We’ve all been there. Scrolling through social media, bombarded with images of picture-perfect vacations, the latest gadgets, and designer digs. Suddenly, our own financial situation feels a little…lackluster.

Comparing ourselves to others is a recipe for financial disaster (and a major mood killer!). Here’s why:

1. Highlight Reel Vs Reality:

Imagine someone posting a picture of a luxurious vacation. What you don’t see are the months of saving, the packed airport terminals, or the stressful work they put in to afford it. Social media is a highlight reel, showcasing the best moments, not the everyday grind. Comparing your behind-the-scenes life to someone else’s carefully curated online persona is a recipe for feeling inadequate.

2. Different Paths, Different Goals:

Everybody’s financial paths are as diverse as the people walking them. Factors like inheritance, family support, and early investment decisions shape individual journeys. Comparing your current chapter to someone else’s climax is comparing apples to oranges—fruitless, and bound to leave you feeling inadequate for no real reason.

3. The Pressure Cooker of Envy:

Then there’s the pressure cooker of envy. Constantly measuring your portfolio against others’ breeds a dangerous desire for more, often leading to impulsive spending and mounting debt.

4. Hinders Your Own Progress:

Focusing all your energy on what others have achieved steals your focus from your own financial goals. Instead of chasing someone else’s dream vacation or designer bag, you miss out on the opportunity to chart your own course and celebrate your own milestones, big or small.

