The Art of Doing Nothing: How Not Reacting Can Boost Your Wealth?

You’re stuck in a traffic jam, everyone’s honking, and you’re constantly changing lanes hoping to get ahead. Sounds familiar, right? Well, believe it or not, this scenario mirrors how we sometimes approach investing – always moving, always doing something, but not always getting where we want to be.

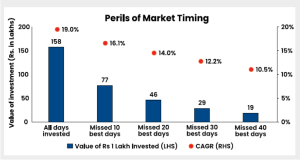

Let’s break it down. There’s this concept called ‘bias for action’ in investing. It implies an investor always feeling the need to do something, anything, because Action is equated to Success. But here’s the catch: sometimes, especially when markets are volatile, doing nothing is the best move. Yep, you heard that right – doing nothing can be a winning strategy too.

Now, let’s talk more on this. Instead of constantly tinkering with your investments, sometimes it’s best to just let them be and give them time to grow; something like planting seeds in a garden – you don’t keep digging them up to check if they’re growing, right? You give them time, water, and sunlight, and eventually, they flourish.

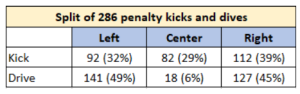

A study in 2007 on 286 football penalty kicks in top events showed the downside of action bias. It showed that penalty takers’ kicks went 32% to the left, 38% to right, and 29% in the centre. Surprisingly, goalkeepers’ dive direction is highly skewed towards left and right, while only 6% stayed in the centre – possible reason is ‘Action Bias’. In fact, the study suggests that staying in the centre more often could have lead to better outcomes for the goalkeepers. This example demonstrates the power of stillness as a strategic approach.

Source: Action Bias among Elite Soccer Goalkeepers: The Case of Penalty Kicks, Michael Bar-Eli and Ilana Ritov (2007)

In investing, the potency of stillness lies in granting investments time to mature, rather than constantly tinkering with them. This historical approach has consistently yielded superior long-term returns. While action is often lauded, the power of stillness can be equally formidable.

So, next time you feel the urge to make a move with your investments, take a moment to pause and consider the power of stillness. Remember, sometimes the best action is NO ACTION AT ALL.

Or better still, contact a trusted and unbiased financial advisor like us.

(Contributed by Ujjwal Dubey, Financial Planner, Advisory Prithvi, Hum Fauji Initiatives)

How Married Women Property (MWP) Act Protects the Rights of Women

As the head of the household, you naturally want the best for your wife and children, whether it’s providing love, care, or financial security. When you buy life insurance, it’s to ensure they’re taken care of, if something happens to you.

However, if you have outstanding loans and you pass away before settling them, your life insurance money payable to your family may be used to pay them off, even against your wishes. However, Married Women’s Property (MWP) Act can protect your family’s financial future even in such circumstances.

The hustle and bustle of the financial world can often feel disconnected from the natural world. But what if the secrets to sound financial practices lie beneath the rustling leaves? Surprisingly, nature offers insightful lessons that can guide us towards financial stability and responsible stewardship of our resources.

Here’s why buying insurance under the MWP Act can be a smart move:

- Protecting Your Assets: The MWP Act shields assets from potential legal threats and creditors by allocating insurance benefits exclusively to named beneficiaries. This ensures financial security for the insured and their family members, particularly in the absence of the husband.

- Avoiding Family Disputes: Insurance policies under the MWP Act provide a clear title to the beneficiary, typically the wife and children, which helps in resolving any family disputes over inheritance or the deceased husband’s estate. These policies operate as a separate trust and cannot be included in the policyholder’s will or claimed by anyone other than the designated beneficiary, even if they are legal heirs or there’s a dispute.

- Empowering Women: By allowing married women’s control over insurance benefits, the MWP Act promotes their financial independence. This empowers them to manage policy proceeds directly, without dependence on their husband or others.

- Estate planning: The MWP Act facilitates the active participation of women in estate planning, enabling them to secure assets for their future and that of their children. This contributes to long-term financial stability within the family.

How to buy term insurance under the MWP Act?

