Be it Farming or investing, Patience Eventually Pays Off

In the vast expanse of financial markets, where the allure of quick gains often overshadows enduring wisdom, lies a realm where the principles of farming converge with strategies for long-term wealth creation.

1. Don’t Shout at the Corpus: Just as a farmer can’t rush the growth of crops by shouting at them, investors must recognize that the market moves at its own pace. Patience and trust in long-term strategies are key to success.

2. Don’t Blame the Crop for Not Growing Fast Enough: Blaming the market for slow growth won’t hasten returns. Blaming slow growth won’t accelerate it, nor will blaming the market for lacking quick returns. Focus on what’s controllable: your investment strategy and response to market shifts.

3. Don’t Uproot Crops before They’ve Had a Chance to Grow: Avoid prematurely uprooting investments in response to adversity. Like plants, investments require time to mature and yield results. Resist impulsive actions based on short-term fluctuations; let investments grow and flourish.

4. Irrigate and Fertilize, Do It Regularly: Similar to farmers’ regular irrigation and fertilization, investors must consistently nurture their portfolios. Regular contributions and adjustments ensure investment health and growth over time.

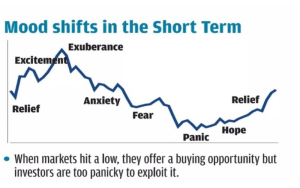

5. Remember You Have Good Seasons and Bad Seasons: You Can’t Control the Weather, Only Be Prepared for It:-

Every farmer knows that some years will bring bumper crops, while others will be lean. Investors face similar uncertainty in the market. Instead of trying to predict the future, diversify your investments, maintain a long-term perspective, and have a strategy in place for both bull and bear markets. By being prepared for all seasons, you can navigate the unpredictable financial landscape with confidence and resilience.

6. So Focus on Wealth Creation Rather Than Market Noise: Amidst market noise and fluctuations, prioritize long-term wealth creation over reactionary responses. Like a focused farmer growing crops amidst background chatter, stick to your investment plan and keep sight of building lasting wealth.

By embracing these farming-inspired principles, investors cultivate a resilient investment strategy capable of withstanding time’s tests and reaping bountiful financial harvests.

(Contributed by Abhinandan Singh, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

Cryptos: The new dazzling star?

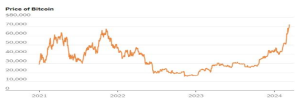

In the expansive galaxy of finance, a brilliant new star has been steadily ascending: Cryptocurrency. Once a niche interest, it has exploded into a dazzling phenomenon, capturing the attention of investors and innovators alike. From the genesis of Bitcoin to the proliferation of thousands of altcoins, the crypto universe has expanded beyond the wildest dreams of its early pioneers.

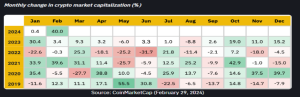

Recent Trends: A Bearish Hibernation and Resilient Innovations

The early months of 2024 have seen the crypto market endure a bearish phase, often referred to as the ‘crypto winter’. Despite this, certain cryptocurrencies have shown remarkable resilience, with significant price changes. This resilience is indicative of the market’s underlying strength and the potential for recovery. The current cryptocurrency market is a reflection of dynamic change and adaptation. The last few months were an exceptionally strong month for crypto, witnessing a 40% increase in total market capitalization. The launch of US spot BTC ETFs in January has been a huge success thus far, continuing to attract constant capital inflows.

Investment Opportunities: Navigating the Digital Frontier – Investing in cryptocurrency is akin to exploring uncharted territories. Direct purchase remains the most common investment method, with platforms like Coinbase facilitating such transactions. For those seeking exposure without direct ownership, cryptocurrency-focused funds and companies offer a viable alternative.

Future Outlook: The Dawn of Regulation and Mainstream Adoption – As we gaze into the future, the crypto market shows signs of a bullish momentum, with Bitcoin and Ethereum reaching new multi-year highs. The increasing regulation of cryptocurrencies and the anticipated approval of the first spot Ethereum ETFs suggest a maturing market poised for mainstream adoption.

