Investing: A Rising Tide That Lifts All Boats

Imagine a harbor filled with boats of varying sizes and shapes. As the tide rises, each boat, regardless of its size or design is lifted. Similarly, when an economy experiences growth, individuals and businesses, irrespective of their financial standing, tend to experience positive repercussions.

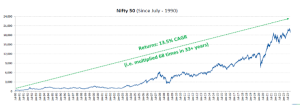

The stock market, while often seen as unpredictable and volatile, has consistently proven its ability to deliver significant returns for investors who adopt a long-term perspective. Nifty 50, the benchmark index of the National Stock Exchange (NSE), has delivered impressive returns over the past few decades. Since 1990, the Nifty has generated an average annual return of 13.5%, outperforming most other asset classes in India. If you had remained invested during this period, your investments would have multiplied a whopping 68 times in 33 years.

Instead of comparing your investment returns to others, it’s more important to compare them to your own financial goals. This will give you a better sense of whether your investments are on track to help you reach your long-term objectives.“As an investor, for you to win, no one else must lose. If you meet your financial goals, you win, along with everyone else who has met them”.(Contributed by Abhilash Rana, Financial Planner, HNI Desk, Hum Fauji Initiatives)

Ditching the Piggy Bank: Elevate Your Savings to Millionaire Status

In a world where building wealth is the name of the game, relying on the old piggy bank trick won’t cut it for those dreaming of financial freedom. Saving is a must, but if you’re eyeing that millionaire status, it’s time to kick things up a notch. Brace yourself for a journey towards financial triumph with these savvy steps:

Dream Big with SMART Goals

Just like every road trip needs a destination, your financial journey demands SMART goals – Specific, Measurable, Achievable, Relevant, and Time-bound. Picture your dream wealth, set a timeline, and let the adventure begin.

Budget Like a Pro, Spend Like a Spy

Unleash your inner financial detective by crafting a budget that’s as detailed as a spy mission. Track your spending, identify those sneaky expenses, and ensure every dime is working towards your financial ambitions.

Savings on Autopilot

Turn saving into a habit as smooth as a Sunday drive. Automate transfers from your checking to your savings – it’s like putting your money on cruise control, making sure it stays on the savings highway.

Hunt for Treasure in High-Yield Seas

Traditional savings accounts are like a buried treasure with a tiny ‘X’ on the map. Seek high-yield investment options like Mutual funds, bonds, and gold that suit your risk appetite and goal, the undiscovered riches that boost your savings faster than a pirate ship catches wind.

Level Up Your Earnings Game

While saving is the sidekick, elevating your earning potential is the superhero move. Sharpen your skills, climb the career ladder, or unlock hidden income streams – it’s time to be the Batman of your financial saga.

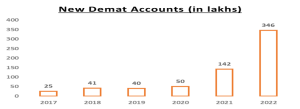

The data sheds light on how others have started participating in the investment landscape:

Remember, the road to a million isn’t a sprint; it’s a thrilling marathon. Buckle up, embrace the adventure, and watch as your savings evolve into a kingdom of wealth, securing a happily-ever-after financial future.

(Contributed by Gautam Arora, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

Investing without a plan: The Recipe For Disaster

Setting off on a military mission without a carefully crafted plan is like sending soldiers into battle without a weapon, compass, and map – a recipe for military disaster. Just as an army without a plan is at the mercy of the enemy’s strategies, an investor without a plan is susceptible to the whims of the markets, emotional biases, and missed chances for financial success.

Why Planning is Paramount?

A sound investment plan serves as a roadmap, guiding your financial decisions towards achieving your long-term goals. Investing without a plan often leads to a series of pitfalls:

- Reactive Investing: Without a clear plan, investors become susceptible to emotional reactions to market movements, buying or selling impulsively based on fear or greed.

- Goal Inconsistency: Without defined goals, investors may chase short-term gains, deviating from their long-term objectives and potentially jeopardizing their financial future.

- Under-Diversification: Without a plan, investors may over-allocate their funds to a single asset class or sector, increasing their exposure to risk.

The Path to Investment Success

To navigate the investment landscape successfully, a well-crafted plan is essential:

- Establish Clear Goals: Define your financial objectives, whether it’s saving for retirement, funding a child’s education, or accumulating wealth.

- Assess Your Risk Tolerance: Determine your comfort level with risk, as this will influence your investment choices.

- Choose Suitable Investments: Select investments that align with your risk tolerance and investment horizon.

- Seek Professional Guidance: Consult with a financial advisor for personalized advice tailored to your unique circumstances.

An army’s battle plan is not a rigid set of orders but rather a dynamic strategy that adapts to the ever-changing battlefield conditions. Just as an army regularly revises its tactics based on new intelligence and unforeseen challenges, an investor should periodically review and update their investment plan to ensure it aligns with their evolving financial goals and adapts to the shifting market landscape.

(Contributed by Ankit Singh, Associate Financial Planner, Team Sukhoi, Hum Fauji Initiatives)