Broke to Boss: Journey from Debt Disaster to Financial Freedom

Imagine this: you’re trapped in a maze. Every twist and turn, there’s a grinning green gremlin demanding cash. Sound familiar? Well, those gremlins are called debts, and let’s face it, they’re no fun.

Step 1: Mapping the Maze

First things first, grab your trusty notebook (or spreadsheet, if you’re fancy). List every single debt you owe, from the creepy credit card clown to personal loan serpent. No debt is too small (unless it’s, like, five rupees to your sister…Just pay her back instantly). This is your financial map, and the more detailed it is, the easier it’ll be to navigate.

Step 2: Befriending the Budget Beast

Track your income and expenses to find sneaky spending areas like unnecessary Amazon orders or unused gym memberships. Make tough choices to control these expenses and free up budget for debt repayment. However, don’t cut out everything you enjoy, like that fornoghtly eating out, completely. Find a balance to make the journey to financial freedom sustainable.

Step 3: Wielding the Weapon of Wise Choices

Now, the real fun begins! You’ve got your map, you’ve tamed the budget beast, it’s time to slay those debt gremlins. Here are your weapons:

Debt Avalanche: Focus on your highest-interest debt first. Imagine whacking that gremlin with a giant snowball of savings! Every penny you throw at it is less money going to its interest-spewing maw.

Debt Snowball: Prefer baby steps? Tackle your smallest debts first. Seeing those gremlins vanish one by one will boost your morale and keep you motivated.

Step 4: Celebrating Every Victory (and Avoiding Treasure Traps)

Reaching a debt milestone? Time for a fiesta! But don’t get too caught up in the celebration. Those sneaky debt gremlins love distraction. Avoid taking on new debt unless it’s necessary. Remember, the maze isn’t conquered until you reach the sparkly debt-free exit!

Remember, escaping the debt maze is a journey, not a sprint. There will be setbacks, temptations, and moments when you want to throw metaphorical sporks at the wall. But with the right tools, some financial fortitude, and a healthy dose of humour, you’ll vanquish those debt gremlins and reach financial freedom.

(Contributed by Gautam Arora, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

FOMO to Freedom: Stopped Chasing Trends and Started Building Wealth

We’re here to tell you that it’s time to ditch the FOMO and start building wealth. And it’s not as hard as you think. In fact, it all comes down to a few simple principles:

- Know your goals. What do you want to achieve with your money? If you don’t do this basic step, remember that a rudderless ship doesn’t go too far in a choppy sea.

- Live below your means. This is the golden rule of wealth building. Spend less than you earn and invest the rest – Simple but most powerful mantra.

- Invest for the long term. Don’t try to get rich quick, just because you can’t. The path to financial freedom is littered with the corpses of such get-rich-quick schemes.

- Automate your finances. Set up automatic transfers to your savings and investment accounts so you don’t have to think about it.

- Don’t chase trends. Just because everyone else is investing in Bitcoin doesn’t mean you should. Do your own research and stick to your investment plan.

- Be patient. It takes time to build wealth. Don’t get discouraged if you don’t see results overnight. Just keep at it and you’ll eventually reach your goals.

We know what you’re thinking: “This all sounds great, but it’s just not that exciting.” And you’re right.

Building wealth isn’t about buying fancy cars or taking luxurious vacations. It’s about making smart choices and having the discipline to stick to your plan.

But here’s the thing: when you reach your financial goals, the feeling of freedom is indescribable. You’ll no longer be beholden to your pay check. You’ll have the time and money to do what you love.

So ditch the FOMO and start building your wealth today. You won’t regret it.

(Contributed by Ankit Kumar, Associate Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

The Illusion of Prosperity

In the world of investments, the allure of real estate and gold has always been the foremost. Both are tangible assets, and the way we are, they seem to have stood the test of time. Owning a bunch of houses or having a stash of gold feels solid and secure. And they have a certain charm, no doubt. But going all-in on these can be real risky business.

Let’s take a hypothetical example of a person X who retired recently. He has 2 kids who are of age 24 and 26. All of the corpus that he accumulated during his job was utilized for the higher education of both the children and of course, the house. Now his main goal is to save for their marriage. After consulting with his friends and family members, he decides to invest all his retirement corpus in 2 rental properties and some physical gold to be able to do a good marriage of his children.

Things were great for the first couple of years. He had tenants, and it seemed like a good plan. But life threw him a curveball – the economy took a hit, the property values dropped and stayed that way for long (remember the 2013-2022, the 9-year property downturn !). Suddenly, selling his place for a good price wasn’t an option. He found himself stuck, needing cash but unable to get it from his properties.

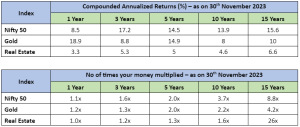

He could have avoided this situation if he had invested his hard-earned retirement corpus in a diversified portfolio. This way even an all-eggs-in-one-basket situation would not have occurred. The below-mentioned charts show how both these assets have performed in comparison to Nifty50, the stock market index, over 15 years.

Sure, property and gold have their appeal, but don’t let the glimmer blind you to the risks. The key is balance. Just like a good recipe needs different ingredients, a solid financial plan involves meaningful diversification. It’s the difference between putting all your money on red or black at the casino and spreading your bets for a more reliable outcome.

(Contributed by Abhilash S Rana, Financial Planner, Team HNI, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Past 7 Days?

Question: What should be the ideal percentage of Equity, debt and gold that should be kept in my portfolio?

Our Reply: The best portfolio is the one that combines a good return with a lower or equal level of risk.

Asset allocation is the key concept of dividing investment money among different asset classes such as equity, debt, gold, and real estate. The appropriate allocation for a client is determined by considering three Ts: time, tolerance to declines, and trade-off in long-term returns.

You should do Limited but Smart Investments: Are you regularly adding new investments to your portfolio, based on what’s trending, creating a buzz or in news for a while and then aiming for optimal portfolio creation based on varied exposures sectors?

Then, you are probably “di-WORSE-ifying” your financial portfolio because you are most likely to end up with an unmanageable mixture of investments instead of a simple, smartly chosen, manageable, and reliable portfolio that balances your risk and return.

Balanced Investments: As the name suggests, a balanced portfolio is a fair mix of diverse and limited investments. Once you achieve it, keeping your age in mind, all you have to do is monitor, re-balance and/or replace those investments from time to time.

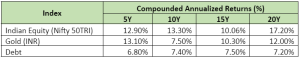

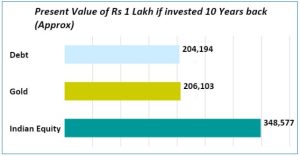

Just as a thumb rule, it is advisable to have some allocation to gold too given that it acts as a hedge against inflation and global risks. For this purpose, one can consider allocating 5-10% of the portfolio to gold in the form of gold SGBs/mutual funds/ETFs. The remaining 95-90% of the portfolio be allocated across equity and debt based on the highlighted/discussed parameters above. The below data and illustration will help in better clarity and understanding between the risk-return trade-off.

Due to the high level of safety offered by fixed deposits/debt funds, their returns are lower compared to the securities listed above. Equity has consistently outperformed inflation over the long run. For a long time, gold has been a favourite with Indians, and that is likely to continue. In order to make the best choice for your investment portfolio, you must first determine your personal risk profile and required time frame in relation to the risks connected with the product and then only take this diversification decision.

(Contributed by Team Sukhoi, Hum Fauji Initiatives)