How to invest in your child’s education?

Investing in your child’s education is one of the most important financial decisions you will ever make. With the rapidly rising education cost, it becomes important to start planning early. Here are a few things to consider before starting your child’s investment:

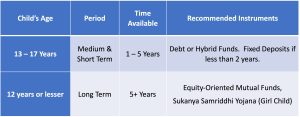

Choose the right investment products as per the time horizon – There are a variety of investment products available, so it’s important to choose the ones that are right for your time horizon and risk tolerance.

Also, there are some specific children’s gift funds that are designed exclusively to meet children’s future financial needs, such as college costs and other expenses.

Tax–Efficient – Investment in your child’s name can be tax-efficient as well. Till the child is a minor, any capital gains arising out of the investments from mutual funds would be taxable in your hands. But once the child becomes 18 years old, any capital gain would be taxed in the hands of the child only. So one can capitalize on this tax hack by investing in a child’s name when the child is a minor and taking it out when he/she is 18 years old saving all or a substantial amount of tax.

Invest regularly – One of the best ways to grow your money is to invest regularly. This means setting up a systematic investment plan (SIP) so that a fixed amount is invested in your chosen investment product at regular intervals.

Seek professional advice – If you’re not sure how to invest for your child’s education, it’s a good idea to seek professional advice from a financial planner. A financial planner can help you assess your financial situation and create a personalized investment plan.

Since the education costs are soaring, if you don’t begin early enough, funding your children’s higher education might get challenging. By investing wisely, you can help ensure that your children have the money needed to pursue their academic goals.

(Contributed by Yogesh Gola, Relationship Manager, Advisory Desk, Hum Fauji Initiatives)

What to do with the mutual funds of your child when he/she turns 18?

There are various investment options available to overcome this and investing in mutual funds is one of the best. We all know the benefits of investing in mutual funds but rarely do we know the steps required to be taken once your child attains the age of majority which we know as the Minor to Major process.

The guardian needs to apply for a change of status of the sole account holder from Minor to Major. By failing to do so, all future transactions would be suspended in the minor’s account. The account can be operated only after completion of certain paperwork. Here is the process to be followed in this regard.

- Apply for PAN – The applicant needs to obtain a PAN.

- Open or update bank account – The applicant needs to open a new bank account as a major or update the existing one from minor to major status.

- Register KYC – Next, the applicant needs to complete the mutual fund KYC process. It can be done online too.

- Submit change of status form – Next, the applicant can fill up the minor attaining majority (MAM) form and submit it along with the following documents:

- Copy of PAN Card

- Copy of KYC acknowledgment or a duly completed KYC form

- A canceled Cheque leaf with the applicant’s name printed on it or the applicant’s latest Bank Statement/Passbook.

- Nomination form

- Signature attestation by the banker in the prescribed format.

- A fresh SIP, STP, SWP mandate in the prescribed form if the applicant wants to continue the SIP, STP, SWP in the folio

(Contributed by Pratibha, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

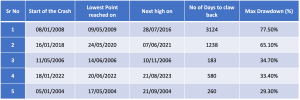

How brutal have the bear markets in small caps been?

History repeats itself – since our childhood we all have heard this quote and the market proves it time and again.

In 2008 January, small cap index corrected 78% from its peak over the subsequent 14 months and it next touched its high in July 2016, only after 8 years. In the 2008 to 2009 crash, how many small cap stocks did not crash? A grand total of 1%! What are the odds that not only would you have held these stocks but that these would have comprised the majority of your portfolio?

In fact, 90% of small-caps were down more than 50% in this period.

The small-cap bull run of 2016-17 too didn’t last long and corrected a 65% fall from the January 2018 high over 14 months. The level was crossed again only 3½ years later.

How about the 2018-20 small-cap collapse? 78% of stocks were down more than 50% and only 2% were up in that period.

Did the majority of small-cap stocks actually ever recover?

The small cap index generally changes 18-20% of its constituents every year. So, every 5 years, the Index is technically all-new. Therefore, even after eight years, the small-cap stocks that made the highs in 2008 never ever recovered – many just vanished from the face of the earth or became penny stocks. So, even if you had been patient enough to hold such individual stocks for eight years, you may not have recovered your money.

The lesson of the story: for the majority of the investors, small-cap stocks may be a landmine instead of the goldmine that they thought, unless they have built up the capacity for high-quality data gathering and research. But alas, most of them rely on Tips and Gyan on WhatsApp and YouTube.

Does it ring a bell for you on what happened in the stock markets last month?

(Contributed by Ujjwal Dubey, Associate Financial Planner, Team Prithvi, Hum Fauji Initiatives)