Volatility – A Curse or an Opportunity for Investors?

Have you ever been on a rollercoaster? It rushes up, plunges down, twists, and turns—just like the stock market! Prices soar, then suddenly dip, making some people nervous.

But smart investors? They see it as an opportunity!

Let’s Break It Down Simply:

Imagine you’ve been eyeing a pair of sneakers that cost ₹1 lakh. One day, there’s a massive sale, and they drop to ₹50K. You grab them at the lower price, and later, when prices go back up, you’ve got a great deal.

That’s how the stock market works—wise investors buy low and wait for the value to rise.

How to Enjoy the Market Ride Without Fear:

🚀Stay Calm & Be Patient – The market goes up and down. If you don’t need money immediately, don’t panic. Good things take time!

🎨Diversify Smartly – Just like you don’t eat only one dish daily, don’t invest everything in one stock. Spread it out to stay safe.

📝Have a Plan – If you know your goal, temporary dips won’t shake your confidence.

Final Thought:

Volatility can feel scary, but it’s just like a rollercoaster – if you hold on tight and stay calm, you’ll enjoy the ride!

Smart investors see price changes as chances to buy good stocks at lower prices.

So, would you rather fear the ride or enjoy it? The choice is yours!

(Contributed by Abhilash Rana, Relationship Manager, HNI Desk, Hum Fauji Initiatives)

SIP Investors Hit the Brakes: Is it Time to Worry?

Headlines are screaming, “Investors hitting the brakes!” Yes, SIP cancellations are on the rise, but before you follow the crowd, take a deep breath and look at the bigger picture.

What’s the disruption? And why?

The SIP stoppage ratio spiked to 109% in January 2025, the highest in years. Many retail investors are shaken, fearing losses.

But here’s the biggest myth: stopping SIPs during a downturn prevents losses.

And the truth? It could be your biggest financial mistake.

Think of it this way: your SIP is like a shopping spree, but instead of buying clothes, you’re buying units of a mutual fund. When the market is high, you get fewer units for your money.

When prices drop, you get more—that’s rupee-cost averaging in action. Right now, when the markets are lower, your money is buying more units than ever before. And if you buy now, when the market rebounds, you’ll be in the best position to get the top profits.

The Winning Move: Invest More, Not Less!

Instead of stopping your SIPs, consider increasing them. By investing more during a dip, you’re setting yourself up for substantial long-term gains. Markets are cyclical—what goes down will rise again as it has over years and decades.

A documented fact: In Jan 2025 in India, Do-It-Yourself (DIY) investors stopped 90 Lakh of their SIPs out of fear. During the same month, 40 Lakh new SIPs were started by investors where financial experts were guiding them.

(Contributed by Gautam Arora, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

What did our Clients Ask us in last 7 Days?

Question– I am an NRI who inadvertently missed filing my Income Tax Return this year, and the last due date has already passed. Am I still eligible to claim a refund and carry forward any losses to future years?

Our Reply- NRIs often manage income in multiple countries, making it easy to miss tax deadlines. If you’ve forgotten to file your return, don’t stress—ITR-U is here to help!

In the 2022 Union Budget, the Indian government introduced ITR-U (Updated Income Tax Return) to allow taxpayers to correct mistakes without major penalties. Even better, the 2025 Budget has extended the time limit for filing an updated return from 24 months to 48 months. This means you now have four years to rectify any errors and ensure compliance.

However, there’s a catch. The deadline to file a belated ITR for FY 2023-24 was 31st December 2024. If you missed it, you can still file an updated return (ITR-U), but only if you have additional tax to pay.

If you were expecting a refund or wanted to carry forward losses but missed the deadline, unfortunately, you can no longer file or claim the same. ITR-U cannot be used to claim a refund or reduce tax liability—it is only applicable when additional tax is due. Since the deadline for filing a belated return has passed, any excess TDS deducted cannot be reclaimed through ITR-U.

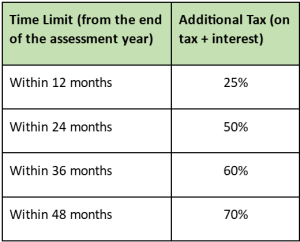

Additional Tax Payable When Filing ITR-U:

When filing an updated return (ITR-U), an additional tax is charged on the total tax due, including interest. The amount depends on how late the return is filed:

This means that the longer the delay in filing the updated return, the higher the additional tax payable.

NRIs can also benefit from DTAA (Double Taxation Avoidance Agreements) to avoid overpaying taxes. If you’re unsure about your tax status or need guidance, consulting a tax expert can help you find the best way forward.

(Contributed by Team Dhruv, Hum Fauji Initiatives)

We keep hand-holding our clients in such complicated cases every day and guide them to take the legally correct path. Click here to take our help today.