The Hidden Delays in Health Insurance: A Guide to Waiting Periods

Buying health insurance? Great move! But before you expect full coverage, there’s one thing you must understand—the waiting period.

A waiting period is the time after buying a policy during which certain claims cannot be made. It helps ensure fairness and prevents misuse of the insurance system.

Types of Waiting Periods:

- Initial Waiting Period: Most policies begin coverage only after 30 days, except for emergencies due to accidents.

- Pre-existing Diseases (PED): Conditions like diabetes, hypertension, or asthma that existed before buying the policy are usually covered after 2–3 years.

- Specific Ailments and Procedures: Certain treatments like cataract surgery, joint replacements, or ENT procedures may not be covered immediately, even if they’re not pre-existing. These usually have a 1–2 year waiting period.

- Critical Illnesses: For severe illnesses like cancer, stroke, or heart conditions, insurers often impose a 90 to 180-day waiting period, ensuring that the policyholder does not buy insurance with the intent to claim immediately for known diagnoses.

- For maternity benefit: If your plan includes maternity benefits, claims are usually allowed only after 9 to 36 months.

Understanding these waiting periods is crucial to avoid unexpected claim rejections during medical emergencies. Being informed allows you to select policies that align with your health needs and financial planning.

Evaluate your health insurance options carefully, considering the waiting periods associated with each. Some insurers offer add-ons or riders that can reduce these periods for an additional premium.

(Contributed by Yogesh Gola, Relationship Manager, Advisory Desk, Hum Fauji Initiatives)

Not on a Salary? Your Money Still Needs a Game Plan

Most financial advice caters to people with a steady pay check, office perks, and monthly deductions. But what if you’re a freelancer, a small business owner, a consultant or work for yourself? When your income isn’t the same every month, your money strategy needs to be smart and flexible.

First, get insurance that really protects you. Beyond term and health insurance, add critical illness and disability insurance—these kick in when your health keeps you from working.

