Unlock Big Savings: Smart Home Loan Strategies

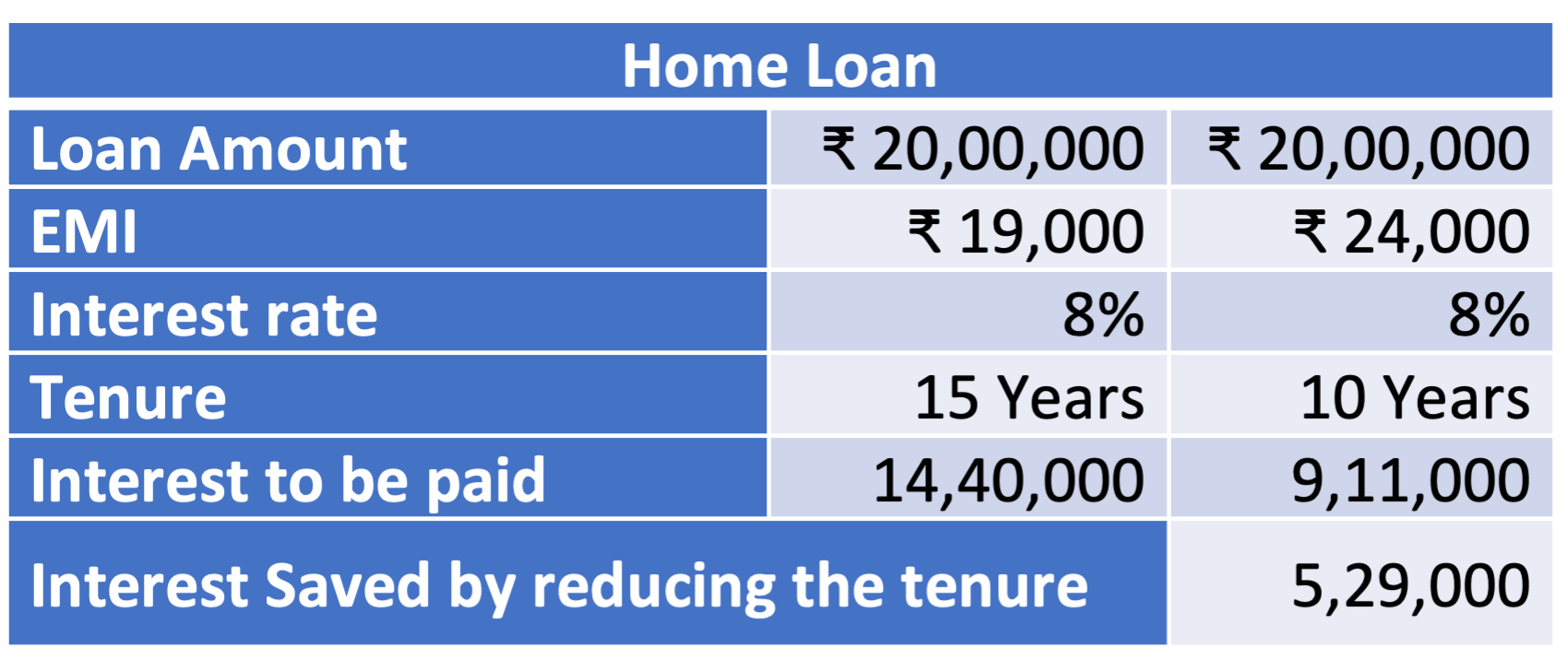

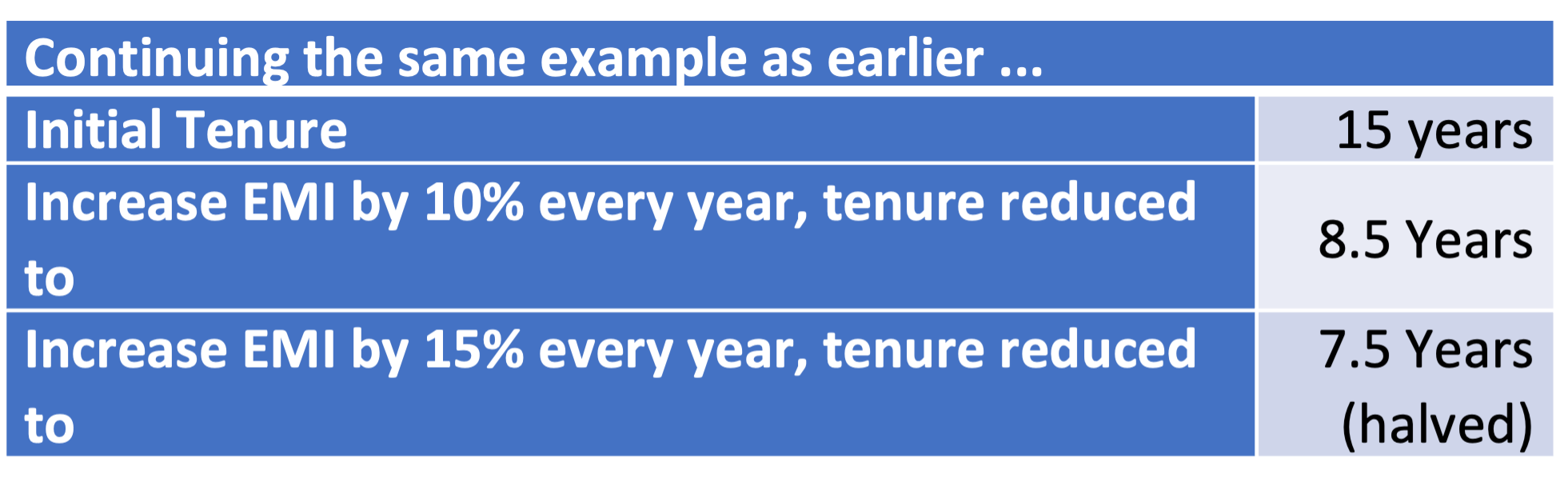

1. Keep Loan Tenure as Short as Possible. The shorter your loan tenure, the lesser interest you’ll pay overall. While your monthly payments will be higher, you’ll be debt-free much sooner. Example: Borrow Rs. 20 lakhs at 8% interest for 15 years, and your EMI is Rs. 19,000. You’ll pay Rs. 34.4 lakhs in total. Cut the tenure to 10 years, and the EMI goes up to Rs. 24,000, but you’ll save over Rs. 5.29 lakhs in interest and be debt-free 5 years sooner!

