Inflation and your wallet: How to manage rising cost and protect your savings

But fret not! Here are some strategies to weather the inflation storm and protect your financial well-being.

Budget Bootcamp:

- Be a detective: Remember that dusty budget you made last year? Time to dust it off and do some detective work. Knowing where your money goes helps identify areas for potential cuts.

- Needs Vs Wants: Be honest, do you really need that fancy new gadget, or would a used one or hiring it do the trick? Prioritize essential expenses like rent, groceries, and utilities and ruthlessly cut back on non-essentials.

- Embrace Technology: Budgeting apps and online tools can automate expense tracking, categorize spending, and even suggest areas to cut back. Leverage technology to simplify and streamline your budgeting process.

Investment 101:

- Don’t Let Cash Sleep: Cash might feel safe, but inflation is slowly eating away its value. Consider investing a portion of your savings in assets that have historically outpaced inflation, like stocks, bonds and mutual funds.

- Diversify, Diversify, Diversify: Don’t put all your eggs in one basket! Spread your investments across different asset classes. This helps reduce risk and protects your portfolio if one area struggles.

- Buffer for the Unexpected: Create a separate ‘emergency fund’ to cover unexpected expenses like car repairs or medical bills. Aim to save 6-8 months of living expenses as a buffer.

Remember, managing rising costs is a marathon, not a sprint. By implementing these strategies and staying informed, you can protect your wallet, safeguard your savings, and emerge financially stronger even in the face of inflation.

(Contributed by Abhilash S Rana, Financial Planner Team HNI, Hum Fauji Initiatives)

Robo-Advisor Vs Human Advisor: AI or Experience – Who Wins?

Picture this: a sleek robot, spewing data-driven insights real fast, versus a seasoned advisor, radiating years of market wisdom. Who wins the crown of ultimate financial counsel? Don’t reach for your wallet just yet, because the answer might surprise you.

What when you face a market meltdown.

Mr Robo-Advisor might calmly spout historical trends, but can it sense your rising panic? Can it explain, in layman’s terms, why this is just a blip on the radar? Probably not. A human advisor, however, can be your emotional anchor, understanding your fears and tailoring advice accordingly. She might even crack a joke (hopefully a good one) to lighten the mood.

Now, let’s not get sentimental and discount the strengths of our robotic counterparts. Robo-advisors excel in areas where pure logic reigns. They can analyze vast datasets, identify hidden patterns, and rebalance your portfolio with laser-like precision. They’re perfect for hands-off investors who trust the algorithms and appreciate the cost-effectiveness.

So, who emerges victorious in this battle of financial titans?

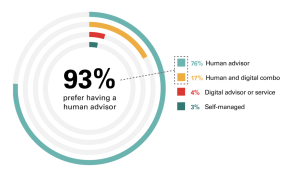

Neither, and both! The above figures show the level of trust people have in human advisors.

The future lies in a symbiotic relationship between man and machine. Imagine a robo-advisor crunching numbers while a human advisor interprets them, considering your unique goals, risk tolerance, and emotional well-being. This dynamic duo offers the best of both worlds: cold hard logic balanced with warm, human understanding.

The future of financial advice lies not in choosing sides, but in finding the right balance. Consider exploring hybrid models that combine the efficiency of robo-advisors with the personalized touch of human expertise. This dynamic duo can deliver a comprehensive solution that caters to your individual needs and preferences, ensuring your financial journey is both data-driven and emotionally secure.

That’s what we at Hum Fauji Initiatives do – we leverage AI (Artificial Intelligence) really intelligently and powerfully to combine it with our human understanding and give to our investors our famous advisory and financial management services.

(Contributed by Ankit Kumar Singh, Associate Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

The Investors’ Dilemma: When to Hold, When to Fold, and When to Buy the Dip!

Investing: a thrilling expedition paved with golden opportunities and anxiety-inducing decisions. “Hold, fold, or buy the dip?”, screams your inner voice, echoing the age-old investor’s dilemma.

Holding Your Ground (and Investments):

Sometimes, the wisest move is strategic inaction. Imagine a delectable pizza – would you judge its potential based on the raw dough?

Similarly, well-researched investments need time to bake. Remember, investing is a marathon, not a sprint. Panic at every market tremor and you’ll end up like a chef throwing out perfectly good dough at the first sign of a bubble. Diversification is your secret sauce, and volatility merely adds a spicy kick to your portfolio!

Folding When the House of Cards Crumbles:

Let’s face it, not every investment blossoms. Recognizing a dud and exiting gracefully is an investor’s superpower. Don’t be afraid to cut your losses, especially if the fundamentals have soured or the future looks grim. Clinging to a sinking ship won’t magically transform it into a yacht. Remember, opportunity cost is real – the time and resources spent on a losing bet could be channeled into more promising ventures.

Buying the Dip: Where Courage Meets Caution:

Market dips can be golden entry points, but remember, discounts aren’t always synonymous with quality. Before diving in, don your detective hat and ask: Why the drop? Temporary hiccup or deeper issue?

Do your research, be patient, and only invest what you can afford to lose. It’s like catching a falling knife – risky, but with the right technique, you could carve a fortune!

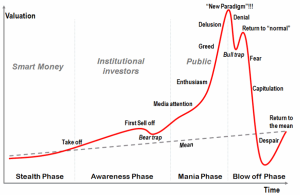

The above chart reflects different emotions of investors while the market is making its move.

Remember, Investing should be an exciting exploration, not a stress-fest. By staying informed, making calculated decisions, and keeping your cool, you’ll conquer the investor’s dilemma and do the macarena all the way to financial freedom!

But also remember that knowledge is power, so do your research, understand the risks, and never blindly follow trends. Your portfolio will thank you for it!

(Contributed by Gautam Arora, Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question- I am a long-term investor. Should I also consider incorporating debt allocation in my portfolio? If yes, why?

Answer- Many of us tend to get attracted by the past returns of equity, as is happening now, without assessing our own risk appetite. But reality dawns when we realize that equity returns are volatile and can deliver negative returns too. This is when we get petrified and tend to exit at a loss.

So, assessing of risk profile is always imperative followed by correct allocation of money.

Today, most investors understand that, for longer duration investment, equity is the best option. But what they may not realize is that unlike fixed income instruments, equity never grows in a linear fashion. It goes through a lot of ups and downs, many-a times drastically, over time.

Let’s understand this with an example.

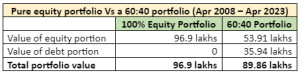

The final corpus after 15 years (April 2008 – April 2023) with a 60:40 portfolio (60% equity, 40% debt) with a SIP of Rs 20,000 will be as follows:

As expected, this portfolio generated less corpus. The final corpus is about Rs 7 lakh less as compared to that generated by a pure equity portfolio.

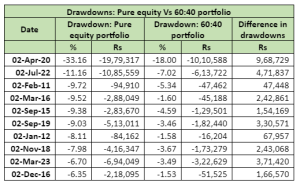

But how about the downside protection? Let’s see in the order of amount of drawdowns starting from the worst days of stock markets during the period.

The pure equity portfolio may be the most rewarding, but the gains from the 60:40 portfolio, which is the most conservative portfolio, aren’t much lesser either with much lesser risk.

So what are the benefits of investing in debt and debt oriented products and why invest in them at the first place?

- Gives stability to your portfolio

- Reduces the overall risk of your portfolio

- A good source of liquidity closer to milestones

- You can structure regular income on your portfolio

- Works as emergency funds when markets are at low