Dream, Plan, Go: Just a bit of planning can take you places!

Making sure that you have this vacation time every year (or even twice a year!) seems a daunting task, given so many demands on your budget and what you earn.

But let us tell you, just a bit of planning can ensure that you and your family get to all those exotic places in India and abroad which you only see on Facebook, travel company brochures and Instagram.

And what is that bit of planning that you can do with our help?

Create a Budget Plan: Start by estimating your vacation expenses for the year, including travel, accommodation, food, and activities for domestic and international travel and even the cruises. This rough plan will give you a clear idea of the amount you need to save for future travel. This will be the benchmark for further planning.

Include a Financial Buffer: Always add a buffer to your budget. Unexpected expenses can arise, and prices can be higher than anticipated. A buffer ensures you’re prepared for surprises, making your vacation stress-free.

And how can small droplets make the big ocean that your multi-year travel plan requires?

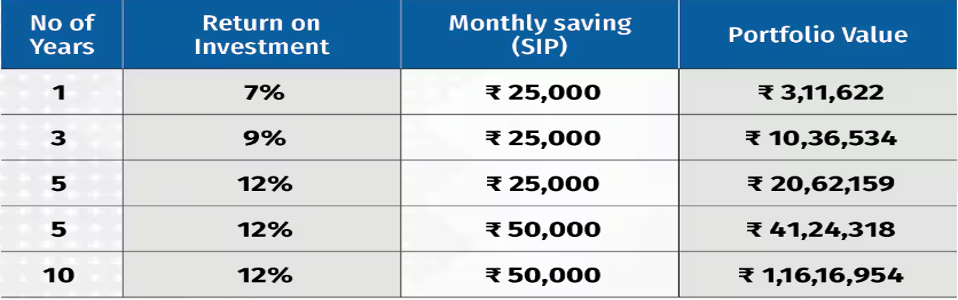

The amount you need to save depends on your travel goals and the time you have to accumulate. Here’s a simple guide on how your SIPs (small monthly investments) of travel bucket can help you save over the years:

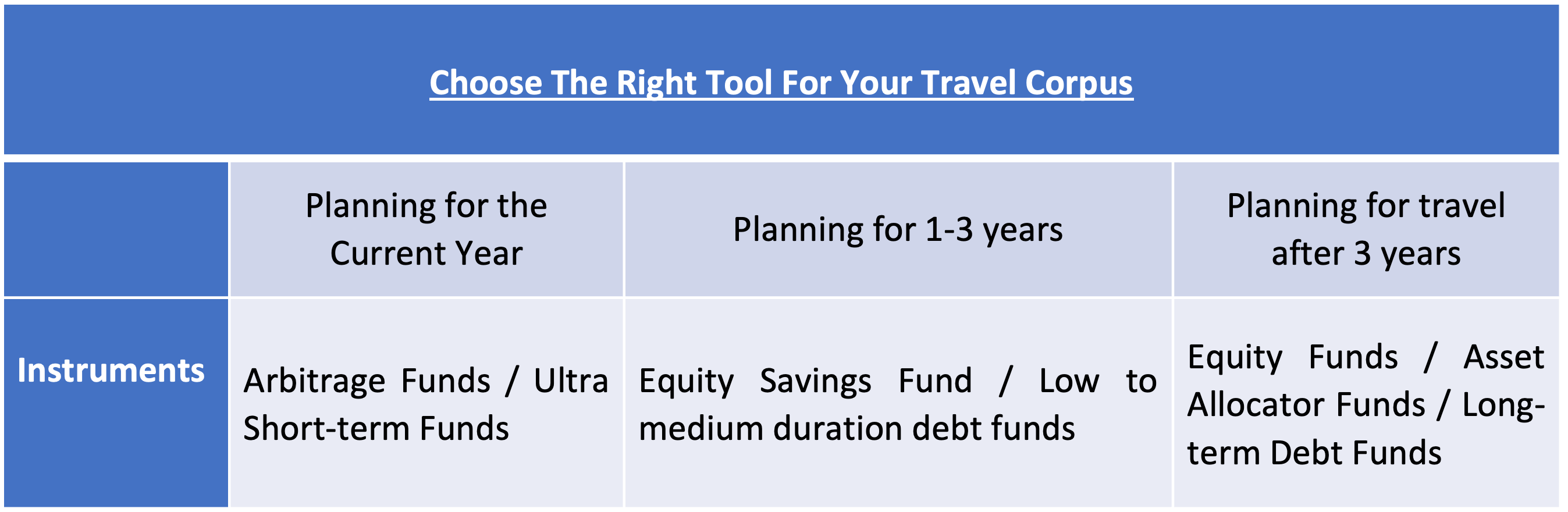

And now the right instrument for creating those Travel buckets…

Through SIPs, you can put aside a bit of your paycheck specifically for vacations. The type of investment instrument you choose depends on how long you plan to save before your trip and your comfort level.