Example:

4. Consider Joint Home Loan with Spouse. Taking a joint home loan with your spouse can help you qualify for a bigger loan or secure a lower interest rate. Plus, both of you can claim tax deductions: Rs 1.5 lakhs each for principal repayment (Section 80C) and Rs 2 lakhs each for interest paid (Section 24b).So, use smart strategies, save big on your home loan and reach your financial goals faster!

(Contributed by Prerna Pattanayak, Financial Planner, Team Vikrant, Hum Fauji Initiatives)

Understanding our Financial Minds

Invisible Hand of Behavioural Biases- Behavioural economics identifies several biases that affect financial decisions. For instance, “anchoring” occurs when we rely too heavily on the first piece of information we receive (like an asking price) when negotiating a purchase. This can lead to overpaying or underselling assets. Similarly, “confirmation bias” makes us seek information that supports our existing beliefs about investments or spending choices, ignoring contrary evidence that could change our minds.

The Influence of Emotions- Emotions are powerful in finance. Stress might lead to impulsive buys, while feeling successful might result in overspending. We often prioritize immediate rewards and fear losses, which can lead to overspending during sales or holding onto bad investments.

Social Influence and Spending Habits- We’re influenced by those around us. If friends spend lavishly, we might feel pressured to do the same, straining our finances. Recognizing this can help us make better choices.

The Power of Mental Accounting-Mental accounting influences how we handle money by categorizing it for different purposes. For example, we might see a tax refund as “extra” money and spend it freely. This helps explain why people save rigorously for retirement but splurge on vacations or gadgets guilt-free. These mental compartments significantly impact our financial choices.

How to go about mastering the Mind-Game of Money?

Money isn’t just cash; it reflects our values and fears. By understanding our financial psychology, we can overcome biases, reshape our financial stories, and achieve financial freedom. Awareness is key to managing our thoughts and emotions for better financial health.

(Contributed by Aman Goyal, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

Crunching the Numbers: The Secret Formula for F.I.R.E. Success

For those not likely to get an employer’s pension or the pension received will be less than what they need, the FIRE (Financial Independence, Retire Early) movement is all about achieving financial freedom, and possibly retiring early, by following three main principles:

- Save Aggressively: Aim to save 40-50% of what you earn.

- Live Frugally: Keep your expenses low by being mindful of your spending.

- Invest Wisely: Make smart investments to grow your money.

The core idea is to save substantial amounts by cutting unnecessary expenses and investing strategically. A popular method in the FIRE community is the Rule of 25. This rule suggests that you should save at least 25 times your expected annual expenses for your first year of retirement.

For example, if you expect to need Rs 12 lakh in your first year of retirement, you should aim to save Rs 3 crore (12 lakhs x 25 = 3 crore).

This is also known as the 4% rule, indicating you can withdraw 4% of your savings each year to cover your expenses.

Retirement planning is indeed complex, but two different FIRE strategies can help simplify this process:

- Lean FIRE: Cut your annual expenses by about 15%, say from Rs 12 lakh to Rs 10 lakh or lesser. This requires strict budgeting but can help stretch your savings further.

- Coast FIRE: Save aggressively early in your career, allowing your investments to grow over time without needing to save continuously. This provides more freedom with your time and money.

Of course, the traditional approach of working until retirement and saving regularly is still a good plan for many people. However, the FIRE movement offers exciting alternatives for those who want to take control of their financial future and retire early if they so wish.

(Contributed by Avantika Agarwal, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question– I am a permanent US Resident now. After my demise, what will be the inheritance tax levied on my inheritors and how should I plan well to pass on my estate?

Our Reply- Cross-border estate planning involves managing and transitioning assets across different jurisdictions. In the US, an inheritance tax applies when someone dies and leaves assets to others, but this tax only affects US residents, citizens, or Green Card holders.

If you meet these conditions and inherit assets from an Indian citizen or resident, you won’t have to pay this tax, but you must report it and file it on form 3520.

The US imposes an estate tax of up to 40% on the transfer of a person’s taxable estate at death. There is an exemption of USD 13.61 million (indexed for inflation 2024) which, as per current laws, will fall to USD 7 million from 2026 onwards.

Following can be helpful for estate planning for a person like you:

1. Well-crafted Will: It will help in easing complexities and helps mitigate potential disputes. Prepare your Will in accordance with cross border rules if you have any assets outside the US also.

2. Gift Assets Strategically: In the US, gifting assets during your lifetime can help reduce the size of your estate and potentially lower estate taxes. Be aware of the annual gift tax exclusion limits and execute gifting regularly and patiently.

3. Consider Trusts: An irrevocable trust transfers asset ownership to the trust beneficiaries. Since these assets no longer belong to the person who set up the trust, they aren’t subject to estate or inheritance taxes when that person dies.

Proper estate planning can help minimize these taxes and ensure that your assets are distributed according to your wishes while maximizing the value passed on to your heirs.

(Contributed by Team Dhruv, Hum Fauji Initiatives)