Decoding the New Income Tax Slabs: Which One Saves You More Money?

You’re at a crossroad, with two paths leading to the same destination—tax savings. One road is the old tax regime, filled with deductions and exemptions, while the other is the new tax regime, promising simplicity with lower tax rates.

Which one should you take?

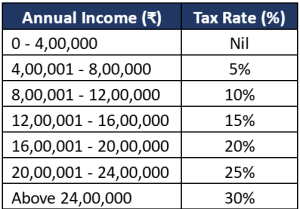

Here’s a quick look at the revised tax slabs in the new tax regime:

💡A key highlight – Salaried individuals get a standard deduction of ₹75,000 under the new regime.

So, which path is better?

If you have significant deductions (like investments under Section 80C, medical insurance, or home loan interest), the old regime may still work for you. But if you prefer a hassle-free approach with lower tax rates, the new regime might be your best bet.

However, the trick lies in calculating exactly under the two tax regimes and then going ahead with deciding on the best regime for you.

Example: A ₹12.75 lakh salary earner pays zero tax under the new regime (after standard deduction & rebate). Under the old regime, they must claim ₹4.5 lakh in deductions to reduce tax liability to ₹62,500. If deductions are below ₹4.5 lakh, the new regime is better.

Your money, your choice— make it work for you.

(Contributed by Mausam Gupta, Relationship Manager, Team Prithvi, Hum Fauji Initiatives)

Active vs. Passive Investing: The Best Bet for Today’s Market!

Think of investing like choosing how to travel.

Do you prefer driving a car, making quick turns and adjustments as needed, or riding a train, following a steady track without intervention? This is the difference between Active and Passive investing.

But which one is better?

The truth is, both have their time to shine, and the market ultimately decides.

Pros & Cons of Active Investing

✅ Quick Market Adaptability – Active funds can swiftly adjust their portfolios in response to economic shifts, interest rate changes, or global events.

✅ Sector-Specific Opportunities – Funds can focus on high-growth sectors and undervalued stocks.

❌ Emotional Decision-Making – Frequent trading can lead to impulsive choices, impacting returns.

❌ Higher Tax Burden – Increased transactions result in higher capital gains taxes.

Pros & Cons of Passive Investing

✅ Steady Long-Term Growth – Historically, passive funds have delivered consistent returns, often outperforming active strategies over time.

✅ No Dependence on Fund Managers – Investments follow an index, eliminating reliance on human decision-making.

❌ Lack of Downside Protection – Since passive funds track the market, they decline when the market does.

❌ No Market-Beating Potential – It can only match the market’s performance, not exceed it.

Finding the Middle Path

For investors seeking a balance, Smart Beta strategies offer a blend of both approaches. These funds follow a passive investment strategy but with a set of rules that tilt the portfolio towards certain factors like value, momentum, or dividends, aiming to enhance returns.

The Best Approach for Today’s Market

There’s no one-size-fits-all answer. Your choice between active, passive, or smart beta investing should align with your financial goals, risk tolerance, and investment horizon. Understanding the nuances of each approach can help you make informed decisions and navigate your investment journey effectively.

(Contributed by Riya Bhandari, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

Estate Planning Vs Succession Planning: What Sets Them Apart?

Let’s visualise building something great—a home full of memories or a thriving business. But what happens to them when you’re no longer around? That’s where estate planning and succession planning come in. While both shape your legacy, they serve different purposes.

Estate Planning: Protecting Personal Assets

Lata, a successful entrepreneur, wants to ensure her family is financially secure. She:

✅ Writes a Will to decide who inherits her home and investments.

✅ Sets up a Trust to protect her family and avoid legal hassles.

✅ Appoints a Power of Attorney for financial decisions if needed.

✅ Creates a Healthcare directive to outline medical preferences.

💡 Estate planning ensures Lata’s loved ones are cared for, and her assets go to the right people.

Succession Planning

Lata also wants her business to thrive after her retirement. She:

✅ Selects Akshay, a trusted manager, as her successor.

✅ Trains him to take over leadership gradually.

✅ Creates a buy-sell agreement for smooth ownership transfer.

✅ Structures finances to keep the business stable.

💡 Succession planning ensures Lata’s business doesn’t just survive—but thrives.

The Key Differences

✔ Estate Planning → Ensures your personal assets go to the right people.

✔ Succession Planning → Ensures your business has the right leadership in place.

Estate Planning and Succession Planning are two sides of the same coin—one protects her family, the other protects her life’s work.

(Contributed by Anjali, Financial Planner, Team Prithvi, Hum Fauji Initiatives)

What did our clients ask us in the last 7 days

Question –

I purchased an under-construction flat in May 2023 with a 100% down payment, funding it by redeeming mutual funds and claiming a Section 54F exemption. The builder has delayed possession beyond two years, and I now plan to exit the project by cancelling the sale deed. How will the Income Tax Department treat my claimed exemption? Will I need to pay tax on the exempted capital gains?

Our Reply –

Section 54F allows capital gains exemption in such cases if proceeds are reinvested in a residential property with possession taken within three years. Since your flat’s construction is delayed and you plan to cancel the sale deed, your exemption is at risk.

Likely Tax Treatment

✔ Exemption Withdrawal – The Income Tax Department may revoke the exemption as the construction condition is not met.

✔ Capital Gains Tax – The exempted gains will now be taxable, calculated in the year of the original asset sale.

✔ Interest & Penalties – Interest on unpaid tax under Sections 234B & 234C may apply from the time your tax payment on redemptions was due, though penalties are unlikely in genuine cases.

What Should You Do?

✔ Keep sale deed, payment proof, builder communication, and cancellation record ready for assessment.

✔ If the delay is due to insolvency or legal hurdles, you may argue for relief with the tax department, but it’s not guaranteed.

✔ Consult a tax professional for guidance.

📌 Key Takeaway: Your capital gains exemption is at risk, and tax liability may arise. Stay prepared, document everything, and seek expert advice.

(Contributed by Team Arjun, Hum Fauji Initiatives)

We keep hand-holding our clients in such complicated cases every day and guide them to take the legally correct path. Click here to take our help today.