Imagine you’re at a bustling street food market, eager to savour the local delicacies. Each stall promises a unique taste experience, but how do you choose? Do you go for the eye-catching signboard or the stall where a celebrated chef personally guides your choice based on your taste preferences and hunger level?

Investing in mutual funds in India is somewhat similar.

In online platforms for mutual fund investments, you’re at a financial bazaar with an array of investment ‘stalls’ to choose from. They’re convenient, accessible 24/7, and let you make transactions with just a few clicks. Like ordering food online, it’s straightforward.

But is it customised to your requirements and suited to your unique financial appetite? Almost never because they’re general-purpose platforms made for everybody in general but nobody in particular.

On the other hand, imagine a scenario where you have a culinary guide or a chef who not only knows the business of food inside out but also makes endeavour to understand exactly what you’re craving. They tailor a meal just for you, considering your preferences, dietary restrictions, and even how adventurous you’re feeling that day.

This is your trusted financial advisor who crafts a customised investment portfolio, offers advice when the financial markets are as unpredictable as the weather, and helps rebalance your investments to keep your financial health in tip-top shape.

Now, here’s the twist that almost everybody using such apps misses.

Whether you order a meal through a flashy app or have a gourmet chef prepare a custom feast, the price tag is surprisingly the same.

This scenario mirrors the investment world in India, where the fees charged to you for a hands-off approach on online platforms for regular mutual fund (MF) schemes is the same as the cost of personalised advice from a celebrated, interactive financial advisory company.

And mind you, most of the common mutual fund online platforms like ICICI Direct (yes, Direct here doesn’t mean direct plans of MFs), HDFC Securities, SBI Securities, Sharekhan, Scripbox etc deal with Regular plans of MFs.

It raises a serious question for you: why opt for a one-size-fits-all solution when you can have a bespoke investment plan for the same price?

Let’s sprinkle in some anecdotes for flavour.

Picture Maj SK Udaas, a budding investor, thrilled by the ease of using a direct platform to dip his toes into the mutual fund market. It was like ordering a fast-food combo meal – quick, easy, but not necessarily fulfilling, as he later realised. Over time, SK noticed his investments weren’t reflecting his changing financial goals and market conditions since nobody knowledgeable ever looked at them. They were like a stale meal that no longer satisfied his appetite.

Then, there’s Maj IM Smart, who decided to consult a financial advisor. The advisor delved into Smart’s financial goals, risk tolerance, personal investment preferences and future plans before crafting a diversified investment portfolio. It was like having a meal tailored to his nutritional needs and taste preferences. Smart found value in the advisor’s insights, especially during market downturns, akin to knowing exactly when to add a pinch of spice to enhance a dish.

The moral of these stories?

While the ease of investing through online platforms is akin to fast food’s convenience, it often lacks the personal touch and tailored advice that can make a significant difference in achieving your financial goals and wealth creation. Just as food is more enjoyable when it matches your taste and nutritional needs, investments yield better outcomes when aligned with your financial aspirations and life goals.

And the clincher is that they both cost the same to you in MFs’ case!

Choosing how to go ahead is an important decision to make when you are starting to invest. The simple reason is that investing is a long-term activity. It’s not just about starting a SIP and forgetting about it. You need to manage your portfolio, likely make additional investments, change schemes, and very importantly, monitor performance and do changes as your future and current requirements demand. All this would mean that you need an investment platform that you feel secure, familiar and comfortable with.

The problem with online platforms is that they do a really poor job of telling their customers how to invest and where to invest – how to choose the good funds for them from the hundreds available.

Besides, they sometimes end up giving dangerously wrong cues, highlighting the recent top-returning funds that can well become the laggards soon like flashes in the pan. Most of the online platforms rely on some variant of a ratings system and let the investor gravitate towards ‘five-star’ funds (who would choose anything lesser??) – And there are problems aplenty with such an approach.

All the banking platforms will fall into the same category. Thus, regardless of how many times your RM tries to sell you a tax-saving MF or some SIP package… avoid. There are much better options out there that would give you more value and, hopefully, better returns. In all such cases, the MF platform is an afterthought purely built as a revenue-grab, cross-sell opportunity for other products from existing customers of the main platform selling similar regular mode investment.

Managing mutual fund investment is not similar to managing a bank account and when the same treatment is given to both, you will end up getting a system that is uniformly bad.

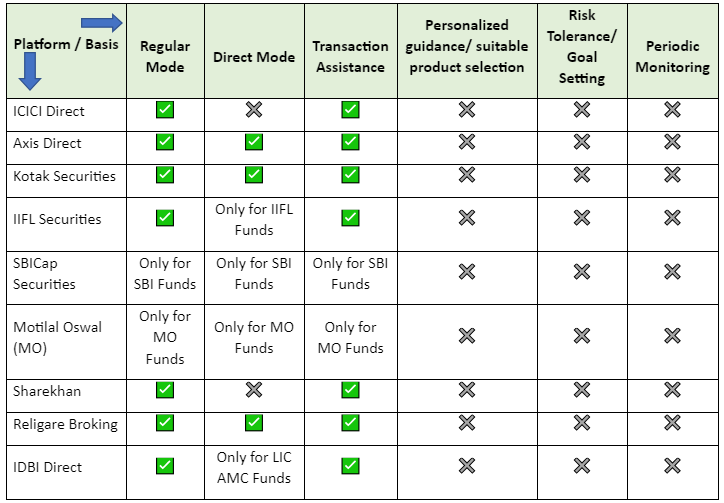

One need to be cautious and aware about offerings by online mutual fund investment platforms that are part of a larger financial services entity and offer only regular plans:

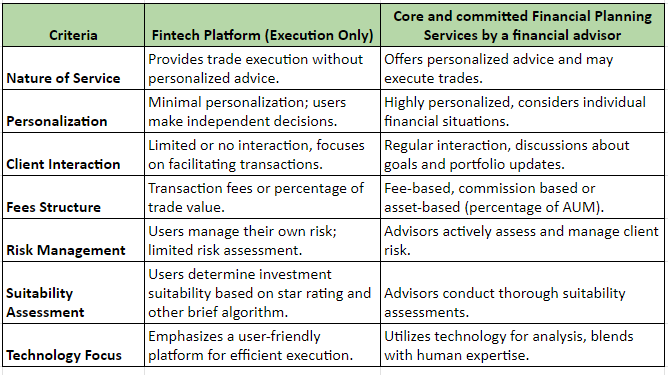

Here is a brief differentiation, how core investment and financial advisory is different and crucial, compared to fintech, execution-only platforms.

Investing with the guidance of an investment advisor offers a comprehensive and personalized approach to wealth management. Unlike execution-only fintech platforms, investment advisors bring a human touch to financial planning, considering individual goals, risk tolerance, and market conditions. Choosing an investment advisor is like having a financial friend who understands your unique money story. They’re not just about buying and selling – it’s more like having a guide who crafts a plan just for you. Think of them as your financial storyteller, navigating the ups and downs with an expert touch – a trusted companion for your money journey, who helps you make smart moves and reach your goals, because everyone deserves a little financial magic in their life!

So, ask yourself as you finish reading this article: do you want to continue with a quick, impersonal transaction or a tailored investment experience that considers your financial wellbeing while both cost you the same?

Remember, in the world of investments, as in gastronomy, the right guidance can turn a simple meal into a gourmet experience, making all the difference in meeting your future requirements – and your wealth creation.

Leave a Reply