Why “Doing Nothing” Might Be the Best Thing for Your Money Right Now

Stuck in traffic – you shift lanes hoping to move faster.

Suddenly, your old lane zooms ahead—and you’re stuck again.

That’s exactly how many people treat their investments.

Jumping around too often, hoping for better returns, but ending up worse off.

Welcome to the world of impulsive investing.

So, what should you do instead?

Sometimes, the smartest financial move you can make is… nothing at all!

No buying. No selling. No chasing the news. Just sitting tight.

The Psychology of Panic

Markets go up and down—like your mood after reading the news. Selling in panic is like throwing away your raincoat because it’s raining.

Slow and Steady = Wealthy

Money loves patience.

Wealth isn’t built by reacting to every headline. It’s built by compounding, which only works if you give it time.

Wealth grows quietly.

The real winners don’t jump at every news update. They follow a plan, invest regularly (SIPs!), and let compounding do its work.

What You Can Do Instead:

- Review, don’t react. Check your portfolio, but don’t panic.

- Stick to your plan. If your goals haven’t changed, why should your strategy?

- Automate and chill. SIPs (Systematic Investment Plans) are your best friends.

Sitting tight doesn’t mean you’re ignoring your money—it means you’re letting it grow.

So, the next time markets wobble, don’t reach for the “Sell” button. Reach for a cup of chai instead.

(Contributed by Aman Goyal, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

Still Worried About Losses in Equity? Here’s What 10 Years of Data Says!

When markets dipped earlier this year, many panicked. WhatsApp groups buzzed, news channels screamed, and some investors rushed to exit.

But guess what? Those who stayed calm and stayed invested are smiling now — because the markets recovered.

That’s the magic of time.

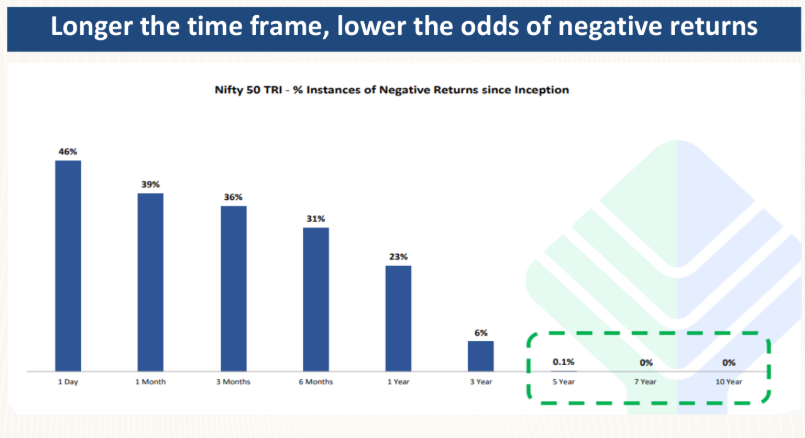

Let’s take a look at what the Nifty 50 index tells us over 10 years:

Image Courtesy Funds India

The image above demonstrates the percentage of instances where investors experienced negative returns across various timeframes, based on historical Nifty 50 TRI data. Here’s what it reveals:

- If you invested for just 1 day, you had a 46% chance of seeing a loss.

- Over 1 month, this chance reduced to 39%, and to 23% over 1 year.

- But once your horizon stretches to 3 years, the probability drops drastically to just 6%.

- Beyond 5 years, the chances of loss are negligible — 0.1%.

- And here’s the clincher: over a 7-year or 10-year horizon, there were zero instances of negative returns.

So, the next time the markets shake a little, remember: reacting quickly often hurts more than it helps.

✅ Invest with long-term goals

✅ Don’t act on fear

✅ Diversify to stay steady

✅ Talk to your advisor

If you planted a mango tree today, would you dig it up tomorrow to check its roots?

Let it grow. Wealth is the same.

(Contributed by Prerna Pattanayak, Relationship Manager, Team Sukhoi, Hum Fauji Initiatives)

When Today’s Fun Eats Tomorrow’s Fortune: Present Bias

An officer once told me:

“I’ll start investing after this year. Just bought a car, my kids’ school fees are due, and there’s a family trip coming up.”

Sound familiar? That’s not poor planning — that’s Present Bias in action.

It’s our tendency to prioritise today’s comfort over tomorrow’s gain. The problem? That “later” keeps pushing wealth-building further out of reach.

Let’s look at the Real Cost of Delay

🔹 If you invest ₹10,000/month at 10% return starting at age 30, you’ll have:

→ ₹76 lakhs by age 50

→ ₹2.3 crores by age 60

🔹 If you delay by just 5 years (start at 35):

→ ₹45 lakhs by age 50

→ ₹1.3 crores by age 60

🔻 That 5-year delay costs you ₹1 crore by retirement time!

Why does this happen?

Because when you start early, compounding has more time to grow your money. Delays shorten the compounding window — and long-term wealth shrinks drastically.

