Is it lawful to use Streedhan to settle a husband’s debt?

Legally, it is not permissible to use Streedhan to settle a husband’s debts without the explicit consent of the wife. Misusing Streedhan without her permission can lead to serious legal consequences, such as charges of misappropriation or even theft. Women need to be aware of their rights and ensure they maintain control over their assets.

If there are any attempts to misuse or take Streedhan unlawfully, women can seek legal protection and reclaim their property. It’s important to explore other financial solutions to repay debts, respecting the legal protections for women’s property. A husband may only use his wife’s assets if both agree.

Women’s financial rights ensure they are not unfairly burdened by their spouse’s financial liabilities. Understanding and exercising these rights is crucial for protecting their assets.

(Contributed by Mausam Gupta, Relationship Manager, Team Prithvi, Hum Fauji Initiatives)

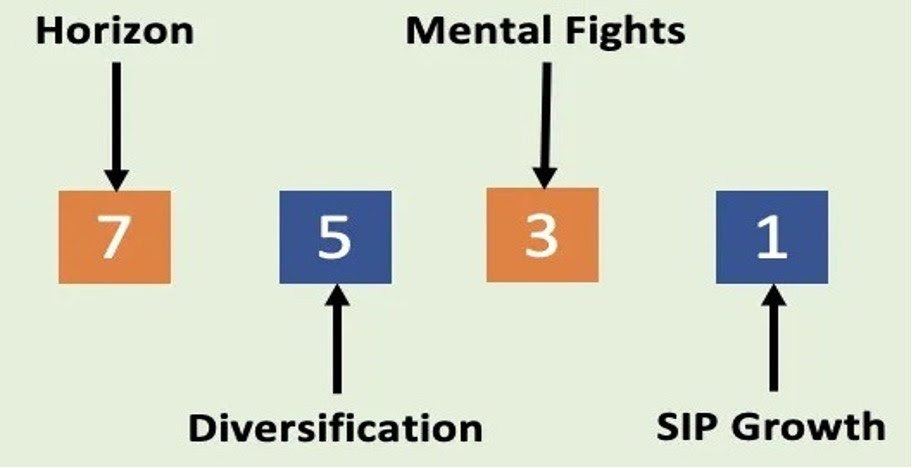

The Rule of 7-5-3-1 in Investing

Be patient and think long-term. Stocks fluctuate, but over 7 years, they generally rise. This long time frame helps you ride out short-term drops and benefit from compounding returns.

Rule 5: Building a Strong Foundation (Diversify Across Asset Classes)

Don’t put all your eggs in one basket! Diversify your investments across 5 different asset classes: large-cap, mid-cap, small-cap stocks, debt funds, and maybe even international exposure. Diversification spreads your risk and smooths out market volatility.

Rule 3: Prepare Mentally for 3 Common Phases

Expect 3 tough phases when you might feel disappointed, irritated, or panicked about your investments. Don’t stop during these times! The market often recovers, giving back good returns in the next 1-3 years.

Rule 1: Unlock the power of compounding with rising SIPs

The magic of every 1 Systematic Investment Plans (SIPs) lies in Rupee-Cost Averaging. By investing a fixed amount regularly, you buy more units when prices are low and fewer when they are high, averaging out the overall cost.

Small yearly increases in your investments can significantly boost your returns over time. Remember, while the 7-5-3-1 rule is a helpful guideline, always think about your comfort with risks and your financial goals when choosing how long to stay invested. It could be your map to help you succeed in the stock market over time.

(Contributed by Anjali, Financial Planner, Team Prithvi, Hum Fauji Initiatives)

Credit Cards: Navigating Rewards and Risks

Credit Cards: A Double-EdgedSword

Credit cards can be incredibly handy but also risky if not used wisely. They offer convenience, rewards, and help build a credit history. However, misusing them can lead to overspending and debt. Let’s see how two people, Diksha and Srishti, use their credit cards differently.

Diksha: The Smart User

Diksha, a 26-year-old marketing executive, uses her credit card carefully. She knows it’s a tool for convenience, not extra income. She mainly uses it for online shopping and paying bills, earning cashback and rewards. She always pays her full bill before the due date, avoiding interest charges. By keeping her spending below 30% of her credit limit, she maintains a high credit score, which will be beneficial when she needs a loan.

Srishti: The Over spender

Srishti, a 28-year-old software engineer, uses her credit card to live beyond her means. She often maxes out her credit limit and only pays the minimum amount each month leading to growing debt due to high interest rates. Srishti’s spending is driven by the ‘pain of paying’ concept. Paying with a credit card feels less painful than using cash, making it easier to overspend.

Our Ancestral Habits

Our ancient ancestors had to consume resources quickly and travel light, a ‘live for today’ mentality that still influences us. Credit cards can amplify this tendency, leading to financial issues if not managed carefully.

So, Use Credit Cards Wisely

Credit cards are powerful financial tools if used responsibly. They can help manage cash flow, earn rewards, and build a good credit history. However, to avoid debt, it’s essential to use them wisely. Like Diksha, you can use your credit card to manage expenses and build a solid credit history.

(Contributed by Abhinandan Singh, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question: The gold prices are already at their peak. What do you think how far can it go?

Our Reply: Predicting how far gold prices will climb is tricky, much like any other asset. Recently, gold has hit a record ₹76,000 per gram, sparking debates about its role as a safe haven in volatile times. But what does this mean for the future?

Understanding the Surge

While gold’s value is often seen as ever-rising, a long-term view shows a modest annual increase of 3.7%, just outpacing the rupee’s depreciation. According to the World Gold Council, gold demand has stayed relatively stable over the past decade, slightly decreasing from 4,519 tonnes in 2013 to 4,468 tonnes in 2023.

What’s Driving the Prices Up?

The recent price surge is more about global uncertainty than any increased demand for gold. Jewelry demand has actually dropped from 2,735 tonnes to 2,192 tonnes. But on the other hand, world’s central banks have doubled their demand from 629 tonnes to 1,037 tonnes, particularly after 2022. The Reserve Bank of India (RBI) increased its gold purchases by 1.5 times in the first four months of 2024 alone.

Central Banks and De-Dollarization:

Despite the dollar’s continuing dominance in global transactions, central banks are turning to gold, a trend likely to continue due to gold’s effectiveness as a diversification tool. This shift towards de-dollarization is becoming more noticeable especially after US froze Russia’s dollar assets in its country leading to unease in the financial word regarding US’ control over other’s money denominated in US dollars.

So, predicting gold’s exact future is challenging, but factors like central bank purchases, global uncertainty, and industrial demand suggest it will remain a valuable asset. While prices may fluctuate, gold’s role as a safe haven and diversification tool stays strong for now and is likely to stay strong in foreseeable future.

In essence, predicting gold prices might be tough, but staying informed and considering your financial goals and risk tolerance is crucial towards this end.

(Contributed by Team Prithvi, Hum Fauji Initiatives)