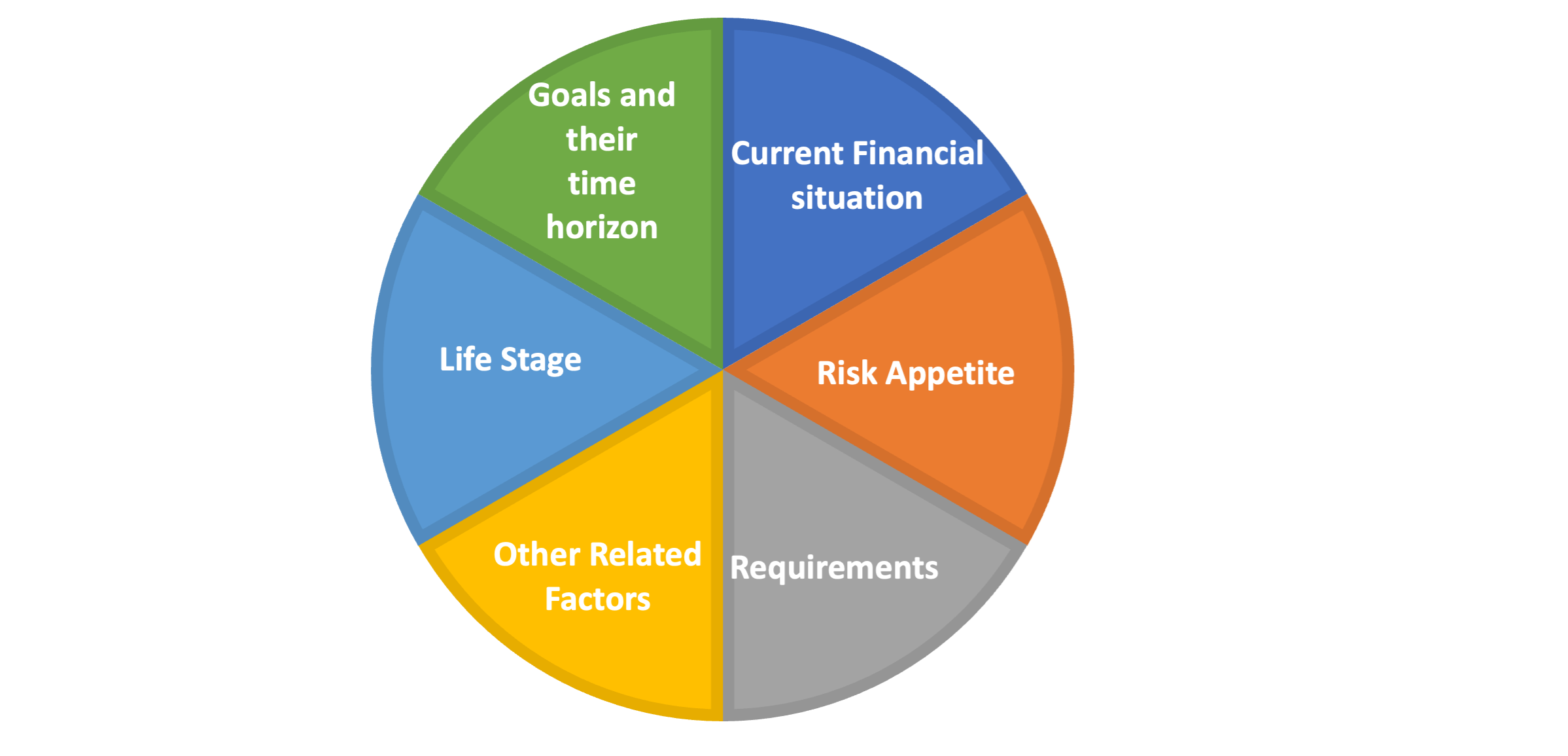

There are different factors that defines an individual’s financial planning.

Remember, financial well-being is a personal journey. It’s about setting realistic goals that fit your circumstances, tracking your progress, and celebrating your achievements along the way. Don’t mistake this.

(Contributed by Gautam Arora, Relationship Manager, Team Vikrant, Hum Fauji Initiatives)

We can help you deal with financial disasters better. But our primary goal is of course to AVOID any financial disaster in the first place . Connect with us to know more how we work solely for armed forces officers and their families.

The Tale of Warren Buffet and His Advisor

Once upon a time, in a land not so far away, there lived a legendary investor named Warren Buffet. He had big dreams and an even bigger heart, but one thing was missing: a happily ever after with his money.

As Warren roamed the kingdom, he stumbled upon a magical treasure chest guarded by the wise old sage, Financial Advisor. With a twinkle in his eye, Warren approached the sage and asked for the secret to unlocking the chest and unleashing its riches.

The sage said, “To open this chest, you need to invest. It’s like a love story, needs patience and trust.”

Eager to embark on this enchanting journey, Warren delved into the world of investing, guided by the sage’s wisdom. It wasn’t easy. Sometimes, the money market was crazy, like a wild dragon. But he didn’t give up. He learned to deal with ups and downs.

Years passed, and Warren’s money grew a lot. He did it by planning and sticking to his plan. His success showed that investing is like a lifelong friendship with money. It needs trust and hard work.

And so, dear reader, let Warren’s tale be a reminder that investing is not just about building wealth; It’s about staying loyal to your goals. Start your own investing journey. Your happy ending might be just around the corner.

By the way, Warren Buffet acknowledges Benjamin Graham as his mentor and financial advisor. Benjamin is known as the ‘father of value investing’ and is the author of the evergreen investing classic, ‘The Intelligent Investor’.

(Contributed by Ankit Singh, Associate Financial Planner, Team Sukhoi, Hum Fauji Initiatives)

Beyond Illusion: Practical Tactics to Combat Overconfidence

Below are few strategies to combat overconfidence in stock markets.

- Learn from Mistakes: Embrace failure as an opportunity for growth and learning. Analyze your past investment decisions, especially those influenced by overconfidence, and identify the underlying causes of any losses or underperformance. Use these insights to refine your approach, strengthen your risk management practices, and avoid repeating similar mistakes in the future.

- Diversify Your Portfolio: Spread investments across various asset classes, industries, and regions to minimize the impact of a single loss. Diversification is a simple hedge against overconfident stock picks.

- Cultivate Humility: Humility is key to overcoming overconfidence. Recognize that no one can accurately predict the market’s movements with certainty. Stay humble in your approach to investing and acknowledge the inherent uncertainties. Embrace a mindset of continuous learning and openness to new information and perspectives.

- Set Realistic Expectations: Establish realistic expectations for investment returns based on historical performance, market conditions, and your risk profile. Avoid overly optimistic projections or irrational exuberance, which can lead to overconfidence and excessive risk-taking. Understand that achieving consistent, above-average returns requires patience, discipline, and a long-term perspective.

To overcome overconfidence, adopt a mindset of humility and discipline. By diversifying, staying grounded, and learning from experience, investors can navigate the stock market with greater resilience and success. Remember, humility is often the most valuable asset in investing.

(Contributed by Abhilash Rana, Relationship Manager, HNI Desk, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question: With so many life insurance products available in the market—such as moneyback, unit-linked insurance (ULIP), endowment and more—which one is the best suited for me as a common person to buy?

