Unlocking Global Mobility: The Mystery Behind Tax Residency Certificates for NRIs

Ever heard of Double Taxation? It’s like paying for your burger, or Dosa for that matter, twice—ouch!

But fear not, countries have a solution: Double Taxation Avoidance Agreements (DTAAs). They make sure you’re only taxed once.

Enter the hero: Tax Residency Certificate (TRC). It’s like your passport for taxes, proving where you call home for tax purposes. It essentially states which country has the right to tax your worldwide income.

Why does TRC matter for Non-Resident Indians (NRIs)?

- Avoid Double Taxation: TRCs are crucial for claiming benefits between countries under DTAA. These agreements ensure that income isn’t taxed twice—once in the source country and again in the resident country. The TRC serves as proof of residency, allowing you to benefit from reduced or exempted tax rates as outlined in the specific treaty.

- Compliance and Investment Opportunities: Several investment opportunities may be restricted for non-residents. A TRC can be your key to unlocking these avenues and managing your finances effectively.

- Proof of Residency: A TRC can serve as official proof of your tax residency status, which may be required for various purposes, such as opening bank accounts or claiming benefits in your resident country.

And how do you obtain a TRC?

NRIs need to obtain TRC from the foreign country’s authorities or the country in which they are a resident. After you’ve got the TRC, by submitting a Form 10F along with your TRC to the Indian income tax department, you demonstrate your residency status and simultaneously claim the benefits you’re allowed under the DTAA applicable to your country. Just remember to renew your TRC before the tax season ends, to keep those benefits flowing.

(Contributed by Yogesh Gola, Relationship Manager, Advisory Desk, Hum Fauji Initiatives)

Money And Marathon

Venturing into new endeavours is thrilling, but the true challenge lies in sustaining momentum.

Consider marathons: while completing one may seem casual, the journey involves enduring rigorous training, often in adverse conditions. Surprisingly, marathon prep isn’t all high intensity; it’s mostly gentle, consistent effort.

Frequently, our attempts of forecasting the market’s fluctuations overshadows the patience needed for long-term investment strategies. The allure of rapid wealth generation leads us to pursue greater returns within condensed periods, neglecting the broader perspective. The market does a pretty good job of boring, at times scaring, impatient investors.

Since inception, the NIFTY50 has soared 78-fold with a robust 13.8% CAGR as of February 2024.

Yet, the daily dance of the NIFTY-50 reveals a capricious rhythm: nearly half the time in short durations, it dips into the red, and only in a scarce 20% of the days does it leap by 1%. This unpredictability tests investors’ resolve, tempting them with risky shortcuts.

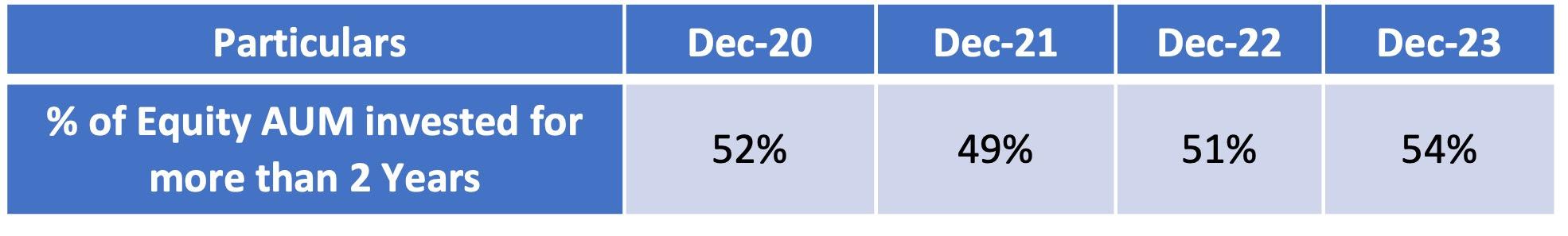

Data shows that almost half of Equity Mutual Fund investments are redeemed within two years, though the ideal horizon is five or more.

Source: AMFI

Ultimately, building wealth is a marathon, not a quick dash. Short-term portfolio performance is insignificant compared to the long-term results of staying committed. True wealth creation demands full dedication, without shortcuts.

(Contributed by Ujjwal Dubey, Financial Planner, Team Prithvi, Hum Fauji Initiatives)

Tax Hacks for Entrepreneurs: Proven Strategies to Cut Your Tax Bill

Entrepreneurs often face a higher tax burden compared to others due to the dual responsibility of personal and business tax liabilities. However, there’s a bright side: the Income Tax Act 1961 offers various tax deductions for entrepreneurs.In this article, we’ll delve into several tactics entrepreneurs can employ to reduce their tax burdens and boost their net income

Deductible expenses like rent, utilities, and salaries can shrink your taxable income. Keep meticulous records to justify these deductions.• Opt for the Presumptive Taxation Scheme

If your business has a turnover of less than ₹2 crore (for non-professionals) or ₹50 lakh (for professionals), you may qualify for the presumptive taxation scheme under Section 44AD and Section 44ADA, respectively. This scheme allows you to declare a percentage of your turnover as profit (6% for digital transactions, 8% for cash), simplifying your tax calculations and reducing compliance costs.• Depreciation on Fixed Assets

Depreciation allows you to spread the cost of tangible assets over several years, reducing your taxable income each year. The Income Tax Act has specified rates of depreciation for various asset classes, such as computers, machinery, and vehicles. Ensure you’re claiming depreciation accurately.

