IRDAI’s latest Health Insurance Reforms: What They Mean for You

Wider Coverage:

- Age No Bar: Health insurance companies can no longer deny coverage based on age, allowing individuals over 65 also to obtain insurance more easily. This is especially beneficial for senior citizens, who often face higher medical occurrences.

- Shorter Waiting Period for Pre-existing Conditions: The maximum waiting period for pre-existing conditions has been reduced from 4 years to 3 years. This means that if you have a pre-existing condition, you’ll get coverage sooner, and no claims can be denied due to pre-existing conditions after 3 years.

Improved Service Standards:

- Faster Cashless Claims: Insurers are now required to process cashless claim approvals within 3 hours. This speeds up the discharge process and lessens the financial burden during hospital stays. These rules take effect on July 31 this year.

- Reduced Moratorium Period: The moratorium period has been shortened from 8 years to 5 years. After 5 years of continuous coverage, insurers can’t reject your claim due to honest mistakes in your medical history disclosure.

Rewards for Responsible Policyholders: Insurers are encouraged to reward policyholders who maintain a healthy lifestyle and don’t make claims. These rewards can include discounts on premiums or additional benefits.

By expanding coverage, speeding up claims, and rewarding healthy habits, these reforms help you manage health risks more effectively.

(Contributed by Yogesh, Relationship Manager, Advisory Desk, Hum Fauji Initiatives)

Understanding Good Vs Bad Liabilities: A Key to Financial Success

In personal finance, not all liabilities are the same. Knowing the difference between good and bad liabilities is essential for making smart financial choices and building a secure future.

Good liabilities

They typically have the characteristics of Low-interest rate, Long-term horizon and Asset-generating capacity. Examples:

- Home Loans: Real estate often appreciates over time, building equity. Plus, loan interest is tax-deductible, offering additional financial perks.

- Student Loans: Investing in education can significantly boost your earning potential. Properly managed student loans are good liabilities because they are an investment in your future career and income growth.

Bad Liabilities: Avoiding Financial Pitfalls

Bad liabilities don’t offer potential financial gain and often come with high interest rates or unfavourable terms, such as:

- Credit Card Debt: With typically high interest rates, credit card debt can quickly become costly and spiral out of control if not managed properly.

- Auto Loans: Cars depreciate in value over time, making auto loans a bad liability.

- High-Interest Personal Loans: Unless used for income-generating or cost-reducing purposes, high-interest personal loans can be financially draining.

Strategies to Manage and Reduce Bad Liabilities

- Prioritize High-Interest Debt: Focus on paying off high-interest debt first, like credit cards and personal loans.

- Create a Budget: Track your income and expenses to identify areas where you can cut costs and allocate more funds toward paying down bad liabilities.

- Build an Emergency Fund: Save 3-6 months’ worth of living expenses in an easily accessible account. This can prevent you from relying on high-interest loans during financial crises.

By distinguishing between good and bad liabilities and managing your debt wisely, you can make informed financial decisions and pave the way for a more secure financial future.

(Contributed by Neeraj Kumar, Financial Planner, Team Arjun, Hum Fauji Initiatives)

Avoid Chasing the top Performers…they’re history

Being a human, it is in our behaviour to be in hurry to reach the destination by taking the shortcuts or go through highways by increasing the speed. But often regular roads are more convenient to reach the goal post early.

Similarly, while investing, we often try to chase top performing funds to generate higher returns and a small mistake leads to massive loss monetarily and opportunistically. But, if an investor stay invested in a fund rather than changing frequently, there are high chances of generating better returns.

As per a recent study over last 19 years, an investor starting SIP in a midcap/small-cap index fund in April 2005 and continued till 2024, earned higher returns than an investor who changed the SIP annually by chasing the top performers of the last year. Please see the table below.

The study also shows that, from April 2005 to April 2024, SIPs started in the large-cap (Nifty 50 TRI) have been the top performers and multiplied the corpus 7 times. But, SIPs in small-cap (Nifty Small-cap 250 TRI) and the midcap index (Nifty Midcap 150TRI), have multiplied the corpus 6 times even by taking more risks.

