Should You Stop Your SIPs in Mid & Small Cap?

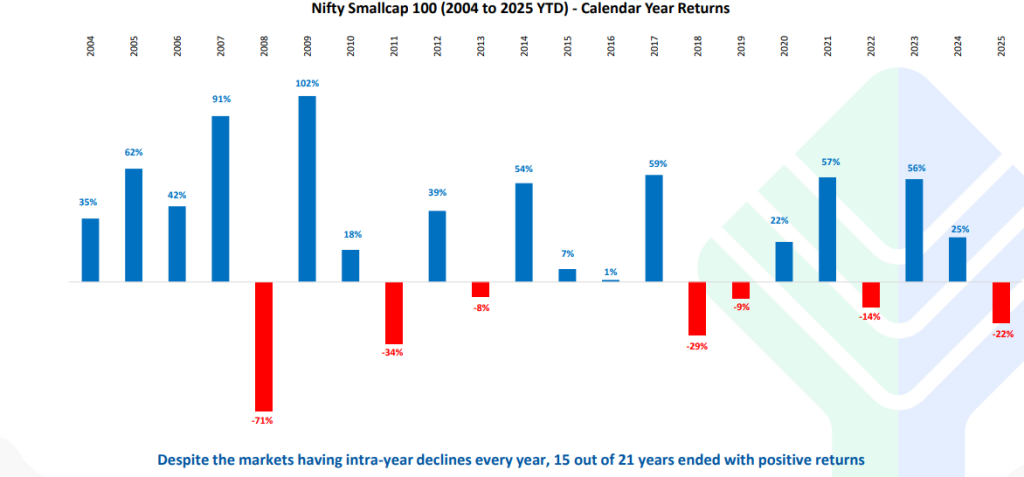

The recent sharp correction in Indian equities has been particularly severe for mid and small-cap stocks, with indices down 20-25% from their all-time highs. This decline stems from stretched valuations and an exceptional four-year rally post-COVID. Given this volatility, should investors reconsider their SIPs in these segments?

Why Staying Invested is the Smart Move

🔹 Market Cycles Are Inevitable – Historically, mid and small-cap declines of 30% or more occur every 8-10 years, but recover within 2-3 years.

🔹 Lower Risk of Long-Term Negative Returns – SIPs help navigate volatility, reducing the impact of market downturns and improving long-term outcomes. When some segment is down, SIPs in that segment helps you buy at much lower prices.

🔹 Timing the Market is Nearly Impossible – Exiting now risks missing the recovery. SIPs ensure you benefit from rupee-cost averaging, accumulating more units when prices are low.

Source: Fundsindia

Who Should Continue SIPs?

✔️ Long-term investors (7+ years horizon) who understand market cycles.

✔️ High-risk investors who can withstand short-term fluctuations.

The Bigger Picture

India’s long-term growth trajectory remains intact. Market corrections create entry points for future gains, and mid & small-cap segments are likely to recover and outperform over time. Pausing SIPs due to temporary volatility could mean missing significant wealth-creation opportunities.

🔎 Investor Insight: Market corrections are opportunities in disguise. Stay the course, trust the process, and let disciplined investing work in your favor! 🚀

(Contributed by MF Alam, Sr. Research Analyst, Hum Fauji Initiatives)

Waiting for a Market Crash? You Might Be Missing Out

Many investors hold onto cash, waiting for the “perfect” dip to invest. But what if that moment never arrives?

Back in March 2020, the Sensex crashed to 26,000. Some waited for a further fall, while others seized the opportunity. Today, with the Sensex above 75,000, those who hesitated missed a massive rally.

Why Timing the Market Fails

1️. Markets Recover Quickly – History shows sharp declines are often followed by strong rebounds.