✅ What You Can Do:

✔️ Start small — consistency matters more than amount

✔️ Automate your SIPs so that emotion doesn’t interfere

✔️ Link investments to future goals: kids’ education, retirement, that dream home

✔️ Reward yourself for staying on track — not for postponing

The future only gets better if you start preparing for it today.

Remember Discipline beats desire — every time.

(Contributed by Avantika Agarwal, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

What did our clients ask us in the last 7 days

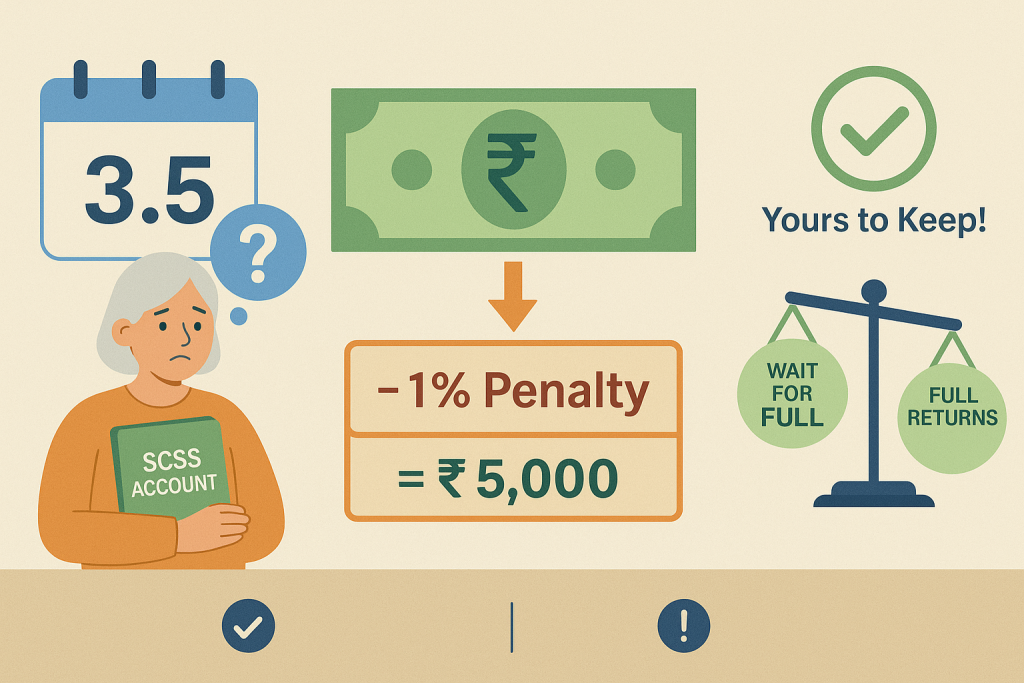

Question – I am retiring shortly. All my course mates and fauji groups are recommending me to invest the maximum allowed money in a SCSS (Senior Citizens Savings Scheme) account. Is it a good decision? I do not need any monthly income and I’m also scared of the high tax that I will pay on it.

Our Reply – The Senior Citizen Savings Scheme (SCSS) is definitely a trusted retirement product — but calling it the best for everyone might be stretching it a bit.

Yes, SCSS offers:

- A government-backed return of 8.2% p.a.

- Quarterly interest payouts, ensuring regular income

- Safety of capital and Section 80C tax benefit at the time of investments

But there’s a catch most people miss:

There is no compounding in SCSS. The interest is paid out every quarter — whether you need it or not, and it is fully taxable. So, your money doesn’t grow on its own beyond what’s being paid out. Over time, this can limit wealth creation, especially if you’re not using or further investing that income.

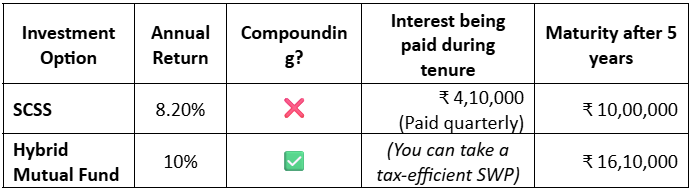

Now compare this with a conservative mutual fund (say, a hybrid or balanced fund) that gives an average return of 10% p.a. with compounding.

5-Year Investment Comparison (₹10 Lakhs invested; no withdrawals)

A better approach?

Invest in a good Hybrid Mutual Fund instead of SCSS. If you don’t need regular income (most retired services officers don’t need it anyway), then the Hybrid MF will compound your money smartly. If and when you need a regular income, take the Systematic Withdrawal Plan (SWP) from the mutual fund for whatever period you need it. This route will be far more tax-efficient, flexible and adjustable to your personal requirements.

SCSS is primarily meant for those retirees who will not get any pension. Armed Forces retirees investing in it may not really be a good use of their life-time savings.

(Contributed by Team Sukhoi, Hum Fauji Initiatives)

📌 Need help building a smart mix of income + growth options? Let us help you decide.

Leave a Reply