However, please do not make wrong conclusions about where to invest – this article is not about that. Any portfolio has to be rightly constructed for your risk profile, future requirements (financial goals) and has to be regularly monitored to be meaningful in the long run. This article is about mindless churning of portfolios based on past record which is actually ‘situating’ the past into your future wealth creation.

(Contributed by Ujjwal Dubey, Financial Planner, Team Prithvi, Hum Fauji Initiatives)

Ques – What is the comparison of tax incurred on income generated from investments in FDs and Debt Mutual Funds? How are SWPs of Mutual Funds more tax efficient?

Our Reply: When planning for retirement, it’s important to ensure your investments provide stable and reliable income. Many people consider Fixed Deposits (FDs) or government-backed schemes like the Senior Citizens Savings Scheme (SCSS), Post Office Monthly Income Schemes (PO MIS), or Pradhan Mantri Vaya Vandana Yojana (PMVVY) for this purpose. However, we have a few questions to help you think about your options:

- Accessibility: Have you considered the practical aspects of these traditional options? They often lock your funds for a certain period, and returns are distributed on a fixed schedule. What if you suddenly need access to a significant portion of your investment?

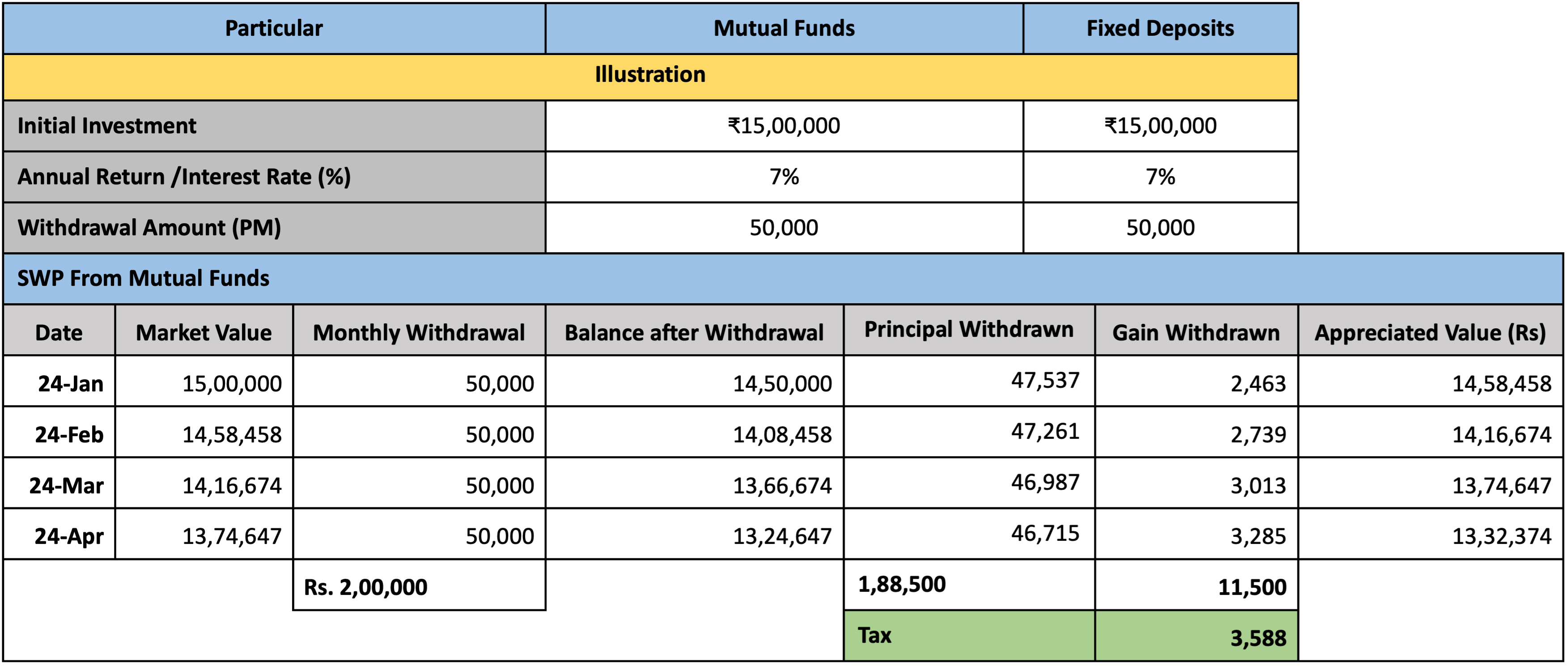

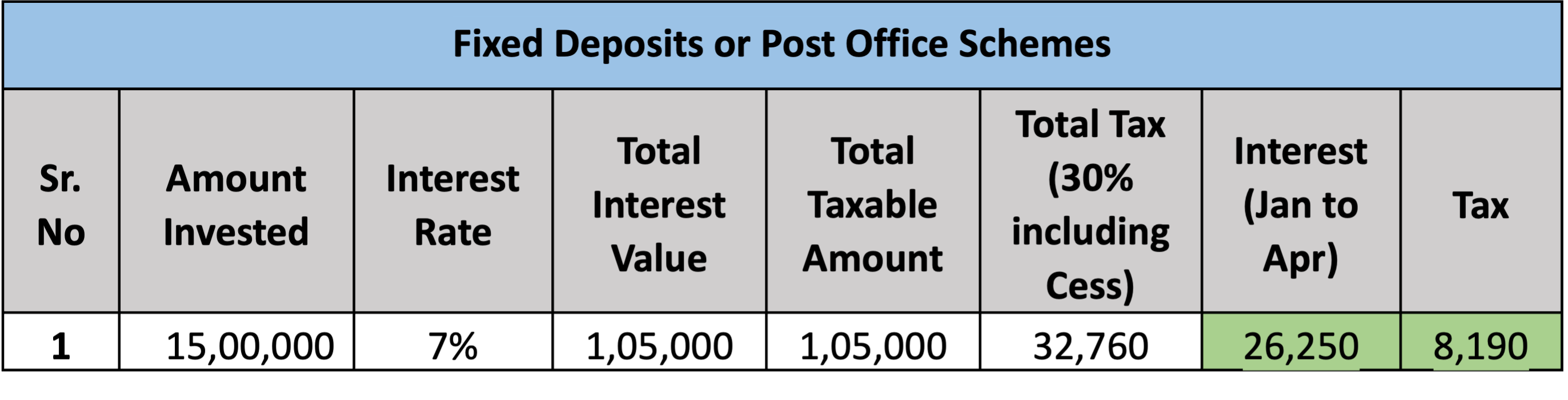

- Taxation: How familiar are you with the tax implications? While some schemes offer tax benefits under Section 80C of the Income Tax Act, the income generated from these investments is fully taxed according to your tax slab. For example, suppose you invest Rs 15 Lakhs in either FDs or Debt Mutual Funds, both offering a 7% annual interest rate. Did you know there’s a significant difference in taxation between these two options?

- Flexibility: Have you heard about the benefits of Systematic Withdrawal Plans (SWPs) from Mutual Funds? SWPs can provide regular income based on the amount and frequency you choose, with much lower taxes compared to other options. Plus, you have the flexibility to withdraw a lump sum if needed.

In the analysis, mutual funds incur tax liability of about Rs 3,588 in a quarter, while fixed deposits incur tax liability of around Rs 8,190. This shows a difference of about Rs 4,600 in tax just within 4 months, highlighting that SWPs from mutual funds are more tax-efficient compared to fixed deposits or post office schemes.

Understanding these factors can help you make a more informed decision. After all, saving on taxes means earning more money, right?

(Contributed by Team Vikrant, Hum Fauji Initiatives)