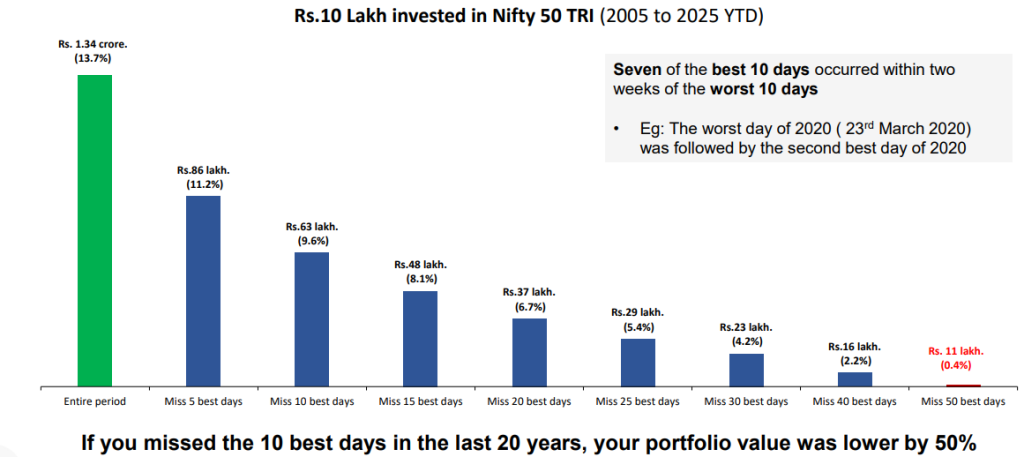

2️. Missing Key Days Lowers Returns – Just a few missed high-growth days can significantly impact long-term gains.

3️. India’s Growth Story Is Strong – A booming economy, rising domestic consumption, and resilience make India a long-term investment hotspot.

Equity Returns are non-linear – Missing few best days in the market significantly reduces returns

Source: FundsIndia

What Should You Do?

✅ Stay Invested – Long-term discipline beats market timing.

✅ Use SIPs to Average Costs – Investing regularly smooths out market fluctuations.

✅ Diversify Smartly – A balanced mix of equity, debt, and gold helps manage risk.

Market corrections may seem unsettling, but they create opportunities. Instead of waiting, leverage the power of compounding and disciplined investing

(Contributed by Anjeeta, Financial Planner, Team Arjun, Hum Fauji Initiatives)

Bottom Line: The best time to invest was yesterday. The next best time? Today.

Checking Your Portfolio Too Often? You Might Be Hurting Your Returns

With investment apps at our fingertips, checking portfolios has become a habit. But constant monitoring can lead to stress and impulsive decisions. Here’s why you should stop doing it daily:

- Markets Fluctuate Daily—It’s Normal! Markets move like the weather—unpredictable in the short term but stable over time. Watching daily ups and downs can cause panic and lead to poor decisions.

- Emotional Investing = Poor Returns. When markets dip, fear makes investors sell. When markets rise, greed pushes them to buy more. Both reactions harm long-term returns. Remember Charlie Munger’s words:

“The first rule of compounding is to never interrupt it unnecessarily.”

- Checking Less = Smarter Investing. Short-term price swings (volatility) are not the same as actual risk. Investors who check less often tend to stay disciplined and benefit from long-term growth.

- Focus on What Matters. Rather than stressing over daily fluctuations, focus on:

✅ Sticking to your financial goals

✅ Investing regularly (SIP is your best friend!)

✅ Ignoring short-term market noise

Bottom Line – Invest & Relax!

Investing is like planting a tree—you don’t dig it up daily to check the roots! Let your money grow, check periodically, and trust the power of compounding.

So, invest, stay patient, and let time do the work!

(Contributed by Vishakha, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

What did our clients ask us in the last 7 days

Question – How will the interest on my late father’s fixed deposit be taxed if I continue it? Can I avoid TDS or claim a refund?

Our Reply – Inheriting a fixed deposit (FD) after a parent’s passing provides financial security, but it also comes with tax considerations. Here’s what you need to know:

🔹 Tax on Interest

- The principal amount is not taxable in your hands.

- Interest earned before your father’s passing is taxed in his hands.

- Interest earned after inheritance is added to your income and taxed as per your income slab.

🔹 TDS Applicability

- Banks deduct TDS on interest exceeding ₹40,000 (₹50,000 for senior citizens) in a financial year.

- To avoid TDS, submit Form 15G (for individuals below 60, taxable income below ₹2.5 lakh) or Form 15H (for senior citizens, taxable income below ₹3 lakh) if eligible.

- If TDS is deducted, you can claim a refund while filing your ITR, if due.

Keeping accurate FD records, including inheritance details and interest earned, is essential. For personalized tax planning, consulting an expert is always a wise choice.

(Contributed by Team Vikrant, Hum Fauji Initiatives)

Need clarity on managing inherited assets? Connect with Hum Fauji Initiatives for expert financial guidance!