(Contributed by Vishakha, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

Declutter Your Finances: Your 30s Checklist for a Healthier Wallet

1. Where does your money go? We all love a good latte or a burger, but where else is your hard-earned cash disappearing to? Track your expenses for a month. There are tons of free budgeting apps that can help. Are you surprised by the amount you spend on impulse buys? Knowledge is power, friend. Once you see where your money goes, you can make informed decisions about your spending.

2. Do you avoid your credit card bill like the plague? Ugh, credit card debt. The struggle is real. But listen up, paying your bills on time and keeping your credit card utilization rate low (ideally below 30%) is key to building a good credit score. That magic number can save you big bucks on loans later on.

3. Big purchases: Planned a party or impulsive frenzy? Reflect on those recent splurges. Did you agonize over that new gadget for weeks or just hit “buy” on a whim? Think about whether these purchases brought you lasting happiness or just a fleeting thrill. Align your spending with your goals. If that dream vacation is what truly sets your soul on fire, maybe hold off on the new phone upgrade.

4. Saving: Trick or treat? Saving doesn’t have to be scary. Even small amounts consistently saved can grow into a significant sum over time. Are you contributing to your retirement fund? There are tons of options out there. If you’re overwhelmed, don’t be afraid to consult us as your trusted financial advisor.

Remember, your financial journey is a marathon, not a sprint. By taking control of your finances and making smart choices, you’ll be well on your way to a secure and prosperous future.

(Contributed by Gautam Arora, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

Estate Planning: Securing Your Legacy in the Digital Age

In today’s digital era, estate planning has evolved beyond traditional wills and trusts. As retirement approaches, securing your legacy and ensuring your wishes are honoured is essential. Here’s how you can effectively plan your estate:

1. Digital Assets: Include your digital assets such as online bank accounts, social media profiles, and digital subscriptions. Document your digital credentials and designate a trusted person to manage these assets after your passing.

2. Create a Comprehensive Will: Draft a will that outlines how your physical and digital assets should be distributed. This legal document is crucial for preventing disputes and ensuring that your estate is handled according to your wishes.

3. Set Up Trusts: Establishing trusts can help manage and distribute your assets efficiently. It can minimize taxes, avoid probate, and provide for beneficiaries over time.

4. Regular Updates: Keep your estate plan updated. Life events such as marriages, births, and changes in financial status can impact your planning. Regularly review and adjust your plan to reflect your current wishes.

5. Professional Guidance: Consult an estate planning lawyer to navigate the complexities of modern estate planning. Professional advice ensures that your plan is comprehensive and legally sound.

By above simple actions, you can secure your legacy and provide peace of mind for your loved ones in this digital age.

(Contributed by Ankit Kumar Singh, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

Question: I am retiring in the next few months. Where and how should I invest my retirement corpus?

As you prepare to retire in the coming months, making smart choices with your retirement savings is crucial to enjoying financial security and peace of mind. Here are some friendly tips to help you get started:

- Mix It Up with a Diversified Portfolio – Don’t put all your eggs in one basket! Spread your money across different types of investments like stocks, bonds, and safe investments. Stocks can help your money grow, while bonds can provide the much-needed stability with fair returns.

- Get Enough Insurance – Make sure you have enough life and general insurance to protect your family and future goals. It’s important to do this before you retire because getting term insurance is harder once your pension starts.

- Inflation Beating Instrument– Choose investments that grow faster than inflation, so that your money doesn’t lose its buying power. This way, you can keep up with the rising prices and maintain your lifestyle that you’re accustomed to.

- Stay Flexible with Your Money – Avoid investments that lock up your money for too long. Keep your savings accessible so you can get to it when you need it. This way, you can handle any unexpected expenses without worry.

- Emergency Fund: Set aside some money in a safe and easy-to-access account for unexpected expenses. This fund will protect you from having to dip into your investments during tough times.

Remember, retirement is your time to shine! By managing your money wisely with these simple strategies, you can enjoy a worry-free and fun-filled retirement.

For extra peace of mind, consider talking to a trusted financial advisor like Hum Fauji Initiatives. We can give you personalized advice to make sure you’re on the right track. By planning carefully and diversifying your investments, you can enjoy a secure and fulfilling golden retirement.

(Contributed by Team Sukhoi, Hum Fauji Initiatives)