Making the Right Choice – Monthly Vs Annual Health Insurance Premiums

In today’s fast-paced world, convenience is the key.

The insurance companies have started promoting monthly plans to make health plans affordable for all. Choosing between monthly and annual health insurance premiums can be a tricky decision. Monthly plans appear attractive, but are they the suitable choice?

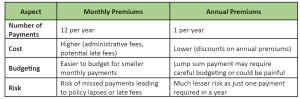

Here’s a quick comparison:

Monthly premiums offer convenience and flexibility, allowing you to spread out payments throughout the year, and making budgeting easier for some. However, there are a few flip sides such as higher administrative fees and the risk of missed payments leading to policy lapses or late fees. Also, any delays could have repercussions, including a hit to your credit score.

Lapse Of Policy – It may happen that premium may not get deducted due to auto-debit failure. Typically, insurance companies offer a grace period of 15 days from the payment due date. Once the grace period is over, your policy will lapse and you will have to buy a fresh policy altogether. In case you get hospitalized during the grace period, the insurance company will not be liable to accept your claim.

Hospitalization – Consider you have paid four monthly premiums and then get hospitalized in the fifth month; the insurer may deduct the premiums for the remaining eight months from the approved claim amount before settling the claim. Even if the claim amount is less than the total premiums paid so far, you will still have to pay remaining premiums before the claim is settled.

The monthly premium option does offer convenience but comes with hassles. It’s advisable to opt for them only if you can ensure timely payments or find it difficult to pay the big amount of yearly premium as delays can negatively impact your credit score.

(Contributed by Yogesh, Relationship Manager, Advisory Desk, Hum Fauji Initiatives)

Harmony in Investment Strategies

Planning your money can be tricky. We all want our money to grow as it help us to achieve our dreams, but the fear of losing it can hold us back. Financial planning is like figuring out the best way to balance your hopes and fears when it comes to money. This is where the concept of harmony in investment strategies comes in, guiding us towards a balanced approach that optimizes returns while mitigating risk.

Let’s embark on a journey where the rhythm of risk and reward creates a harmonious investment symphony:

1. Understanding Your Risk Profile: Every investor is unique, with varying risk tolerances and financial goals. Assessing your risk appetite through questionnaires, consultations, or even risk tolerance calculators is crucial. This understanding forms the foundation upon which your investment strategy is built.

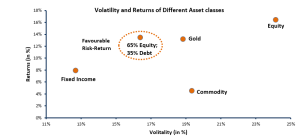

2. Diversification Dynamics: By spreading your investments across different asset classes like stocks, bonds, real estate, and commodities, you mitigate the impact of any single asset’s performance.This creates a resilient portfolio that weathers market fluctuations with greater stability. Remember, diversification is not just about asset classes; it’s also about sectors, geographies, and investment styles.

3. Regular Portfolio Reviews: The market is dynamic, and your personal circumstances evolve. Regular portfolio reviews ensure your investments remain aligned with your evolving risk profile and financial goals. These reviews involve analysing your asset allocation, rebalancing if necessary, and addressing any emerging risks or opportunities.

4. Emergency Funds: Craft a corpus of emergency funds. Envision different financial storms, and actively decide how to allocate your funds for a harmonious response. Your emergency fund becomes the instrumental backup, ensuring your financial composition remains resilient in the face of unexpected challenges.

Conclusion:

Remember, there’s no one-size-fits-all approach. The key is to find the equilibrium between risk and reward that resonates with your unique financial situation and goals. Consider seeking professional guidance to navigate the complexities and personalize your investment strategy for a harmonious financial future.

(Contributed by Neeraj, Financial Planner, Team Arjun, Hum Fauji Initiatives)

Deciding between buy & hold or Booking Profit

In the bustling market carnival, where Nifty and Sensex pirouette at their all-time highs, investors find themselves at a crossroads: to harvest profits or ride the bullish wave?

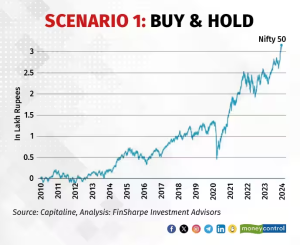

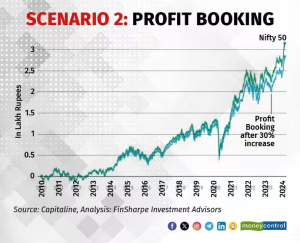

To overcome this dilemma, let’s take a journey through a fascinating study conducted on the Nifty 50 from January 5, 2010, to January 1, 2024. Analysis was done on two scenarios: Buy & Hold Vs Profit Booking.

Scenario 01: Buy & Hold An investor waltzes in, invests Rs 1 lakh in Nifty 50 in 2010. Fast-forward to January 1, 2024—the investment dazzles at Rs. 4.11 lakh, twirling at an impressive 11.98% CAGR (that’s a huge 311% absolute returns!) over 14 years.

Scenario 2: Profit Booking Savvy investors pirouette out at 30% profit, reinvesting elegantly. Their initial Rs. 1 lakh becomes Rs. 3.88 lakh (a mere Rs. 23,000 less), with subtle transaction costs of 0.25% joining the dance.

Why does this happen? Ah, the market tango! During bullish years (cue 2014, 2017, 2020, 2021, and 2023), portfolios shimmy to a 30% profit beat. But here’s the paradox: timing the market is akin to predicting weather with a frayed umbrella. Sometimes, you’ll dodge the thunderstorm; other times, you’ll waltz through unexpected rainbows. So, diversify, hold on tight, and remember that even in the wildest market dance-offs (and profits), it can surprise you.

1. Achieving Goal-Based Targets Setting clear investment goals is crucial. If you’ve met your goal, consider booking profits, especially during market highs. However, if the goal remains unmet and time allows, avoid market timing. Consistent re-entry at lower prices is challenging bordering on to impossible over the long term.

2. Balancing Asset Allocation If your portfolio is diversified in Equity, Gold and Debt, according to your risk profile it may have been recommended that you stick to an asset. Currently, equity markets are at high, the likely weightage of Equity in your portfolio might have increased. This could be a good time to rebalance your portfolio to ensure that the Asset Class weightage is maintained, otherwise your portfolio will be subjected to a higher than anticipated risk.

(Contributed by Ujjwal Dubey, Financial Planner, Team Arjun, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question – How can I maintain a good credit score?

Our Reply – Maintaining a good credit score is not only essential for financial stability, it also opens doors to favourable loan terms. To achieve this, individuals should be mindful of common mistakes that can negatively impact their credit scores and take proactive steps to avoid them.

Here some common mistakes that can negatively affect your credit score

- Late or Missed Payments

- High Credit Utilization

- Taking Multiple Unsecured Loans

- Spreading Expenses Across Multiple Lenders

- Not Establishing a Credit Track Record

How you can avoid the common mistakes and maintain a good credit score

- Ensure timely payment of credit card bills and loan EMIs.

- Set up automatic payments or use digital reminders to stay on track with payment deadlines.

- Keep your credit utilization ratio low by not maxing out credit card limits.

- Spacing out expenses over time can help maintain a healthy credit utilization ratio.

- Refrain from taking unsecured loans from multiple lenders, as this may negatively affect your credit score.

- Consolidate your credit accounts rather than spreading expenses across multiple lenders.

- Having no debts does not guarantee a good credit score. Establish a credit track record by responsibly using credit cards or taking out loans and repaying them on time.

(Contributed by Team Vikrant, Hum Fauji Initiatives)