The Science of Food and Finance

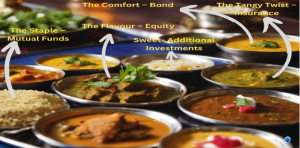

Welcome to the world of investing, where we’ll spice up our financial strategy thali-style!

Just like a perfectly curated thali brings together a variety of flavours, textures, and aromas, a balanced investment portfolio combines different assets to create a feast for your financial future. So, grab your metaphorical plate, and let’s dive into the delicious world of diverse investments!

Rice: The Staple – Mutual Funds: Rice, the thali’s basis, gives consistent energy, just like mutual funds are the backbone of your portfolio. They provide a portfolio of several equities or bonds, spreading your risk and lowering volatility. Consider it a delightful pulao – rice with a variety of veggies and nuts, each bite unique yet integral to the whole.

Dal: The Comfort – Bonds: Dal adds protein and balances the spicier elements. Similarly, bonds provide stability and income when markets get turbulent.

Sabzi: The Flavour – Equity: Ah, the sabzi! The show’s star, bringing colour and excitement. Equity assets, like stocks, have significant growth potential and higher risk. Consider tandoori paneer – bold, flavourful, and potentially scorching, much like the stock market!

Chutney: The Tangy Twist – Insurance: An excellent chutney offers a zingy aspect that awakens your palette. Insurance serves a similar purpose, acting as a safety net against life’s unforeseen twists and turns. Consider a spicy mint chutney: it’s sharp, unexpected, and necessary to complete the dish.

Dessert: The Sweet Reward – Additional Investments: Sweeten your portfolio with dessert! Think gold, real estate – the fun stuff! These alternative picks add a touch of diversification and excitement to your financial journey.

Now, assemble your thali with care, ensuring a balance of flavours and textures. Just as you wouldn’t load up on only spicy dishes or skip the dal entirely, diversify your investments wisely. This thali-style approach ensures that your financial taste buds are constantly stimulated, and you’re prepared for whatever the market kitchen serves up.

So, dive into the world of investing with the gusto of enjoying a thali, savoring the variety and relishing the journey toward a well-nourished financial future. Bon appétit!

(Contributed by Abhinandan Singh, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

Financial Well-being in Relationships

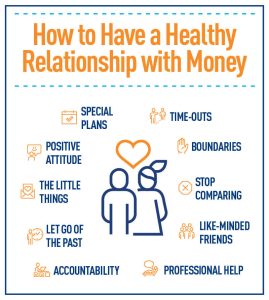

Ah, relationships! Love, laughter, and money… the awkward money conversations? Yes, finances, that sometimes taboo topic, can cast a shadow on even the sunniest relationships. But fear not lovebirds! It isn’t a mythical beast, it’s a journey of trust, communication, and shared goals.

Let’s break it down:

Open Communication is the Golden Key: Money matters, and pretending it doesn’t make it disappear. Talk openly and honestly about your financial situation, income, expenses, and goals. Be transparent about debts and savings, and avoid money secrets.

Budgeting Together: Ditch the “you pay this, I pay that” model and build a budget together. Discuss expenses, set realistic goals, and create a plan that works for both of you. This collaborative approach fosters a sense of shared responsibility and prevents resentment from brewing.

Goals, Dreams, and Money Magic: Do you dream of a beachside retirement or a family adventure around the world? Talk about your financial goals, both short-term and long-term. Work together to create a roadmap, adjust priorities, and celebrate milestones along the way.

Financial Transparency: Don’t hide financial skeletons in your closet! Be open about debt, investments, or unexpected expenses. Communication and honesty are key to weathering financial storms together.

Planning for the “What-ifs”: Life throws curveballs. Discuss financial plans for potential challenges like job loss, illness, or caring for elderly parents. Having a roadmap in place for unexpected situations alleviates stress and fosters a sense of shared security.

Remember, financial well-being in relationships is an ongoing journey, not a one-time fix. Be patient, communicate openly, and adjust your approach as needed. By working together and respecting each other’s money mojo, you can build a secure financial foundation that makes your relationship special.

