Life Insurance: The One Thing You Don’t Want to Think About Until You Absolutely Have To

Let’s be honest—thinking about life insurance isn’t exactly exciting. It’s like planning your own funeral—who wants to do that? But here’s the catch: life insurance isn’t for the person who is buying it; it’s for their family.

Did you know that only 30% of Indians have life insurance, even though 85% agree it’s essential?

Let’s break it down without the doom and gloom and help you feel more confident about this necessary topic.

Why Do We Avoid Life Insurance?

Because it makes us confront uncomfortable questions: What happens if I’m not around? Plus, the confusing jargon—premiums, beneficiaries, underwriting —can be overwhelming. But at its core, life insurance is simply a safety net for those you love.

Why You Should Think About Life Insurance Now

- Protect Your Family’s Future

Would your family be financially secure without you? Life insurance ensures they won’t struggle with bills, loans, or daily expenses. - Leave a Legacy

Whether for your children’s future or a cause you care about, life insurance helps you leave something meaningful behind.

Which One to Choose?

✅ Term Insurance – Simple, low-cost protection for 10-30 years.

✅ Whole Life Insurance – Covers you for life and builds savings.

How to Get Started

A quick chat with a financial advisor can make things clearer. The sooner you plan, the better. Because peace of mind? That’s priceless.

(Contributed by Aman Goyal, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

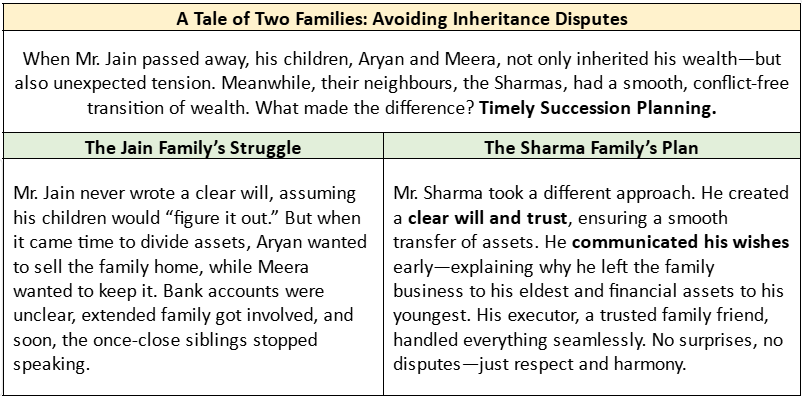

Avoiding Family Disputes: How to Ensure a Smooth Asset Transfer

Family disputes over inheritance can create lasting conflicts. Here are 7 ways to ensure a smooth asset transfer:

1️. Write a Clear Will – A legally valid will prevents confusion and conflict.

2️. Use Trusts for Complex Assets – This ensures proper asset distribution and protection (though most families don’t need this).

3️. Communicate Openly – Managing expectations avoids family shocks later.

4️. Choose a Fair Executor – A responsible and impartial executor prevents bias.

5️. Update Beneficiary Details – Ensure accounts reflect your latest wishes.

6️. Plan for Fair, Not Always Equal Distribution – Define a strategy for assets like a home or business.

7️. Seek Professional Guidance – An estate planner or financial advisor ensures legal security.

The difference between a united family and a divided one is proper planning. Don’t leave your family’s future to chance.

(Contributed by Prerna Pattanayak, Relationship Manager, Team Sukhoi, Hum Fauji Initiatives)

Why Every Indian Needs a Financial Plan – Not Just the Wealthy!

In India, where financial uncertainties are as common as monsoon rains, having a solid financial plan isn’t a luxury—it’s a necessity. Whether you’re a salaried professional, a business owner, or a defense officer, a structured plan ensures security and helps you achieve your dreams.

- Beating Inflation & Growing Wealth

Saving ₹10 lakh in a fixed deposit at 6% interest grows to approx ₹18 lakh in 10 years. But with 7% inflation, something worth ₹10 lakh today will cost ₹19.67 lakh, meaning your money loses value!

Instead, investing in mutual funds or in equity market at 12% returns could grow it to ₹31 lakh, keeping you ahead of inflation.

- Achieving Life Goals

Want to send your child to IIT or IIM? A systematic investment plan (SIP) in mutual funds can help accumulate the required ₹50–₹80 lakh over time. Likewise, buying a dream home or going on a foreign vacation is easier with structured savings.

- Protecting Yourself from Emergencies

Medical emergencies don’t knock before arriving. A ₹10–₹20 lakh health insurance plan can save you from financial stress while ensuring the best treatment.

- Securing Retirement

Many Indians rely on pensions, but is it enough? If you invest just ₹10,000 per month in a retirement fund from age 30, you could retire with ₹5–₹7 crore by 60!

Financial planning isn’t just about money—it’s about peace of mind. The earlier you start, the brighter your future!

(Contributed by Avantika Agarwal, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

What did our clients ask us in the last 7 days

Question – My other broker gave me funds that pay me regular cash, but your Growth Funds don’t give me anything directly. How do I know if my money is actually growing?

Answer – When you invest in Growth Funds, you might notice something different: they don’t give you regular cash payouts like dividends or interest. Instead, Growth Funds aim to increase the value of your investment over time. But how do you know if your money is really growing?

The key to tracking your growth is the Net Asset Value (NAV). NAV represents the “price” of one unit in your fund. When the NAV rises, it means your investment is growing in value.

To see how your Growth Fund is doing, you can look at performance reports. These reports show how the fund has performed over time—whether it’s been growing or not. You can also compare your fund’s performance with others in the same category to see how it’s stacking up.

While Growth Funds don’t pay you cash right away, they offer something even better: long-term growth. By keeping an eye on the NAV and checking the performance reports, you’ll know exactly how your investment is growing and whether it’s on the right track. This way, you can feel confident that your money is working for you, even if you’re not seeing cash payouts right now. Growth Funds may take time, but they have the potential to turn your money into much more wealth in the long run!!!

(Contributed by Team Sukhoi, Hum Fauji Initiatives)

Our professional approach will keep you focused on your goals without diversion of your hard-earned money into flimsy avenues. Get in touch with us today.