friction among family members. Having open conversations today can prevent conflicts tomorrow.

The Time to Act Is Now

Laws and tax treaties change frequently. Waiting could put your family’s financial future at risk. The best plan is one that is flexible, legally sound, and built to adapt.

(Contributed by Ankit Kumar Singh, Financial Planner, Team Prithvi, Hum Fauji Initiatives)

What did our clients ask us in the last 7 days

Question- Is Buying Home Insurance Really Necessary If I Live in a Safe Neighborhood and My Home Is Well-Built? What factors should I consider before deciding?

Our Reply – It’s natural to feel secure in a well-built home located in a safe neighborhood. But disasters—both natural and man-made—don’t check addresses before striking. That’s why home insurance isn’t just an extra expense; it’s a safeguard for your biggest investment.

Why Home Insurance Matters

- Protection from unexpected – Covers damages from earthquakes, storms, fires, theft, and vandalism.

- Financial Security – Prevents out-of-pocket expenses for repairs and replacements.

- Temporary Living Costs – Covers accommodation expenses if your home becomes uninhabitable due to damage.

More Than Just Your House

- Home Contents Coverage– Protects furniture, electronics, and valuables from loss or damage.

- Liability Coverage – Shields you financially if someone gets injured on your property.

- Theft and Burglary Protection – Ensures reimbursement for stolen items and break-in damages.

Making the Right Choice

✅ Assess Risks – Consider threats like floods, earthquakes, or fire hazards in your area.

✅ Choose the Right Coverage – Ensure your policy protects both your home’s structure and contents.

✅ Compare Policies – Look at different insurers, coverage options, and premium costs.

✅ Read the Fine Print – Understand exclusions to avoid surprises during claims.

Final Thought

Your home is your biggest investment—protect it. Even in the safest neighborhood, unforeseen events can happen. Home insurance isn’t just about covering losses; it’s about securing your future and ensuring peace of mind. Protect your home today, because safety is never absolute.

(Contributed by Team Dhruv, Hum Fauji Initiatives)

The cost to insure your house is laughably low. Take that small step with us and insure your house worth crores for just a few thousands for multiple years. Talk to us.