Lessons of Investment from the Golf Course

Welcome to the intersection of golf and investment planning, where strategy, foresight, and the art of balancing risk and reward come together in harmony. For those unfamiliar with the complicated dance of finance, fear not, for we’re about to start a journey where the lessons of the golf course illuminate the path to financial wisdom.

The birdie game plan: Just as in golf, successful investment planning requires a clear, long-term vision. In golf, you wouldn’t aim for the flag without considering the wind direction, the lie of the land, or the hazards that lie in between. Similarly, when crafting an investment strategy, it’s essential to assess your long-term goals, risk tolerance, and the economic landscape.

Playing the course: Selecting the right club for a shot in golf is a critical decision. It’s similar to choosing the right investment vehicles that align with your risk tolerance and the opportunities available in the market. Just as you wouldn’t use a driver for a putt, aggressive stocks may not suit a conservative investor.

Hazards of impulsivity: In golf, impulsivity can lead to landing in the sand trap or water hazard. Similarly, in investing, hasty decisions can result in significant financial losses. Avoiding these pitfalls requires careful planning and a deep understanding of the potential risks involved. Whether it’s assessing the wind before a tee shot or evaluating market trends before investing, thoughtful deliberation is key to avoiding blunders.

Adjusting the swing: Golfers often need to adjust their swing to suit the playing conditions—a skill equally important in managing investments. Market conditions can be as unpredictable as the weather, requiring investors to adapt their strategies. Whether it’s a change in grip to counteract the wind or a shift in asset allocation in response to market volatility, flexibility and adaptability are vital.

In the rough: Every golfer finds themselves in the rough at some point, just as every investor faces market downturns. Building a resilient portfolio that can withstand these challenges is akin to having the skill to play out of the rough in golf. It requires patience, skill, and an understanding that these setbacks are just a part of the journey’s enjoyment.

In the zone: Distractions are a golfer’s enemy, just as they are for investors. Staying focused on your game plan, regardless of the ups and downs, is crucial. In investing, this means sticking to your long-term strategy and not getting side tracked by short-term market fluctuations.

So, whether you’re navigating the fairways or the financial markets, remember: with a strategic approach, foresight, and a steady hand, you can master both the golf course and your investment portfolio.

Here’s to teeing off towards financial success 😊

(Contributed by Devanshu Anand, Relationship Manager, Team Prithvi, Hum Fauji Initiatives)

The Secret Wealth Weapon: It’s Not What You Think!

When we talk about getting rich, it’s easy to get caught up in complicated money stuff like fancy investments or big opportunities. But what if we told you that the real secret to building wealth isn’t about that at all? It’s actually about something much simpler—your behaviour and how you handle your money.

Imagine, you have the power to steer your financial ship through stormy seas. And the best tool you have for navigating those waters? It’s not some fancy trick or special formula. It’s actually just sticking to a plan and staying disciplined.

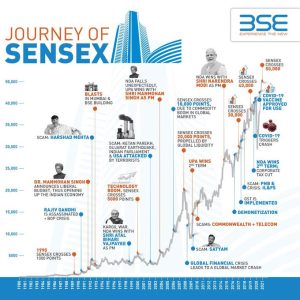

Let’s look at 2020 as an example. It was a wild year for the stock market, with lots of ups and downs. Some people freaked out and pulled their money out. But others stayed cool and kept their investments where they were. And you know what happened? When things calmed down, the latter folks ended up with more money than before.

So, how do you do it? It’s all about having a plan and sticking to it. Don’t let your emotions drive your decisions, and don’t get distracted by what everyone else is doing. Just keep your eyes on the prize and stay disciplined.

