Facing an Unexpected Expense? Don’t Raid Your Mutual Fund Investments!

Life throws curveballs, but that doesn’t mean sacrificing your long-term financial goals or disrupting the wealth creation path. Introducing Loan Against Mutual Funds (LAMF), your financial superhero that grants liquidity without selling your investments.

Think of LAMF as a loan secured by your existing mutual funds. Pledge a portion of your holdings for just as long as you require and access instant cash, just like tapping a magic money tree without pruning a single branch (unit).

It’s the perfect blend of financial flexibility and future growth. So, you get to keep your Mutual Funds and they keep earning while you get the cash that you require for your requirements. You return the loan in EMIs with the flexibility of bulk repayment as per the terms and conditions of the LAMF provider.

Here’s why LAMF rocks:

- Stay Invested, Keep Growing: Unlike selling your mutual funds, LAMF lets you hold onto your investments and continue to generate returns as in the normal course.

- Flexi Cash at Your Fingertips: It can be done online in a matter of minutes, with some platforms offering almost instant approvals.

- Cost efficient: Here, you get a lower interest rate than credit card loans or personal loans. This is because LAMF are secured i.e. they are backed by collateral of your Mutual Funds.

To avail loan against mutual funds, the investor can approach the financing institution or bank. Many finance companies also provide online applications that facilitate the entire process and give approval instantly. Lien marking of units is also done online through the mutual fund registrar’s records.Lien on mutual funds lets a bank hold/sell your units as loan security. Repaying some loan releases a proportional amount of units from the lien. We also have a tie-up with a good trusted platform that offers a very quick LAMF at very reasonable rates.

LAMF is a powerful tool for unlocking liquidity without sacrificing your long-term investment goals. Use it wisely, understand the risks, and you’ll have a financial superhero by your side.

(Contributed by Vishakha, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

Beyond the Hype: Safeguard Your Investments in the Midst of IPO Mania

The recent surge of Initial Public Offerings (IPOs) has attracted many investors all over. While the allure of IPOs is undeniable, navigating this landscape with prudent judgment and a well-defined strategy is essential. As your trusted financial advisor, let’s explore effective strategies to safeguard your investments amidst the fervour.

Thorough Due Diligence: Before falling for the IPO-mania, embark on a journey of thorough due diligence. Scrutinize the fundamentals of the companies going public, evaluating their financial health, market positioning, and growth prospects. A solid understanding of the underlying businesses is essential for making informed investment decisions.

Define Risk Tolerance: Understand your risk tolerance before diving into it. Not all IPOs guarantee immediate success, and prices can be subject to significant fluctuations. Define your risk tolerance and align your investments accordingly. This ensures that your financial decisions are in harmony with your comfort level and overall investment objectives.

Resist FOMO: Fear of Missing Out (FOMO) can be a powerful force, especially during IPO mania. However, it’s crucial to resist impulsive decisions driven by FOMO and instead focus on a disciplined investment approach. Opportunities will continue to emerge, and strategic, well-timed investments often yield more sustainable results.

Monitor and Adapt: In the ever-changing landscape of financial markets, vigilance is the key. Regularly monitor your portfolio, keeping a keen eye on market trends and developments. Be prepared to adapt your strategy as needed, making informed adjustments based on changing market conditions.

Although the idea of quickly creating money through IPOs could seem like instant gratification, the truth is that very few of them provide significant profits. On the other hand, there is a far greater chance of suffering financial loss. By adopting the aforementioned strategies, you can effectively navigate the IPO landscape and make informed investment decisions that align with your financial goals and risk tolerance.

(Contributed by MF Alam, Sr Research Analyst, Hum Fauji Initiatives)

Why Fixed Deposits May Not Be Your Best Bet Against Inflation?

Do you really think that FDs are a good investment?

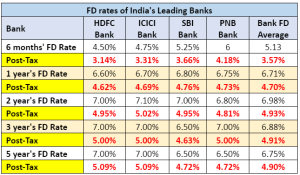

FD rates have increased in the last one year, but post-tax returns are still below the Inflation expectation of 5.4% for the year 2024. As depicted in the below table, FDs of prominent Indian banks have not delivered positive returns in comparison to inflation (taking a 30% tax bracket):-

Source: fundsindia.com

Factors Affecting FD Investments

- Liquidity risk: FDs cannot be surrendered piecemeal. Eg, if you have a bank FD of Rs 5 Lakhs, you cannot take out Rs 1 Lakh from it. Either you prematurely encash it fully or look elsewhere for your requirements.

- Inflation risk: Banks will always short-change you there. The rate at which the cost of things that you buy increases will never be compensated by the interest rate being given by bank FDs ever unless you take a chance with one of those small and unknown banks.

- Interest rate risk: If interest rates rise, investors who are locked into a lower-rate FD will not be able to benefit from the higher rates unless they’re ready to take the penalty of premature encashment.

- Reinvestment risk: When an FD matures, investors may not be able to reinvest the money at a favourable rate. Eg, the interest rates in the economy are headed down any time now and your future maturities of bank FDs will be at lower rates.

- Taxation risk: The interest earned on FDs is always fully taxable, which will reduce your overall returns.

Bank FDs lag inflation in post-tax returns, but ditching them entirely might not be the best move. Consider boosting your portfolio with debt mutual funds or safe, liquid options like G-Secs or high-rated bonds. This balances safety with better returns. Do your research and consult a financial advisor for optimal decisions.

(Contributed by Avinash Kumar, Research Executive, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Past 7 Days?

Query from our Investors: Since markets are at all-time highs, should I withdraw all my investments and reinvest when markets come down?Our reply to them: The Stock Market is either moving up or moving down all the time and it is this volatility that helps us generate wealth through it at a faster rate than say, bank FDs and post office products. Trying to outrun (or is it hoodwink!!) it has never succeeded for anybody anywhere in the world except sometimes maybe as a stroke of luck.

Sample the data below of the positive and negative returns in the Indian Stock Markets over the past 43 years over 11,000 trading days:-

- Daily: 53% positive, 47% negative.

- Weekly: 56% positive, 4% negative.

- Monthly: 61% positive, 39% negative.

- Quarterly: 64% positive, 36% negative.

- Yearly: 72% positive, 28% negative.

- Over 3 years: 89% positive, 11% negative.

- Over 5 years: 96% positive, 4% negative.

- Over 10 years: 100% positive, 0% negative.

So, what is the sense that the above data gives? Buy right and sit tight!!

If one keeps on buying and selling, one is shooting in the dark – betting that markets will surely go down now, without having any real reason to believe so. Also, you every ‘sell’ generates a tax liability which you have to pay and maybe the exit load too – none of which is coming back to you once you have incurred it.

Who knows – markets may keep rising further and you will forever keep waiting for the ‘right moment’ to get in, after getting out.

All in all, there is no right time to enter the markets if you have a long-term horizon of more than 5-7 years. And if you are in the stock markets, whether through direct stocks or equity mutual funds, you should be there ONLY for the long term; short-term stock market investments are like Russian Roulette, dice might be heavily loaded against you.

So, timing the markets is no strategy at all. Staying in the markets is.

Buying stocks through Tips, or reacting to the fear/greed generation of WhatsApp forwards, is the right path toward wealth destruction! Avoid it like the plague.