Our Reply: When buying life insurance, we hardly think more than the sum assured, premium and tenure of the policy. Most of us choose life insurance policies according to word of mouth information from family, friends and colleagues. And of course, what the insurance agent aggressively pitches.

First, ask yourself: do I really need life insurance? If so, how much coverage suits my needs? Lastly, does the plan align with my financial goals?

For those eyeing insurance as a saving tool, endowment and money-back policies might seem like relics of the past. Yet, for certain investors, they still hold value largely due to their perceptions, albeit with modest returns.

When it comes to big-ticket goals like your child’s education or marriage, clarity is the key. While ULIPs offer flexibility, they come with a price tag. Mutual funds, on the other hand, offer transparency and freedom.

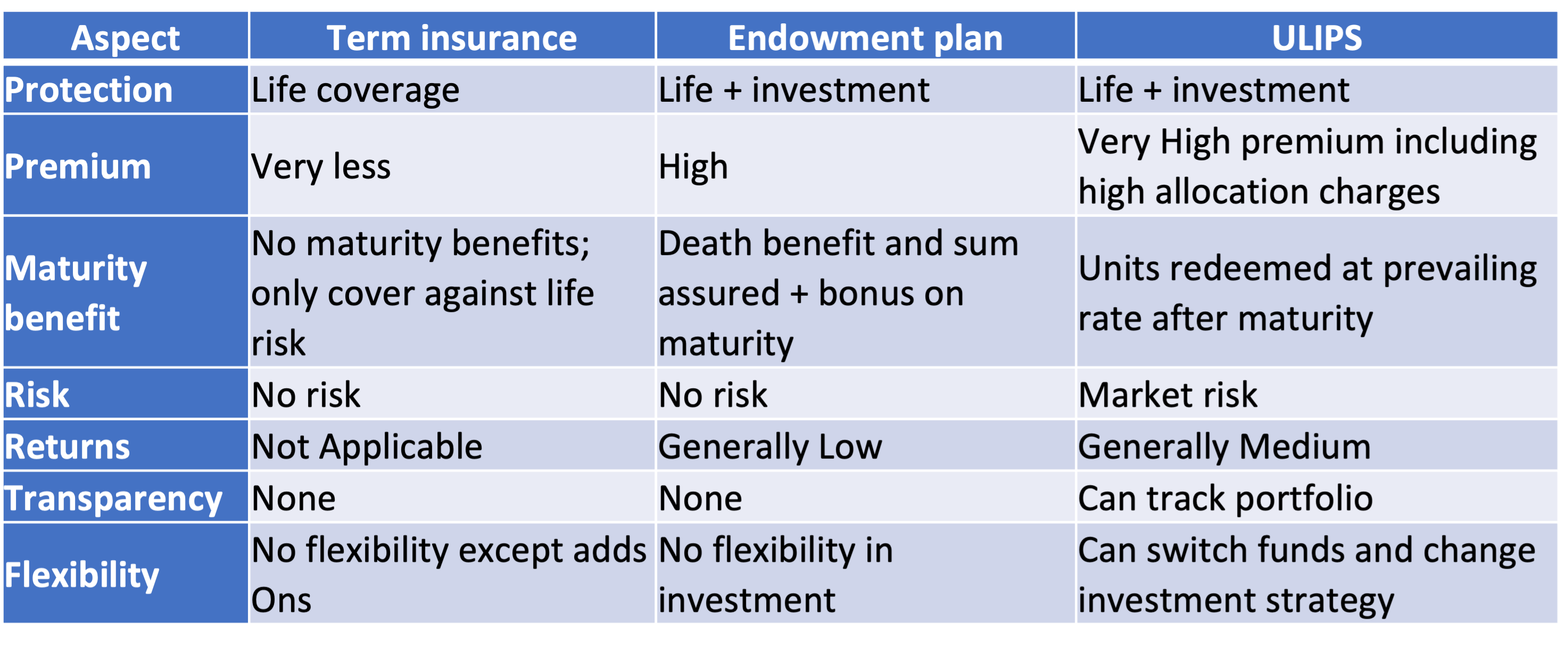

A brief basis of differentiation on different plans is as follows-

In the end, whether it’s endowment, money-back, or ULIP, knowing your needs and doing thorough research will ensure your ship sails smoothly in the vast sea of life insurance.

(Contributed by Team Sukhoi, Hum Fauji Initiatives)

Leave a Reply