Decoding the Dynamics: Stock Markets and GDP Growth

Well, it’s not that simple. Let’s break it down.

What’s GDP Anyway?

GDP, or Gross Domestic Product, measures the total value of everything a country produces.

And the Stock Market?

The stock market is where people buy and sell shares of companies. It’s influenced by how investors feel about the future of these companies.

Do They Move Together?

1. Timing is Everything:

- GDP numbers come out quarterly or yearly, meaning there’s a delay.

- Stock markets react immediately to news and predictions. So, stock prices might already include expected GDP changes before the official numbers come out.

2. More Than Just GDP:

- Stock markets don’t just look at GDP. They also care about interest rates, company profits, political events, and how optimistic investors are feeling.

- Different sectors react differently. For instance, tech companies and luxury goods do well when the economy is growing, while essential services and goods stay strong even in bad times.

3. The Global Picture:

Our world is interconnected. Economic issues in one country can affect markets everywhere. For example, if there’s a slowdown in a big economy like the US or China, it can impact markets worldwide, no matter what the GDP growth rate is in another country.

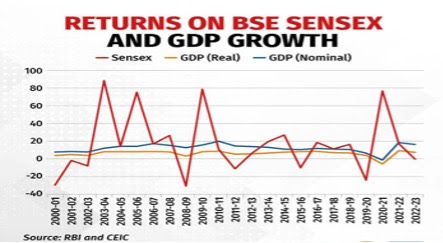

So, while GDP growth and stock market performance can be related, they aren’t directly linked (refer to the above graph). Stock markets are driven by a variety of factors, making it essential for investors to consider a broad range of economic indicators and market conditions, not just GDP growth, when making decisions.

In simple words, GDP is hard numbers and stock market is economy numbers, company performances, emotions, herd mentality, TV and media and much much more!

(Contributed by MF Alam, Sr. Financial Research Analyst, Hum Fauji Initiatives)

When the US sneezes, the entire world catches a cold

The US Market: It’s on everyone’s Radar

When the US stock market fluctuates, it sends ripples through global markets. The Dow Jones, S&P 500, and NASDAQ are key indicators that influence investor sentiment worldwide. Their movements, along with US Treasury yields, set the global investment climate.

Trading Ties: A Global Tango

The US is a dominant player in international trade. Economic issues in the US can cause global disruptions, as seen during the 2008 financial crisis, which started in the US housing market and impacted economies from Germany to Japan, highlighting global interconnectedness.

| The impact of the 2008 Global Financial Crisis is depicted in the chart below: |

Ever heard of tariffs? These are like taxes that countries put on each other’s trade. When the US puts on tariffs, it can hurt exporters. This affects their profits and stock prices, causing waves across markets. And don’t forget about the Federal Reserve—their decisions on interest rates can make investors rush in or run away from the market.

Weathering the Storm

While the US plays a significant role in the global economy, other markets are becoming more resilient. Countries are strengthening their economies and recovering from setbacks independently. However, the US still wields significant influence, and its financial decisions can either bolster or destabilize global economies, demonstrating the tight interconnection of global finance.

Finally, It is the Global Market Symphony

In short, the US market is like the conductor of a big financial orchestra. Its moves decide how markets around the world play. Some are finding their own way, but the US is still the leader, shaping the music of global finance. So, when the US has problems, it’s not just a small thing—it’s a big deal that affects all of us.

(Contributed by Avinash, Financial Research Executive, Hum Fauji Initiatives)

Question – Should I file my ITR in June or wait till 31st July? What are Vital key points and things I should keep ready?

Our Reply – The question often arises that whether one should file the ITR early in April-May or wait until they receive Form 16 or until the last date, i.e., 31 July of every year.

- Individuals with all income reported to the tax department: They can use their Annual Information Statement (AIS) to file returns and claim refunds without waiting for Form 16.

- Non-resident Indians with only capital gains Income: As their TDS returns are already filed and reflected in AIS and Form 26AS, they can file early.

Early filing allows ample time to gather necessary documents like Form 16, pay slips, and savings certificates, ensuring a smooth process and timely resolution of discrepancies. It also avoids last-minute hassles, and potential penalties, and facilitates quicker refunds

Who Should Wait?

Taxpayers with substantial TDS credits to offset against their tax liabilities: They may need to wait until June, as Form 16/Form 16A is issued by 15th June. This ensures their tax return aligns with the tax department’s information, avoiding mismatches and potential questioning.

Filing closer to the deadline helps accurately assess financial situations, ensuring all income sources and deductions are included, reducing the risk of errors and penalties.

(Contributed by Team Dhruv, Hum Fauji Initiatives)