• Consult a Tax Professional

The tax system can be complex, and tax laws are subject to change. To ensure you’re using the most effective tax-saving strategies while remaining compliant, it’s wise to consult a tax professional. They can help you navigate the intricacies of the tax code and identify additional opportunities to reduce your tax bills.

Incorporate these strategies to trim your tax bill, stay compliant, and keep more earnings in your pocket. Stay informed, keep records tight, and seek expert advice when needed.

(Contributed by Neeraj Kumar, Financial Planner, Team Prithvi, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

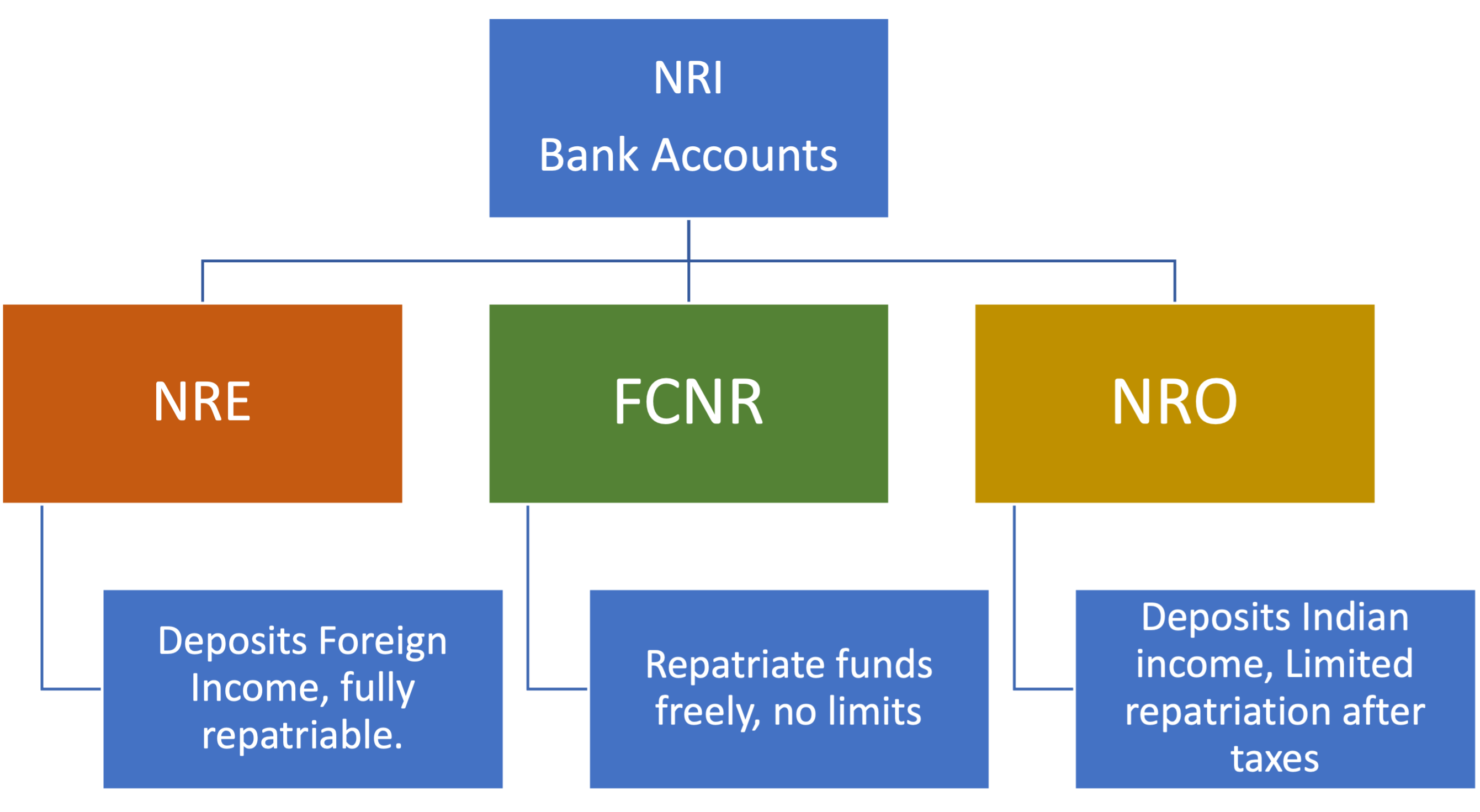

Question: I am an NRI investor. What’s the most efficient and tax-friendly way for me to repatriate funds from India?

Our Reply: Repatriating funds as an NRI from India involves navigating a strict regulatory landscape. Full repatriation of funds is allowed from NRE and FCNR accounts as there are no specified limits on repatriation.

Documents Required for Repatriation

For NRE/FCNR accounts, the process is comparatively straightforward. Simply submit a request application to your Indian bank and complete the A2 (FEMA declaration) form.

Repatriating funds from NRO accounts entails additional steps:

- Request to the bank.

- Fill out the A2 form.

- Submit Form 15CA for self-declaration of payment details liable for taxes.

- Submit Form 15CB, an affirmation from a Chartered Accountant confirming tax clearance.

- Don’t forget to email self-attested copies of the required documents.

It is crucial to recognize that each financial scenario in case of cross-country dealings is distinct. Seeking guidance from a financial advisor ensures a strategy tailored to your specific circumstances, maximizing efficiency and minimizing complications.

(Contributed by Team Vikrant, Hum Fauji Initiatives)