From Small Coins to College Funds

Remember those days of collecting small coins, only to devour them in a sugary frenzy? Let’s face it, teaching kids about finances can feel just as fleeting.

But fear not, parents! We can transform those fleeting candy moments into a foundation for future financial superstars.

Here’s the trick: Make it Fun!

Imagine this: Your child proudly deposits a crumpled Rupee note (earned from chores, perhaps?) into their very own decorated piggy bank. This isn’t just about saving for that new toy; it’s about planting the seed of delayed gratification.

- Turn playtime into a learning zone. Board games like Monopoly become financial literacy tools in disguise. Explain the concept of buying and selling, and maybe even let them “invest” a portion of their play money in a “high-risk, high-reward” venture (like building a hotel on Monopoly!).

- Embrace technology. There are fantastic budgeting apps designed specifically for kids. These apps allow them to track their allowance, categorize their spending (got to differentiate between needs and wants!), and even set saving goals. Imagine the excitement of watching their virtual piggy bank grow!

- Lead by example. Talk openly about your own budget and financial decisions (age-appropriately, of course). Let them see the value of comparison shopping, the importance of setting aside money for emergencies, and the power of long-term saving.

- Remember, it’s a journey, not a destination. There will be slip-ups (that forgotten candy purchase!), but use those moments as teaching opportunities. The goal is to foster a healthy relationship with money, and that takes time and patience.

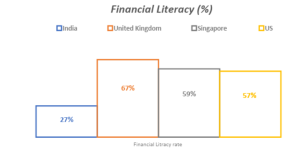

The data paints a clear picture: India has a gap to bridge when it comes to financial literacy. While other countries equip their young citizens with financial knowledge from a young age, we’re missing a crucial step. Let’s join the movement and empower future generations to make informed financial decisions!

So, ditch the lecture and embrace the play! By incorporating the above tips, you’ll be well on your way to raising financially savvy kids who understand the true value (not just the candy kind) of a rupee.

(Contributed by Gautam Arora, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

Don’t Make These Tax Savings Mistakes

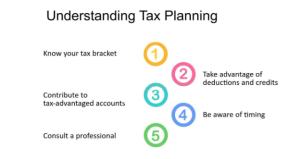

The financial year 2023-2024 has concluded, and we trust all have managed their taxes prudently. Many individuals rushed to invest in ELSS and NPS for last-minute deductions. Let’s steer clear of such hurried decisions and optimize your deduThe financial year 2023-2024 has concluded, and we trust all have managed their taxes prudently. Many individuals rushed to invest in ELSS and NPS for last-minute deductions. Let’s steer clear of such hurried decisions and optimize your deductions and credits, thereby retaining more of your earnings. Here are some common tax savings mistakes to avoid:

- Choose your tax regime wisely: With the recent changes in the tax regime, new tax regime has become the ‘default’ one. So, first calculate which tax regime suits your profile. Analyse your various sources of income and deductions. If you’re our client, just contact her/him and you’ll get the answer.

- Think Twice Before You Invest: Don’t just invest in any scheme to save tax. Choose options that suit your financial goals, risk appetite and diversify well.

- Maximize Your Deductions: Many tax-saving instruments offer deductions up to a certain limit. You can claim the deductions under various sections of income tax i.e. 80C (ELSS, PPF, DSOPF, etc), 80E (Education Loan), 80D (Health Insurance), 24B (Home Loan Interest), etc in old regime. In new regime you can claim a very few – standard deduction of Rs 50,000 and employer’s contribution to NPS majorly among others.

- Last Minute Rush: Waiting until the last minute can lead to wrong decisions and missed opportunities. Start planning early to avoid last-minute stress and unlock a wider range of tax-saving options. We got many calls on 29th for 80C investments this year when it was a Good Friday and rest two days were also closed on Sat and Sunday!

- Assess your tax liabilities at regular intervals: Regularly monitor your estimated tax amount and adjust savings accordingly based on actual income and expenses, also keep a tab on advance tax liability in each quarter, pay it on time to avoid late payment fees.

