Balance your investment buffet: Add a healthy dose of stability to a portfolio with Bonds

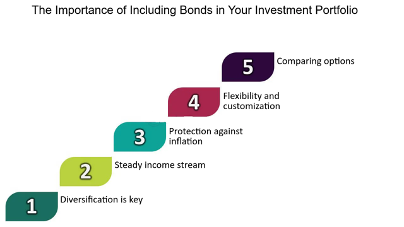

Stocks are the rockstars of investing, soaring high but sometimes unpredictable. Bonds, on the other hand, are more like reliable friends. They offer a steady income through interest payouts, adding much-needed stability to your portfolio. They act as the calm, collected adult at a party, ensuring things don’t get too wild.

How Much Bond is Enough?

The right amount of bonds you need depends on your age, risk tolerance, and investment goals. Generally, younger investors can afford more risk and might have a smaller bond allocation. As retirement nears, increasing bonds can help protect your nest egg.

Buffett’s Secret Recipe

Even legendary investor Warren Buffett knows the value of bonds! He recommends a simple recipe for beginners: 90% stocks (the exciting part of the buffet) and 10% bonds (the broccoli). This mix offers a good balance of growth and stability.

The Bottom Line

Bonds might not be glamorous, but they keep your portfolio healthy. When building your investment buffet, don’t forget the broccoli – the bonds! They’ll help you weather market storms and keep your investments on track for the long haul.

(Contributed by Aman Goyal, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

Baby Steps: Crafting Your Financial Blueprint for Starting a Family

Starting the beautiful journey of parenthood? While the emotional rewards are priceless, the financial aspects need thoughtful planning. Let’s walk through some practical steps to craft your financial blueprint for parenthood.

Baby Step 2 (Build a Safety Net): Create an emergency fund covering 3-6 months of living expenses for unexpected costs. Use tax refunds or bonuses or small windfalls to boost this fund.

Baby Step 3 (Invest for the Future): Start early! Invest in diversified mutual funds to grow wealth for your child’s future. Look into tax-advantaged options for extra benefits.

Baby Step 4 (Protect Your Family): Get term life insurance to secure your family’s future. Consider disability insurance to replace income if you’re unable to work.

Baby Step 5 (Communicate and Seek Guidance): Discuss financial goals with your partner and create a shared budget and investment plan. Consulting a financial advisor can offer personalized advice.

By taking proactive steps, you can build a secure financial foundation, allowing you to focus on the joys of parenthood.

(Contributed by Prerna Pattanayak, Financial Planner, Team Vikrant, Hum Fauji Initiatives)

Question: I am an investor with you in regular mode of investments, and now considering investing my retirement corpus in the direct mode with you. Could you explain the implications of this change, and what steps I need to take to make this transition?

Our Reply: Transitioning your retirement corpus to Direct Mode is a significant decision, and we’re here to help you understand the implications and steps involved. Please remember that this kind of facility and management is only offered by Corporate RIAs (Registered Investment Advisors) like Hum Fauji Initiatives who number just a handful in the entire country, unless you are ready to have different advisors for different purpose which can get your overall financial management into a messy soup.

A mindset change that you also have to contend with from now onwards is that you would have to pay a quarterly fee to us. Remember that you have not paid any fee directly to us so far all these years while it was nevertheless being deducted by the mutual fund companies and being given to us.

Once you switch to Direct Mode with an Advisor, you can no longer make additional investments in the Regular Mode, including bulk investments or systematic plans like SIPs and STPs. Any ongoing SIPs and STPs in Regular Mode will need to be halted and restarted in direct mode.

Your existing investments made before the switch will remain unaffected and will continue to grow with market conditions. You can still redeem these investments whenever needed and we will continue to monitor and review your investments regularly like hitherto fore.

One key difference in Direct Mode is the commission structure. In Regular Mode, we receive commissions from Mutual Fund companies (AMCs). However, in Direct Mode, these commissions cease, we will get nothing and hence we will charge a fee based on your Assets Under Management (AUM) with us to keep our business running.

All our services will continue as usual in Direct Mode. This includes regular client connects, portfolio monitoring and reviews, assistance with ITR filing, loan analysis, insurance analysis, and recommendations on various financial products whether held through us or otherwise.

To transition to Direct Mode, please reach out to us, and we will guide you through the necessary steps to make this process smooth and seamless.

(Contributed by Team Arjun, Hum Fauji Initiatives)