Mastering Your Money: What’s your Ideal Savings Rate?

In the journey toward financial wellness, understanding and mastering your saving rate is a crucial step. Your saving rate is the percentage of your income that you save instead of spend. Navigating this aspect of personal finance is essential for building a secure future and achieving your financial goals.

Why is the Saving Rate Important?

Your saving rate determines how much money you can allocate toward savings and investments. A higher saving rate means more funds for emergencies, future expenses, and retirement – in short, a more comfortable life.

Understanding Your Goals: First things first – let’s define your financial goals. Whether it’s building an emergency fund, buying a home, or planning for your children or your retirement, having clear goals helps shape your saving strategy. Clear goals are like the treasure map guiding your saving strategy.

Finding the Ideal Saving Rate: The ideal saving rate will vary based on individual goals and circumstances but for most of the people, at least 30% of gross income should be saved and invested in general.

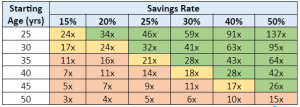

Lets understand it better through Retirement saving example.

A universal goal that everyone shares is planning for retirement if you are not going to get sufficient pension otherwise. One should aim for at least 25x (ie, 25 times) the current annual expenses for a comfortable retirement.

(Green cell indicates Adequate corpus, Yellow cell – Manageable corpus, Orange cell – Insufficient corpus. Also, 5% annual growth in salary and 12% per annum equity returns are assumed)

Let us dwell on it just a bit more.

Assuming you earned Rs 50,000 per month at the age of 25, a salary increment of 5% each year and the return on investments is 12% p.a., at the time of retirement, you would require about 25 times your current annual expenses, that is, Rs 5.52 cr.

So you see, while a 30% saving rate is good if you start early, but not so if you start late. You will have to compensate by saving more.

So, gear up! Embrace your saving rate, set your goals, and let the magic of compounding be your trusty sidekick on this exciting journey to financial triumph!

(Contributed by MF Alam, Sr. Financial Research Analyst, Hum Fauji Initiatives)

Navigating Market Turbulence: Decoding the Dance between Corrections and Crashes

Investing is a rollercoaster with unexpected twists and turns all the time. Most of retail investors, driven by the unending fear-and-greed cycle, are almost always on the edge of their seats when taking market exposure, mistaking even small corrections as the start of a market crash.

Distinguishing between a correction and a crash is crucial: a correction is a temporary 10% dip, acting as a pit stop, while a crash is a sudden 30% or more drop, possibly leading to a prolonged bear market and widespread panic.

Let’s explore Major Stock Market Crashes:

- Black Monday (1987): Dow Jones plunged 22.6% in a single day. This was caused by computerized trading and loss of investor confidence.

- Dot-com Bubble Burst (2000): Surge in internet-based companies led to a speculative bubble resulting in collapsed companies and trillions in market losses across the world.

- Global Financial Crisis (2008): Collapse of the U.S. subprime mortgage market. This led to a severe credit freeze, global economic downturn, and stock market declines worldwide.

- COVID-19 Pandemic Crash (2020): Unprecedented market crash due to the pandemic. Extreme volatility, stabilized by government interventions.

Just to add in here, despite global market crashes leaving a lasting impact, Indian equities have consistently risen over long time, mirroring sustained earnings growth.

Predicting a crash’s exact timing is tough, but indicators and red flags provide valuable insights into the market’s health.

Market Volatility: Increased price swings and erratic movements indicate potential trouble.

Overvalued Stocks: Rapid stock price rise without justified earnings suggests market exuberance.

Inverted Yield Curve and Interest Rates: Historical precursor to economic downturns, leading to decreased investor confidence.

Sentiment indicators like VIX or Fear & Greed Index gauge market sentiment.

To wrap it up: Remain prepared for stock market downturns by diversifying investments, practicing rupee-cost averaging (eg SIP in mutual funds), avoiding panic selling, and seeking professional guidance from qualified advisors for personalized strategies.

Treat the above list as your compass, not a crystal ball. While unexpected events may shake the market, understanding fundamentals empowers informed investment decisions. Whether the market dips or dances, the answer depends on a complex economic tango. Stay informed and don’t let the market’s rollercoaster ride scare you away. 🎢 💸

(Contributed by Vishakha, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

F&O Speculation – Is it a good thing for you?

In the fast-paced world of finance, more people are jumping into the stock market, hoping for quick gains. However, many find themselves depleting their capital severely due to indulging in Future and Options (F&O) trading. Let’s see if they are good for you.

F&O are key segments in the stock market, deriving value from underlying securities. Originally designed for hedging and exploiting arbitrage, a large number of investors use them for speculation now. The challenge arises when newcomers dive into F&O trading without fully understanding the risks, often influenced by recommendations from financial influencers lacking Securities and Exchange Board of India (SEBI) licenses.

To address this, SEBI has imposed regulations, limiting recommendations on underlying securities to registered advisors and research analysts. Several influencers have faced SEBI bans and penalties.

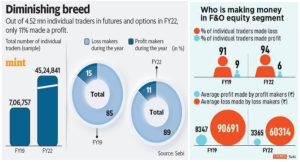

As per SEBI, 89% (i.e., 9 out of 10) individual traders in the equity F&O segment incurred losses, with an average loss of Rs. 1.1 lakh during FY21-22. Meanwhile, 90% of active (so-called knowledgeable) traders incurred average losses of Rs. 1.25 lakh during the same period.

To safeguard your money, consulting financial advisors before investing is crucial. Resist the sway of influencers, considering the substantial risks associated with F&O trading. Remember, “Paris was not built in a single day.”

SEBI’s statistics stress the need for caution in F&O trading. For safer investment options, consider mutual funds, bonds, corporate fixed deposits, real estate, etc.

The journey from Paris to ashes in the F&O market highlights the importance of informed decision-making. As an investor, consult your financial advisor to navigate market complexities, ensuring smart and secure investing in this dynamic landscape.

(Contributed by Avinash Kumar, Financial Research Executive, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question: I have five funds in my portfolio. Is that enough, or should I consider adding more for a better financial balance?

Answer – While keeping all your eggs in one basket (one fund!) is never a good idea, how many baskets (funds!) should you have, is the question.

So, are five funds a good-enough diversification? Maybe, maybe not. It depends on what’s in your baskets (the types of funds) and how bumpy a ride are you planning for yourself (your risk tolerance).

Think of it like this:

- Risky eggs: High-flying funds, like the ones with only IT stocks, are like those fragile, exotic mangoes in your basket. Delicious, but one bad storm and they’re mush. Only put a few in if you’re comfortable with the occasional splash, but frankly, you should be without them.

- Steady apples: Stable funds like flexicap and large cap bonds are your trusted lieutenants. They won’t win any fancy contests, but they’ll hold up through most weather. Fill your basket with these for a smooth ride.

- A mix of fruits: A well-balanced portfolio has a mix of risky and steady funds, like a fruit salad with a few exciting kiwis alongside dependable bananas. This way, even if some fruits get bruised, you still have a tasty, nutritious mix.

How many baskets? We say 5-8 funds is a balanced basket, but it’s not a one-size-fits-all recipe. Consider your goals – saving for retirement or your next vacation? – and your risk tolerance – are you okay with a rollercoaster or prefer a gentle cruise?

Feeling overwhelmed? Don’t worry, you don’t have to juggle all these baskets alone. A trusted financial advisor like us can be your chef, helping you choose the right fruits and mix them up into a delicious, balanced portfolio that’s just right for you. So, let’s make your financial picnic a feast to remember! 🍇🍎🥝

(Contributed by Team HNI & Advisory)