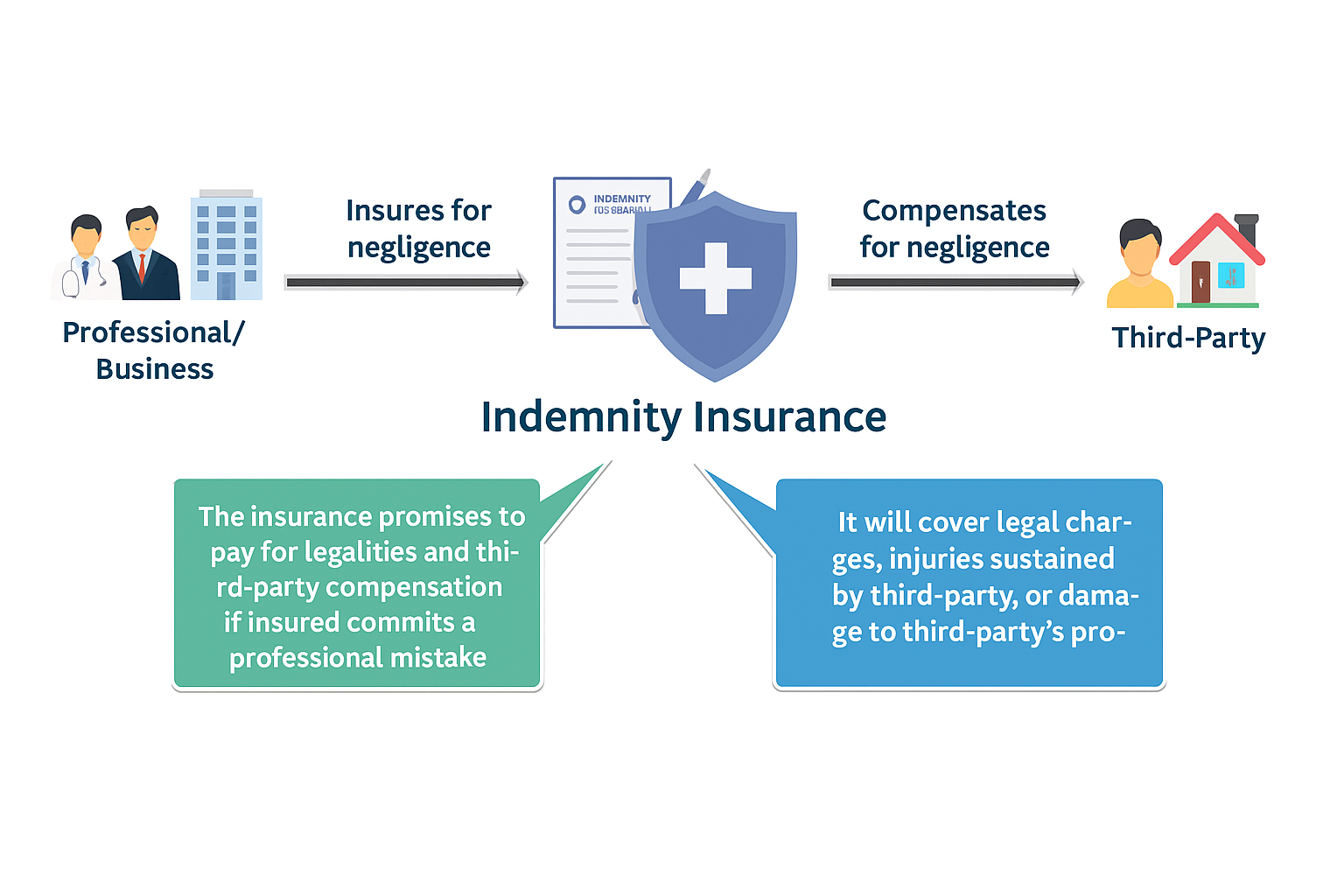

For professionals, indemnity insurance is a must. It protects against legal claims due to errors or negligence in your work. For instance, a doctor facing a malpractice claim or a consultant sued for a flawed recommendation would have their legal costs and liabilities covered. Many professionals only realise this when it’s too late.

And what about investments? Forget rigid monthly large SIPs. Have small SIPs on acting as a ‘base plan’. Then, set yearly goals. In good months, invest more. In slow ones, take a break—your plan flexes with your income. Balance equity funds (for growth) and debt options like PPF or liquid funds (for stability).

Your career is flexible. Your finances should be too.

(Contributed by Neeraj Kumar, Relationship Manager, HNI Desk 1, Hum Fauji Initiatives)

Investing in Defence Stocks: Look Beyond the Headlines

Defence stocks are suddenly in the spotlight—thanks to rising global tensions, government initiatives like Make in India, and a string of good past returns. But should you jump in just because everyone’s talking about them?

The Nifty Defence Index has 18 stocks, yet just three—Bharat Electronics, Hindustan Aeronautics, and Solar Industries—make up 55% of its weight. This means the performance of a few companies is driving most of the rally.

Interestingly, these stock prices aren’t rising mainly because of stronger profits, but due to P/E re-ratings—investors are paying more for the same earnings, hoping and betting big on future growth. That’s sentiment-driven investing, not fundamental driven.

Yes, India’s defence focus and export push are real. But the risks remain: patchy order books, dependency on a single buyer (Ministry of Defence), and high reliance on government policy. These can impact growth and profitability.

Still, with careful planning, you can benefit from the sector’s long-term promise. Several good mutual funds already include smart defence allocations, offering exposure without the risk of putting all eggs in one basket. And they do rebalancing of portfolio in a manner most investors cannot hope to do.

Final word? Investing wisely means relying on research, not hype.

(Contributed by Bhawana Bhandari, Financial Planner, HNI Desk 1 Hum Fauji Initiatives)

What did our clients ask us in the last 7 days

Question – I redeemed my investments and booked a loss out of fear when the market was high and tensions between India and Pakistan were escalating. Should I reinvest now or wait for better opportunities?

Our Reply –

You’re not alone—panic-selling is more common than you think. In uncertain times, it’s natural to act out of fear. But staying out of the market too long can mean missing the recovery and long-term gains.

Here’s a simple guide to help you:

- Remember Your Why – Revisit Your Goals:

– What are you saving for? A home, children’s education or retirement?

– Pick a timeframe—short (1–3 years), medium (5 years) or long term (10+ years). - Ditch the “All-Or-Nothing” Mindset:

– Markets constantly move up and down. Trying to buy at the very bottom or sell at the peak doesn’t work and nobody ever has been able to achieve this ‘utopian dream’ !

– Instead of trying to Time the market, focus on SPENING TIME in the market.

- Consider a Systematic Investment Plan (SIP): This is a smart way to average your entry price over time. If you do see a big dip (say, 5–10%), you can add a little extra in one go.

- Focus on Quality & Diversification:

– Keep it a Simple Mix: equities (stocks), with safer options like debt, and gold, based on how much risk you’re comfortable with.

– Fund Selection: Choose funds or stocks with solid track records and clear management that fit your comfort level.

- Check In, Don’t Check Out:

– Review your portfolio every Six months—not after every news headline.

– Stay focused on your goals, not on today’s headlines.

–Schedule a session with your advisor to fine-tune allocations.

And remember—we’re always here, as your financial advisors, to guide you through every market mood with clarity and confidence.

(Contributed by Team Prithvi, Hum Fauji Initiatives)

Let us help you re-enter the market confidently and build a future-ready portfolio. Book your personalized free advisory session today.