When filling out insurance forms, choose ‘Yes’ for purchasing term insurance under the MWP Act. Do note that an insurance policy under the MWP Act only allows your wife and any children to be your nominees.

The Married Women’s Property Act is a wise option for safeguarding family finances with insurance, particularly beneficial for married individuals concerned about their spouse and children in unforeseen circumstances.

(Contributed by Yogesh Gola, Relationship Manager, Advisory Desk, Hum Fauji Initiatives)

ESG Investing: Opportunities in Sustainable Mutual Funds

In recent years, a notable shift has occurred in the investment landscape, with more investors prioritizing Environmental, Social, and Governance (ESG) factors when making investment decisions. This trend has driven the rise of sustainable and ESG investing within mutual funds too, offering investors the opportunity to align their financial goals with their values. Let’s delve into this trend, exploring what ESG investing involves, why it matters, and how we can evaluate ESG funds effectively.

Why ESG Investing Matters:

Think beyond just making money. ESG investing acknowledges how a company’s actions impact the environment, society, and even its own governance. Imagine if your investments could not only bring you financial gains but also contribute to a better world.

By choosing companies that ace these areas, investors can create positive change while still aiming for those sweet financial returns. Generally, companies with strong ESG practices tend to be more resilient, innovative, and competitive – talk about a win-win!

How to Choose the Right ESG Funds:

When evaluating ESG funds, investors should consider several key criteria to assess the fund’s alignment with their investment objectives and values:

- ESG Integration: Make sure the fund walks the talk by fully integrating ESG factors into its investment process.

- Portfolio Holdings: Review the fund’s portfolio holdings to understand the types of companies and industries it invests in. Consider whether the portfolio aligns with the sustainability goals and risk tolerance.

- Expense Ratio and Fees: Nobody likes surprises, especially when it comes to fees. Check that the fund’s fees are fair and square compared to others out there.

The Future Looks Bright:

And here’s the cherry on top – governments worldwide are pushing for greener economies and less climate risk. This means more opportunities for social causes and a cleaner, greener future for all. By investing in ESG funds, you’re not just securing your financial future – you’re shaping a better tomorrow!

So, next time you’re thinking about where to put your money, consider ESG investing. It’s not just about profits – it’s about making a positive impact on the world.

And hey, who says responsible investing can’t be exciting? 🌱📈

(Contributed by Neeraj Kumar, Financial Planner, Advisory Arjun, Hum Fauji Initiatives)

What Did Our Clients Ask Us in the Last 7 Days?

Question – What are the tax implications of receiving gifts, particularly from relatives, unrelated persons, and during weddings?

Our Reply – Ah, the joy of receiving gifts! But be careful about the tax man who can come knocking!

Gift from Relatives: Good news first! Gifts from relatives are like little bundles of joy exempt from the taxman’s reach. So, whether it’s your spouse, siblings, or even those cool close aunts and uncles, you can breathe easy. The Income Tax Act generously exempts gifts from these dear ones from any tax obligations. In case of HUF, gift received in HUF from any of its members is exempt from Income Tax.

Gift from Unrelated Persons: Now, here’s where it gets a bit trickier. If you’re receiving gifts from someone unrelated and the total value of such gifts in a financial year exceeds Rs 50,000, you have gotten into Uncle Tax’s gaze. These gifts are considered taxable income and will be subjected to regular tax rates under the head ‘Income from other sources’. So, remember to keep an eye on those big-ticket presents!

Gifts Received at Own Wedding: Well, good news again for newlyweds! The gifts you receive on the auspicious occasion of your marriage are like little tokens of affection, exempt from the clutches of taxation. So go ahead, dance, celebrate, and cherish those heartfelt gifts without worrying about tax implications! Remember, while gifts are indeed wonderful gestures, understanding their tax implications can save you from any unwelcome surprises. So, whether it’s from dear relatives, distant friends, or in the midst of matrimonial bliss, know your tax game to enjoy those gifts to the fullest!

Happy gifting! 🎉

(Contributed by Team Vikrant, Hum Fauji Initiatives)