(Contributed by Akash Singh, Financial Planner, Team Vikrant, Hum Fauji Initiatives)

What Do Investors Like You Have to Say About Current Market Conditions?

We asked the following question on our Telegram Channel ‘HFI Money Talks’:-

There is a mix of fear and greed amongst Indian retail investors due to stock markets having run up very fast recently (leading to ‘Fear’) and most of the investors having got huge returns in the recent past (leading to ‘Greed’). What should a common investor do at this stage in the stock market?

We are publishing below two replies received on the group verbatim:

Col Ravi Chander (retd):

The market runs on fear and greed, but the smart player is fearful when others are greedy, and vice versa… As we head into an expectedly choppy 2024, retail investors holding direct stocks could adopt one suggestion to protect profits and save themselves from losses:

First, review their portfolio and decide which stocks are well-researched picks, random tips, and stocks purchased in FOMO, which were short-term plays but are now being held in loss, and which are doing unexpectedly well. For the stocks which you plan to hold for long, prepare a plan to add more on pre-decided dips (say, every 1%) and let them grow.

The losing stocks, amputate them at the earliest before the entire portfolio starts getting affected. Be ruthless in this. The unexpected gainers, try and decide at which price your greed ends, and fear begins, and put exit orders to remove the strain of daily decision-making.

Keep the cash you get from exiting these stocks in hand and add to the good, researched stocks on dips. Control the greed, ride the fear, and 2024 could be another great year.

Cdr SS Kumar (retd):

The year 2023 saw the Russia-Ukraine war, China Taiwan’s continuous skirmishes and likely US intervention, the Israel-Hamas major conflict which could have involved Iran and other countries, record levels of inflation in the last 20 years in Europe and US causing suffering to their common people through higher cost of energy and higher EMIs on housing and car loans etc. Still, our markets were up 20% and 100s of stocks went up 3-4 times and investors made a lot of money. Our markets are trading at all times high, and the market cap to GDP ratio is more than one.

One school of though is that this is not sustainable, and there would be a correction of about 2000 points on Nifty. This will look like blood on the street, so stay away.

The other school of thought is that the Indian markets will continue to do well and that hundreds of stocks will rise many times over. This belief is on the back of stable and progressive leadership likely to continue for another 5 years, falling fuel prices and expectations that the Fed will start cutting repo rates soon, stock markets will go up and lots of FII money will flow into India because IMF and World Bank are forecasting our 6.5 to 7% GDP growth, the highest in major economies.

I am staying invested and adding more. I see path-breaking reforms after the present government assumes office again in May-June. So please stay invested and keep buying good stocks.

‘HFI Money Talks’ group on the Telegram app has 4000+ armed forces officers and their spouses discussing financial issues – community members ask questions, answer questions, discuss, debate, unlearn and learn, and become financially savvy with each other’s active participation. Do join it at this link: https://t.me/joinchat/UsAn1KhhudsfFPMb

What Did Our Clients Ask Us in the last 7 Days?

Clients’ query: General elections are round the corner and markets will be risky now. If there is some problem in Govt formation, markets will crash. What to do?

Our reply: While upcoming elections might spark concerns about your investments, let’s remember the bigger picture:

Since 1980 to 2023 the government has changed 11 times. The average real GDP growth is 6.2%, and Sensex gave 15.5% CAGR returns. The Sensex has given positive returns after all the elections that have taken place this entire century where similar speculations about volatility, risk and concerns abounded before the elections.

Historically, regardless of who’s in power, India’s economy has maintained a pro-growth trajectory. The focus on infrastructure, reforms, and market-driven policies has created a solid foundation for sustained growth and there is no reason that a routine democracy journey should topple or affect it.

Please remember that general elections are one of the temporary events in your long investment journey. By making well-considered decisions, and seeking professional guidance, you can navigate the potential turbulence and keep your investments on track for the long term.

Here’s the fun part: it’s a bit like a movie, and elections are just one scene. Sometimes things shake up short-term, but the real story happens over a longer time. So, get ready for the election ride, enjoy the twists, and remember, in money matters, you’re the director of your show and you hold all the cards!

Play your cards well with our help and enjoy the show when it goes onstage.