“In the journey to wealth, your behaviour and discipline is the compass that guides you. Make positive choices, and you’ll find yourself on the path to abundance”

(Contributed by Mausam Gupta, Financial Planner, Team Prithvi, Hum Fauji Initiatives)

Tax Hacks: Uncover Quick Wins in the New Tax Regime

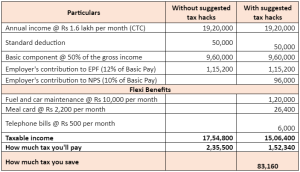

Meet Raj, a 38-year-old professional, earning a monthly income of Rs 1.6 lakhs. Raj, like many others, believes that the new tax regime provides no room for tax savings. Is that correct? Let’s see.

Options for Tax Savings:

Employees’ Provident Fund (EPF): Raj’s monthly EPF contribution is Rs 9,600, matched by his employer, leading to an annual tax deduction of (9,600*12= 1,15,200) i.e Rs. 1,15,200/-. As per the rules, the employer matches the amount and that is something Raj gets in his savings in PF but does not count towards his income, leading to an indirect tax-free income.

Flexi Benefit Plan (FBP): Ever heard of turning your everyday expenses into tax-saving manoeuvres? With Raj’s monthly allowances for fuel, food, and phone bills, totalling Rs 1,52,000 annually, he’s doing just that. It’s like squeezing lemonade out of lemons!

His monthly allowances of Rs 10,000 (fuel), Rs 2,200 (food), and Rs 500 (phone bills), potentially reduces his taxable income by Rs 1,52,000 annually.

National Pension Scheme (NPS): NPS, a lesser-known gem in the tax-saving arsenal. While the new regime might not offer additional deductions, employer contributions to the NPS count, providing a sweet deal similar to EPF but with its own unique perks.

Steps to Optimize Tax Savings:

1. Maximize Basic Pay: Consult with your accountant to explore opportunities for increasing the basic pay, subsequently boosting EPF/NPS contributions.

2. Continue EPF: Raj benefits from the employer’s contribution to EPF, providing valuable tax benefits.

3. Utilize FBP: Explore available Flexi Benefit Plans and ensure that allowances are achievable, with required proof at year-end.

4. Start NPS Contributions: Both your contributions and those from your employer to the NPS can offer substantial tax benefits.

As we navigate the ever-changing landscape of taxation in India’s new regime, it’s crucial to explore customized tax-saving strategies tailored to your individual financial situation.

(Contributed by Abhinandan Singh, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question: Even when I have zero tax to pay, is it necessary to report my capital gain in my tax return?

Our Reply- When it comes to gains on equity investments—like listed shares or equity mutual fund units—if you hold them for more than a year, they’re considered long-term capital gains. Now, here’s the deal: Up to Rs 1 lakh of these gains are taxed at a rate of 10%.

Now, onto the reporting part. Gains must be reported in your tax return if you’re required to file one. Your tax return usually comes pre-filled with this information if it’s included in your Annual Information Statement (AIS). However, you can skip reporting the gains only if you’re exempt from filing taxes. This happens when your Gross Total Income (GTI) is less than the basic exemption limit.

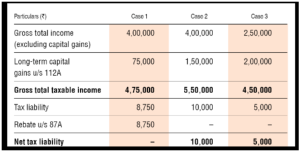

Let’s break it down a bit further. Imagine there are three scenarios, and we’ll assume the basic exemption limit is Rs 3 lakh:

Scenario 1: Your taxable income is less than Rs 5 lakh, making you eligible for a rebate under section 87A. This means your tax liability is nil.

Scenario 2: Your taxable income exceeds Rs 5 lakh, so you don’t qualify for the rebate. You’ll be taxed at slab rates for your regular income, and for your long-term capital gains exceeding Rs 1 lakh, you’ll pay a 10% tax.

Scenario 3: Your taxable income is less than the basic exemption limit, but your long-term capital gains exceed Rs 1 lakh. In this case, you can use the unused portion of the basic exemption limit to reduce the taxable portion of your gains.

While the above three scenarios should be quite clear, we also illustrate below three similar-looking cases which would further clear the air:-