Five Financial lessons from Ramayana

Our celebrated ancient Indian epic ‘Ramayana’ is filled with exciting stories of bravery, love, and doing what’s right. But did you know it’s also packed with smart money lessons? Let’s discover how it can help us handle our finances better!

Choose your advisers wisely: Manthara’s advice to Kaikayei lead to family disputes and exile of Lord Rama. Vibhishan’s advice helped Lord Rama in conquering the battle against Ravana, the evil. Wrong of right financial advisors can do likewise to your financial life. Choose your advisor wisely.

Estate Planning: There was pure love amongst the brothers Ram, Lakshman, Bharat and Shatrugan. However, we all are aware about the role of Kaikayei and Manthra and what happened thereafter. Have your succession planning tools like nominations and Will in place to maintain harmony in the family . It’ll lead to a happy and conflict-free distribution of assets and avoid any Mahabharat-like situation.

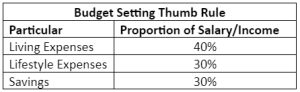

Set your budget: There are lot of Golden Deers/ मारीच roaming around in the garb of your do-gooders giving you huge discounts or projecting impossible pipe-dreams. Set your own ‘Laxman Rekha’ (Financial budget) to avoid any debt trap. Understand the difference between needs and wants. Stay financially disciplined.

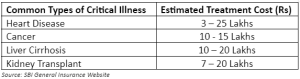

Secure your Health: Hanuman saved Lakshman’s life demonstrating the importance of having adequate protection and security around. Life, Health, Vehicle and Home Insurance serve as a shield against similar unforeseen circumstances. Just as Hanuman acted as a mediator between life and danger, health insurance providers bridge the gap between quality healthcare and financial stability. The below table will help you understand the importance of Health Insurance.

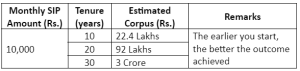

Understand the importance of small efforts: The long Ram Setu to Lanka was built with tiny but disciplined efforts of the monkey army. Each small stone had its own importance and place in the making of the bridge. Your small monthly SIPs do the same and help you achieve your goals equally well.

By integrating these profound insights into our financial journey, we equip ourselves with the tools to navigate challenges, seize opportunities, and cultivate lasting prosperity. Join us on this exciting adventure through the Ramayana, where ancient wisdom helps us make smart choices with our money today!

(Contributed by Jatin Uppal, Deputy Manager, Hum Fauji Initiatives)

Nature’s Financial Wisdom: Lessons from the Wild

The hustle and bustle of the financial world can often feel disconnected from the natural world. But what if the secrets to sound financial practices lie beneath the rustling leaves? Surprisingly, nature offers insightful lessons that can guide us towards financial stability and responsible stewardship of our resources.

Diversification is the key: Just as an ecosystem thrives on a variety of plants and animals, a healthy portfolio thrives on diversification. Look beyond a single asset class and spread your investments across different sectors, regions, and risk profiles, just like the diverse varieties of life in a forest.

Patience is a virtue: Trees don’t grow overnight. Similarly, building wealth takes time and patience. Resist the urge for quick gains and focus on long-term strategies that mimic the slow, steady growth of nature.

Cyclicity is inevitable: Seasons change, tides rise and fall, and so do markets. Understanding and accepting financial cycles – booms and busts – helps you weather storms and make informed decisions. Remember, a single sunny day doesn’t guarantee eternal summer.

Resourcefulness is your superpower: In nature, every resource is used efficiently. Translate this to your finances by minimizing waste, budgeting effectively, and seeking creative solutions to maximize your income and savings.

Community matters: Animals form herds and flocks for support and protection. Seek financial guidance from trusted advisors, learn from others’ experiences, and consider collaborative investment opportunities for mutual benefit.

By tapping into nature’s wisdom, we can cultivate a more mindful, patient and sustainable approach to our finances. Just as nature constantly evolves, so should our financial strategies.

So, take a deep breath, step outside, and connect with the financial lessons hidden in plain sight. It might surprise you where the best advice lies.

(Contributed by Aman Goyal, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

Salary Boost: Pay Off Home Loan or strengthen Investments?

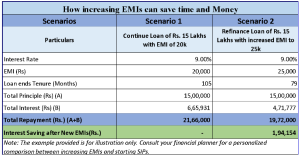

When you get a raise, deciding what to do with the extra money can be a big deal for your finances. Usually, it comes down to two main choices: paying off your home loan faster or putting the extra cash into your investment accounts. Let’s take a closer look at what factors you should consider when making this important decision.

- Financial Goals: Evaluate your long-term financial goals. Are you aiming for financial freedom, early retirement, or saving for your children’s education? Your goals should guide your decision-making process. If becoming debt-free is a top priority, directing the extra funds towards your home loan could provide peace of mind. On the other hand, if you’re focused on building wealth over the long term, investing the additional income may align better with your objectives.

- Interest Rates: This has to do with cost of money. Start by examining the interest rates of your loans. If it is significantly higher than the potential return on your investments, prioritizing paying off the loan might be the wiser choice and vice versa.

- Consider the tax implications of loans such as home and education loans. While paying off your home loan may not yield immediate tax benefits, it can lead to long-term savings on interest payments. Strive to keep your loan EMIs within tax exemption limits to optimize tax benefits.

- Risk Tolerance: Last but not the least, and often neglected factor in our financial journey, is risk tolerance level. Paying off more towards your loan offers a guaranteed return through reduced interest payments. On the other hand, investments carry inherent risks, with portfolio values subject to fluctuations. Assess your comfort level with market volatility and your ability to withstand potential losses when allocating funds.

Ultimately, there’s no one-size-fits-all answer. The decision depends on individual circumstances and priorities. By carefully evaluating these factors, you can make an informed choice that aligns with your goals and propels you towards financial success.

(Contributed by Hemant Bisht, Financial Planner, Team Vikrant, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question – Why am I advised to continue with funds in the portfolio review that have a low ranking on MoneyControl? Could you explain the reasoning behind not suggesting top-rated funds through rebalancing in their respective categories to maximize returns?

Our Reply – Our portfolios are strategically composed of both equity and debt components, meticulously aligned with the financial goals of our clients, ensuring a balanced approach to optimize returns while managing risks effectively. We strive to incorporate the best-performing funds into our clients’ portfolios, aligning with the current market dynamics. We conduct periodic portfolio reviews at defined intervals considering various parameters like funds’ performance, risk-to-reward ratios, and how the funds respond in different market conditions. This methodical assessment enables us to analyse the present composition of the portfolio, ensuring that any adjustments made are not only strategic but also well-founded. In simple terms, we conduct necessary rebalancing in our clients’ portfolios when we identify the need, ensuring confidence in providing a better future outlook and growth that aligns with their requirements.

Each investment fund employs its unique approach to maximize returns while managing its corpus. The efficacy of these strategies can fluctuate, reflecting inherent market risks. It’s not prudent to incorporate new funds into the portfolio solely based on rankings and past returns, as no fund can consistently maintain a top position and get the highest returns all the time.

Excessive portfolio churning, keeping returns as the sole aim in mind and forgetting consistency of good returns, may result in the loss of compounding benefits and unnecessary tax and exit load liabilities which finally will reduce your overall returns without you even coming to know of it. Also, every fund faces temporary lows due to various reasons and bounces back if it continues to be well-managed – this is what we keep looking for and avoid unnecessary tax penalties to you. A careful and well-informed approach, considering long-term objectives and potential risks, is crucial for sound investment decisions.

(Contributed by Team Arjun, Hum Fauji Initiatives)