Ditch the Resolutions, Spark a Financial Revolution in 2024!

Forget those traditional resolutions that fizzle out faster than that last samosa!

2024 is the year to ditch the tired resolutions and ignite a true financial revolution! This year, let’s break free from the cycle and make lasting changes that transform our financial landscapes. Here’s the masala:

Why is the Saving Rate Important?

- Budget Like a Bollywood Badshah: Financial resolution 2024 can’t start without budgeting. Create a realistic budget that outlines your income, expenses, and savings. You can follow the 50:30:20 rule of budgeting where 50% of your income goes into needs, 30% into wants, and 20% into savings.

- Emergency Fund: Life throws curveballs like Kapil Dev at the crease. Build a financial fort so strong it defends every life’s bouncer or yorker. Aim for six months’ worth of expenses as the emergency fund to stay in the game.

- Debt: It’s your Rakshasa, slay it like Rama! High-interest debt is the Ravana to your financial Ram Rajya. Prioritize slaying those credit card monsters and loan demons. Use debt consolidation like Hanuman’s Gada, and avalanche or snowball methods to send those debts flying back to Lanka.

- Invest: Build your Dream Mandir of Wealth! Invest regularly with a long-term investment horizon and witness the compound interest magic with time!

- Portfolio Checkup: Take a deep dive into your portfolio. Analyse asset allocation, diversification, and individual securities. Is your mix still aligned with your risk tolerance and long-term goals? Consider adjustments if needed.

- Rethink Risk Assessment: Your risk tolerance might have evolved with time and age. Reassess your comfort level with volatility and adjust your portfolio accordingly.

- Financial Advisor: Let your Finances be on a Professional-Driving Rath! Consult a financial advisor, sit back, relax, and watch your wealth flourish, knowing everything’s in expert hands.

Remember, this isn’t just about resolutions, it’s about a big-time financial revolution!

So, ditch the dull and shine like gold in 2024! ✨

(Contributed by Yogesh Gola, Relationship Manager, Advisory Desk, Hum Fauji Initiatives)

Beating the Market Rollercoaster with Longer Investment Horizon

In the financial world, everyone’s talking about the market hitting all-time highs and experts predicting its future. But here’s the catch – predicting short-term market movements is like trying to predict the weather. We can’t tell if it will rain tomorrow, and similarly, nobody can accurately predict where the market will go in the short run.

However, there’s good news for those who are not financial experts – in the long term, usually spanning 5-7 years, the market will almost always be higher than it is today.

Let’s break down why having a long-term perspective is crucial, especially when the market is soaring.

Let’s Break Down the Numbers

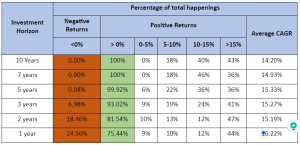

To understand the benefits of a long-term approach, we analyzed data from Nifty50, covering the period from 30th June, 1999, to 1st September, 2023. Our analysis involved looking at the average performance of the market over various investment horizons over the past 24 years.

Source:- National Stock Exchange

Take aways:-

The key is time. The longer you stay invested, the better your chances of making money. Short-term ups and downs are normal, but history shows that over the long haul, the market tends to reward patient investors. So, if someone tells you they can predict the market’s future, take it with a grain of salt. It’s the long-term view that really matters.

There is a saying, “market can remain irrational longer than you can remain solvent”.

(Contributed by Ujjwal Dubey, Financial Planner, Team Prithvi, Hum Fauji Initiatives)

Demystifying Economic Indicators: How Data Shapes Financial Strategies

Ever wondered about the mysteries behind economic indicators? Let’s explore how these indicators shape our financial world and, more importantly, how they impact your investment strategies.

Unlocking Employment Insights:

Decoding employment rates unveils industry stability insights, guiding savvy investments. High rates signal a thriving economy—ideal for tech, consumer goods, and real estate investments. In downturns, find stability in sectors like utilities and healthcare. Ride the waves wisely!

Navigating the Cost Landscape:

The Consumer Price Index (CPI) may sound complex, but it’s your tool for navigating the cost terrain. It tells us how inflation affects the prices of goods and services. Why does this matter? It ensures your investments are shielded against the erosive effects of rising prices.

Economic Growth as Your Investment Ally:

Gross Domestic Product (GDP) growth rates are like a buddy for your investments. Understanding these rates helps you pick areas that are growing. It’s like matching your investments with how the economy is doing.

Smart Borrowing, Wise Investing:

Interest rates are the quiet heroes of money decisions. Managing how much it costs to borrow money isn’t just about loans; it’s about making your investment plan work well. Lower rates can mean more profit for you, shaping your money journey in a smart way.

In essence, economic indicators are the keys to unlocking a savvy investment journey.

Cheers to your investment success! 🚀

(Contributed by Neeraj Kumar, Financial Planner, Team Arjun, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question: How do I transfer my shares to another individual and how is it taxed?

Our Reply: Firstly, you can transfer your stocks investments to your spouse or anyone else in two ways. Either you can transfer shares through a Will/inheritance, or you can gift it to them.

Transferring investments, like shares, to a spouse involves a straightforward online process. However, the tax implications are nuanced and hinge on three factors.

- Will/Inheritance: No tax liability, regardless of the recipient.

- Gift to Non-Relative: Taxable if value exceeds Rs 50,000 annually.

- Gift to Relative: No tax liability, with a detailed definition of ‘relative’ as per the relevant Succession law applicable to your religion.

- Different tax rates apply to long-term and short-term investments.

- If transferring to a relative, tax is incurred upon their eventual sale.

- The combined holding period determines whether gains are classified as long or short-term.

Example: Stocks bought on Jan 1, 2023 and gifted on Sep 1, 2023. If sold before Jan 1, 2024 (less than 12 months), 15% short-term capital gains tax. After Jan 1, 2024, taxed at 10% if gains exceed Rs 1 lakh.

Clubbing of Income:

Income from transferred assets is taxable for the transferor in specific cases, including:

- Transfer to a spouse without adequate consideration (except specific situations).

- Transfer to son’s wife without adequate consideration.

- Transfer to someone else for the immediate or deferred benefit of a spouse or son’s wife.

In summary, gifting shares requires careful consideration of taxation nuances. The mode of transfer, holding period, and potential clubbing of income are vital factors to navigate when transferring investments to loved ones.

For detailed guidance tailored to your specific situation, it is advisable to consult with a professional financial advisor.

(Contributed by Team Vikrant, Hum Fauji Initiatives)