We are generally comfortable investing our money in bank FDs, PF/EPF/DSOPF and other fixed income instruments, always smug in the belief that our money is safe and will grow up adequately to meet our aspirations regarding self, spouse and children. However, we neglect the combined damaging effects of Inflation & Taxation from our calculations.

If your safer investments are tax-free (generally the PF/EPF/DSOPF, and Insurance policies), they should generate at least 8% per annum to merely neutralise long-term inflation and your money actually grows only if you earn beyond this. If the investments are not tax-free (all your bank and post office instruments including savings accounts, FDs, PO MIS, SCSS and RDs) and say, you are in 30% tax bracket, your investments should give at least 11.43% annualised returns for you to ‘break-even’. For 20% and 10% tax brackets, the minimum returns to break even are 10% and 8.88% respectively. We call this these the ‘Tread-mill’ rates! When you are earning this return, you feel you are moving fast. But when you get down from this tread-mill and take a reality check, you find you are not even reaching the place where you started from – you’ve actually lost due to inflation and tax.

Have you ever considered Debt Mutual Funds as an investment? Debt funds generally invest in Govt Bonds, equivalents of bank FDs and Company FDs. They have no component of stock investments. When interest rates go down, while your FDs will lower the rates, the returns from long-term debt funds will actually rise. Even without that, currently long-term debt funds are clocking returns between 11-13% per annum. Also, if you remain invested in them beyond 3 years, you are likely to pay a tax of just about 5-7% after 3 years and maybe Nil tax after 4 years, going by the past 3-4 years’ performance and inflation statistics.

What about Equity Mutual Funds? You take stock market risks and get the risk-premium there. A large number of investors continue to believe that stock market movements can lead to a complete loss of your money if the markets do not behave. This happens only if you try very hard to achieve such a complete loss!Consider this – what was one of the worst financial year for Indian stock markets? Undoubtedly 2001-02. Twin Towers attack in USA took place on 11 Sep 2001 (9/11, famously) and the Indian Parliament attack on 13 Dec 2001. The BSE Sensex was 3604 on 30 Mar 2001 and 3469 on 28 Mar 2002. So if you kept your head when everybody else was losing theirs, there was literally no effect even in the worst of the crisis.

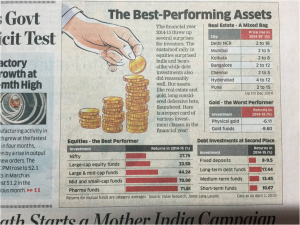

See the returns chart for the last financial year (FY 2014-15) published in Economic Times of 03 April 2015. Do you still think you can afford to leave out mutual funds from your portfolio if you want to meet your future financial commitments comfortably?

Visit our Blog, https://humfauji.in/blog or facebook page http://www.facebook.com/HumFaujiInitiatives or follow us on Twitter https://twitter.com/#!/humfauji to get latest insight on matters financial

Comments (2)

Require guidance for investment in mutual fund

Dear Pradeep, We will get back to you on mail please.