Level up your financial game this new financial year! Remember, tax planning isn’t just about saving money today; it’s also very much about building a secure financial plan for tomorrow.

(Contributed by Anjali Tomar, Financial Planner, Team Prithvi, Hum Fauji Initiatives)

Are Small Cap Funds in a Bubble?

The Indian small-cap sector has been a star performer in the past year, attracting significant investor interest. However, concerns are rising about a potential bubble.

What is considered as a bubble in small cap funds?

When the valuations are so high that even after a 20 -25% correction, it would still remain expensive, that’s a Bubble in simple terms.

From valuations perspective, it is historically seen that whenever the market cap of small cap in overall market cap crosses 15%, it warrants caution. Currently the share of small caps is at 17.2% which shows that small caps in general are overvalued.

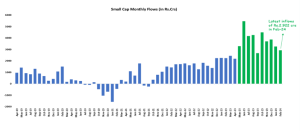

In the past few months, small-cap mutual fund schemes have witnessed a massive inflow which has led to inflated valuations which is beyond a compIn the past few months, small-cap mutual fund schemes have witnessed a massive inflow which has led to inflated valuations which is beyond a company’s true potential. The below graph shows how much inflow has come to small cap funds over the past few years.

What should you do in this situation?

- Cautious Approach: While small-caps offer high potential returns, it’s crucial to be cautious in the current scenario. Diversify across asset classes and a focus on quality companies with strong fundamentals remain key.

- Continue with SIPs: Systematic investments through SIPs allows you to average out your cost and potentially benefit from any market corrections.

- Have a Long-Term View: Small-cap funds are inherently volatile, if you can ride out market volatility then Small-cap funds can provide you good returns in a long-term horizon of 7-10 years.

The possibility of a bubble in small-cap funds cannot be ignored. However, stay informed, maintain a diversified portfolio, and focus on long-term goals. It can help you to navigate these uncertain times. Remember, even if a correction occurs, small-caps have the potential for significant growth in the long run.

(Contributed by Abhilash Rana, Relationship Manager, Team Dhruv, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question- As I am a serving officer, should I also consider purchasing health insurance?

Our Reply- Joining the armed forces opens doors to a realm of financial perks, from the security of a defined pension to the assurance of comprehensive health insurance coverage while serving and after retirement for serving and retired personnel and their dependants, as per laid down rules. These facilities can be availed at all the hospitals owned by the armed forces as well as empanelled hospitals across the country. The biggest part – there is no upper monetary limit to this benefit.

However, amid these enticing benefits many military personnel, whether serving or retired, might have not experienced such an encouraging experience with military hospitals or the Ex-Servicemen Contributory Health Scheme (ECHS) and believe that private medical insurance would be a better option for them, requiring only a small annual premium.

However, do consider the following points when you take this decision:-

- Private hospitals are profit-driven as they are after-all businesses, raising concerns about whether prescribed treatments are genuinely necessary or driven by financial motives. Nobody would like to have their bodies tinkered with, if there is no such need only because that hospital wants more revenues.

- Claims paid by medical insurance companies reduce their profits, potentially affecting the quality or coverage of treatments. So, many a times, claims may get fully or partially rejected because of technical points and you sitting on huge bills to pay.

- Premiums for private medical insurance are reviewed every year and are not fixed unlike life insurance policies. They also increase significantly with age.

- Almost all the private medical insurances come into play only on hospitalisation and do not cover OPDs. So, consider your medical state – how many times are you likely to be hospitalised or have been hospitalised in the past?

- The ECHS has robust systems and procedures, often underutilized by many due to lack of knowledge about correct procedure, offering quality healthcare options for veterans.

- Military hospital facilities are far-off from you or your family’s selected place of residence.

- You have an ailment or genetic history of an ailment whose facilities are inadequate in military hospitals. But also remember, premiums rise due to claims taken.

- Parents or children are not dependent on them and thus they require health insurance.