Bank FDs: Comfort Trap or Smart Choice?

Did you know over 50% of Indian households still park their money in Bank Fixed Deposits (FDs)?

Bank FDs have long been the go-to for conservative investors. But are they still the smart choice today—or are you holding on to outdated beliefs? Let’s uncover the truth behind some common FD myths:

🔸 Myth: “Auto-renewed FDs give the same return.”

Truth: Nope. Renewed FDs earn the rate in effect at the time of renewal—not your original rate. If rates drop, so do your returns—quietly.

🔸 Myth: “FD interest is tax-free.”

Truth: Far from it. FD interest is fully taxable as per your income slab. Banks deduct TDS once the interest crosses ₹50,000 (₹1,00,000 for seniors). If you’re in a higher tax bracket, your real returns take a real big hit.

🔸 Myth: “FDs are completely risk-free.”

Truth: Only ₹5 lakh per bank per depositor is insured. Any amount beyond that? Exposed, if the bank defaults.

🔸 Myth: “FDs are highly liquid.”

Truth: Breaking an FD early often means penalties or lower interest. So, the flexibility could come at a big cost.

🔸 Myth: “FDs beat inflation.”

Truth: Most don’t unless you take FDs of risky ‘small finance’ banks. After tax, your bank FD returns may not even match inflation—meaning your money loses value over time.

🔸 Myth: “FDs are the best for retirees.”

Truth: Not always. Today, there are safer, more tax-efficient options that offer better returns, more flexibility, and true peace of mind.

(Contributed by Abhilash Rana, Relationship Manager, HNI Desk, Hum Fauji Initiatives)

Looking for a smarter alternative? We have something designed especially for those who want peace of mind without compromising on growth or tax efficiency.

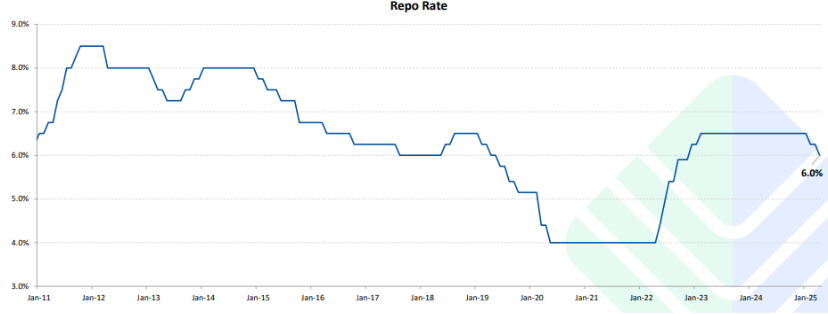

RBI’s U-Turn: What Falling Rates Mean for Your Debt Investments

Just when savers were getting used to those slightly higher FD interest rates, the winds may be shifting again!

The Reserve Bank of India (RBI), which acts like the financial captain of our country, appears to be changing its course. Lately, their signals suggest a possible move towards lower interest rates.

Well, the RBI keeps a close eye on two big things: how much prices are going up (inflation) and how fast our economy is growing. If inflation seems to be under control and the economy needs a bit of a push, the RBI might decide to lower interest rates. Recent chatter from the RBI in April-May 2025 hinted at a comfortable inflation level, giving them room to think about supporting growth.

So, what does this potential drop in rates mean for your hard-earned money parked in debt investments? Let’s break it down simply:

- Bank FDs: Lower RBI rates usually mean banks offer lower FD rates. New deposits or older deposits when renewed may earn less than before. So, the returns you get on fresh FDs might be a bit less juicy.

- Debt Mutual Funds: These could benefit as bond prices, a big constituent of longer term debt mutual funds, rise when interest rates fall.

- PPF and Small Savings: These often follow broader interest trends. A rate cut could eventually reduce returns here too.

- Old Bonds: Already own long term bonds with higher interest? Their value might rise—good news!

It might feel like things are changing, but don’t panic—just realign your strategy. And here’s a little something to ponder: in the current scenario, some other investment avenues might actually offer you better returns after taxes compared to traditional FDs.

Why Travel Insurance Should Be As Essential As Your Passport

Traveling abroad— whether for work or a well-earned break—brings exciting experiences, but it also comes with risks. A missed flight, lost luggage, or sudden illness can quickly turn a well-planned trip into a costly ordeal.

Surprisingly, over 80% of Indian travellers go overseas without travel insurance. Yet, a medical emergency abroad can cost lakhs—and most health policies don’t cover international expenses. (Source: ICICI Lombard Travel Survey 2023)

That’s where travel insurance steps in. It’s your financial safety net when the unexpected strikes.

So, while you compare flights and hotels, don’t forget to protect your finances. One unexpected incident can not only ruin your trip—it could strain your long-term financial goals.

Here’s what it typically covers:

✔️ Emergency medical expenses and air evacuations

✔️ Trip cancellations, delays, or interruptions

✔️ Lost, stolen, or delayed baggage

✔️ 24/7 global support and assistance

By covering these risks, travel insurance doesn’t just protect your trip—it protects your finances.

At Hum Fauji Initiatives, we view travel insurance not as a formality, but as smart financial planning. Whether you fly often or occasionally, the right policy provides peace of mind across borders.

Before you pack your bags, pack peace of mind.

What did our client ask us in the last 7 days

Question –

I have taken health insurance from more than one company. If I ever face a major medical emergency, how do I manage the claim across these different insurers? Is there a proper way to split the claim, and what documents would I need to provide to each of them?

Our Reply –

Absolutely, you can claim from more than one insurer—and it’s simpler than it sounds.

Think of your insurance policies as stopovers on a journey. Each one helps cover a part of the cost if the first doesn’t take you all the way.

Here’s your step-by-step route:

- Start with the Primary Insurer

File your claim with the insurer offering higher or more relevant coverage. - Collect Your Documents

After the first claim is settled, collect the following:

- Final hospital bill

- Discharge summary

- Diagnostic/lab reports

- Prescription copies

- Settlement letter from the first insurer

(Ensure all documents are duly attested.)

- Submit to the Second Insurer

Submit the above documents + the first insurer’s settlement note. The second insurer will assess and pay the remaining eligible expenses as per their policy and due diligence.

⚠️ Important: You can only claim up to your total hospital bill, no more. And do not forget to inform about the settlement done by other insurer(s).

Thanks to IRDAI’s simplified rules, you don’t have to split claims proportionally. You’re free to choose the order of insurers.

Your policies are your safety nets—use them smartly!

(Contributed by Team Dhruv, Hum Fauji Initiatives)

Confused about how your policies work together? Or need help in getting the best medical insurance cover for yourself or your family members? Hum Fauji Initiatives is here to assist.