The Star May Continues to Shine – Cryptocurrency remains a volatile yet enticing asset class, with a trajectory that continues to captivate and inspire. Its journey mirrors the celestial dance of stars—unpredictable but awe-inspiring. As we continue to witness its evolution, one thing is certain: Cryptocurrency is a star worth watching in the investment universe. Its path, while dotted with huge uncertainties, promises a vista of opportunities for those willing to explore the digital frontier.

Explore the thrilling realm of cryptocurrency investment with confidence! If you’re located outside India, look no further than our expert guidance. Our OWAS portfolios are expertly managed to suit the unique needs of international investors like you.

(Contributed by Devanshu Anand, Relationship Manager, Team Prithvi, Hum Fauji Initiatives)

Mindful Spending: Aligning Your Purchases with Your Values and Goals

In the world of advisement, it’s simple to get carried away with careless buying. Frequently, we find ourselves buying purchases without thinking how they will affect our lives, money, and the environment in the long run. On the other hand, developing a habit of thoughtful spending can result in increased financial security, and alignment with our objectives and beliefs.

What is Mindful Spending?

Mindful spending is the practice of consciously evaluating our purchases to ensure they align with our values, goals, and priorities. It involves being aware of our spending habits, understanding the motivations behind our purchases, and making intentional decisions that reflect our true desires and aspirations.

How to Practice Mindful Spending?

- Identify Your Objectives and Values: Take the time to identify your core values and long-term objectives. What is most important to you? Clarifying your values and goals provides a framework for making purchasing decisions that are in line with what truly matters to you.

- Create a Budget: Allocate funds to different categories based on your priorities, such as necessities, savings, investments, and discretionary spending. Having a budget help prevent impulsive purchases and ensures that your money is allocated towards your values and goals.

- Research and Compare: Spend some time researching goods or services before deciding to buy them. Examine elements including cost, value, sustainability, moral behaviour, and societal effect.

Benefits of Mindful Spending:

- Financial Freedom: By prioritizing your spending based on your values and goals, you can allocate resources more effectively, leading to greater financial stability and freedom.

- Reduced Stress: Mindful spending reduces the stress and anxiety associated with financial insecurity and excessive consumption.

What Did Our Clients Ask Us in the Last 7 Days?

Query – I retired from the armed forces and my father was a Government Employee. We have the ECHS and CGHS facilities available to us. Should we take our own private health Insurances too?

Our Reply – The Central Government Health Scheme (CGHS) and Ex-servicemen Contributory Health Scheme (ECHS) offer comprehensive healthcare facilities to active and retired central government employees and their families. They cover medical care, diagnostic testing, expert consultations, and more – almost everything – at government and empanelled facilities. Cashless therapy is also generally offered as per their specific rules. One of the biggest attractions of CGHS or ECHS hospitals, ie the Govt or military hospitals, is that they operate without a profit motive and hence, their diagnosis and line of treatment may inspire more confidence.

But do note that there could be very limited CGHS/ECHS and centres, and that too primarily in metro cities. Even their private empanelled hospitals could be very limited and that too primarily in metro cities. If you live in an area where these facilities are not easily accessible, or if you prefer more flexibility in choosing healthcare providers, it might be beneficial to consider purchasing additional health insurance coverage.

Reasons why Government Employees may consider additional Health Insurance:

- Limited Availability of Network Hospitals: One of the primary concerns could be the limited availability of CGHS/ECHS hospitals or their network hospitals in your area.

- Specialized Treatment for Critical Illnesses: Certain critical illnesses require specialized treatment, which may not be available at the govt or empanelled hospitals.

- Dissatisfaction with Empanelled Hospitals: In some cases, the quality of services provided by these empanelled hospitals may not meet your expectations especially if they know that you are a CGHS/ECHS, which means lesser and delayed revenues for them.

- Complex Processes: Government insurance processes can resemble a labyrinth at times, laden with administrative hoops and delays. The private health insurance network hospitals may not have such delays inherent in their procedures – this could be very important in emergency situations.

So, you need to take a call based on an overall assessment of your own personal situation.

(Contributed by Team Prithvi, Hum Fauji Initiatives)