The SIP Frequency Dilemma: Is More Really the Merrier?

SIPs let investors ride market waves by investing small amounts regularly. This approach uses rupee cost averaging, reducing market timing risks and promoting disciplined investing. But does more frequent investing lead to better returns?

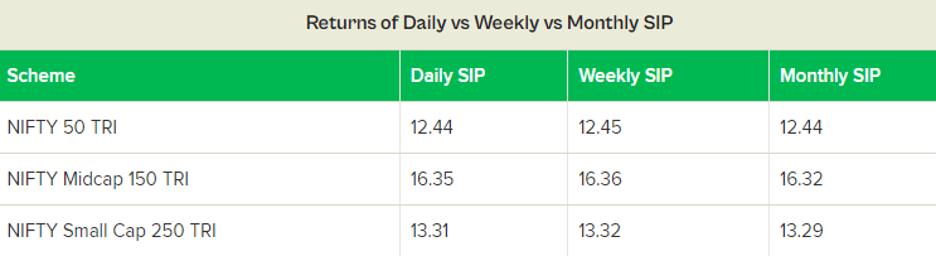

To answer the question, we looked at the performance of daily, weekly, and monthly SIPs over the last 10 years in three different indices:

One look at the above table makes it clear that increasing the frequency of your SIPs doesn’t have any material impact on the returns.

So, while more frequent SIPs might seem appealing, their practical benefits are minimal. Monthly SIPs, like catching the best waves, offer the essential advantages of SIP investing.

When it comes to SIP frequency, more isn’t necessarily merrier. A consistent monthly SIP is enough to help you reach your investment goals smoothly and confidently.

(Contributed by Vishakha, Relationship Manager, Team Arjun, Hum Fauji Initiatives)

Just cashed in on your property?

Don’t let the government take a big bite!

Capital gains tax applies to profits from selling assets like property, based on the difference between the selling and the purchase price (cost basis). It’s divided into short-term (held for less than two years) and long-term (held for more than two years) capital gains.

Consider these strategies if you’ve recently sold a property, to reduce your tax liability:

- Reinvestment in Residential Property (Section 54): Reinvest proceeds in another residential property within specified timelines to defer capital gains tax.

- Capital Gains Account Scheme (CGAS): Deposit gains into a CGAS with a bank for temporary fund parking and tax benefits if your property investment is getting delayed.

- Investment in Bonds (Section 54EC): Invest gains in specified bonds issued by notified institutions for tax exemption with a five-year lock-in period.

- A combination of the above three strategies if that suits you better.

Case Study: Lt Col Nitin Sharma’s Tax-Saving Strategy

Lt Col Nitin Sharma recently sold his property, earning Rs. 20 lakhs in capital gains. Since he did not want to buy another property but also needed some money out of this sale for his personal use, He bought 54EC bonds for Rs. 15 lakhs locking in his money for 5 years, after which he would get his principal back with no tax being paid, and paid tax only on the remaining Rs. 5 lakhs of capital gains using the balance for his immediate requirement. This strategy supported his need for some money while minimizing taxes.

Reducing tax on property capital gains requires strategic planning and tax law understanding. Utilizing avenues like reinvesting in residential properties, CGAS, and Section 54EC bonds minimizes tax burdens and secures financial futures.

Consulting a financial advisor like Hum Fauji Initiatives ensures informed decisions for optimized savings and returns.

(Contributed by Anjeeta, Financial Planner, Team Arjun, Hum Fauji Initiatives)

Silver Bonanza: Wealth Builder or Risky Play?

Silver has recently captured investor attention, often touted as the “new gold” due to its increasing demand and impressive market performance. But how does it measure up in terms of potential rewards versus risks? Is silver truly a lucrative opportunity, or is it a risky gamble?

The Allure of Silver

Silver’s superior electrical conductivity and reflective properties make it an essential element to use in electronics, solar panels, and medical devices, driving its industrial demand and prices higher. On the other hand, silver is in great demand as an ornamental metal in lower-income households in India and China.

The Risks of Silver Investment

Despite its appeal, silver is highly volatile, with prices swinging dramatically due to speculative trading and market manipulation by large institutions. This volatility can lead to significant short-term losses, posing a risk for those with low-risk tolerance.

Silver prices remained dormant for a very long period of time in history (2012 – 2020).

Silver’s price is also tied to industrial demand, which can decline during economic downturns. Unlike gold, a safe-haven asset, silver’s dual role as an industrial and ornamental metal makes it more susceptible to economic fluctuations.

Better Alternatives

For stability, gold remains a more reliable choice as an ornamental investment with less volatility and a long history of preserving wealth. Similarly, other investments like equity and debt offer more consistent returns and lower risk compared to silver.

Thus, while silver can yield high returns, its price is highly volatile and sensitive to economic conditions, making it a risky investment. Unlike gold, silver’s price is unpredictable, making it more of a bet than a safe option. Investors should consider more stable and diverse options for steady wealth growth. For those seeking reliable returns and long-term security, silver’s allure might not be worth the risk.

(Contributed by MF Alam, Sr. Research Analyst, Hum Fauji Initiatives)

Question: Why should I invest in the DOP2 portfolio, and how is it better than traditional bank FDs?

Our Reply: Strategic Timing and Market Insights: Launched as the successor to our successful DOP portfolio from February 2023, the DOP2 Portfolio is designed to capitalize on current debt market conditions. Interest rates in India are nearing their peak, and we anticipate future rate cuts soon, especially with India’s inclusion in JP Morgan and Bloomberg‘s bond indices in 2025. When this comes through, anybody invested in longer-term bonds or similarly strategized mutual funds will gain well with every interest rate cut.

Competitive Returns: Currently, established and scheduled banks offer returns between 6.5% and 7.5% on their FDs. However, as interest rates decline, newly issued bonds and FDs will carry lower rates while the FD interest rates will decline. The earlier-issued bonds in our portfolio, DOP1, offering higher yields, will appreciate in value, driving up the Net Asset Value (NAV) of our Debt Mutual Funds. This appreciation, known as Mark to Market (M2M) gains, enhances overall returns. The same thing will happen to our investors of DOP2.

Tax Efficiency: Investing in Debt Mutual Funds offers tax advantages. These funds are taxed only upon sale, unlike FDs where interest is taxed annually. Additionally, there’s no TDS for resident Indians, and gains can be offset against losses from other capital assets.

Conclusion: The DOP2 Portfolio presents a very limited window opportunity for strategic, competitive, and tax-efficient investing. For a potentially more lucrative alternative to traditional bank FDs, consider the DOP2 Portfolio very seriously NOW, before you miss out on this opportunity.

For further details or to discuss how the DOP2 Portfolio can fit into your investment strategy, please reach out to us.

(Contributed by Team Prithvi, Hum Fauji Initiatives)