When it comes to investments made for the purpose of tax savings under Section 80C of Income Tax Act, Public Provident Fund (PPF), Life Insurance premiums and Equity Linked Savings Schemes (ELSS), which are basically Equity Mutual Fund, are among the most popular choices, especially for young investors. However, as far as wealth creation is concerned, there is simply no comparison between ELSS and the rest of the 80C investment options. It is often seen that, when we compare different investments, we are influenced by personal opinions, either our own or that of others. However, objective comparison should always be based on actual data. In this article we will see how much wealth could have been created in the last 15 years by investing in ELSS compared to other popular choices. Why have we chosen a time horizon of 15 years? The term of one of the most popular tax saving investments, PPF, is 15 years. Hence it is appropriate to choose duration of 15 years when comparing ELSS with PPF. For our analysis we have assumed an annual investment of Rs70,000 in FY 2000 – 2001, Rs100,000 from FY 2001 – 2002 to FY 2013 – 2014 and Rs150,000 in FY 2014 – 2015, as per Section 80C limits for the respective years.

What would your maturity amount be if you invested in PPF

Before we deep dive into the analysis, it suffices to say that PPF is one of the best fixed income investment choices under Section 80C. The tax treatment of PPF makes the returns more attractive relative to other fixed income investments under Section 80C (like NSC, PO time deposits, tax saving fixed deposits) except ELSS. Even when compared to historical returns of traditional life insurance policies, PPF returns are higher. The chart below shows the PPF returns since FY 2000 – 2001.

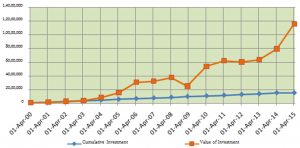

Let us now see how much maturity amount one would have accumulated in the last 15 years by investing upto the maximum 80C investment limit in PPF. The chart below shows the cumulative deposit amount and value of the investment in PPF.

The blue line shows the cumulative deposits made by the investor in his or her PPF account every year. The total deposit made by the investor is Rs15,20,000 ( 15.2 lacs) over the duration of the PPF. The red line shows the value of the PPF account, inclusive of accrued interest. The maturity amount of the investor is about Rs29,82,000 (around 29.8 lacs).

What would your maturity amount have been if you invested in ELSS

For the ELSS investment we have chosen at random a tax saver fund which has completed more than 15 years. For purpose of this analysis, we have selected HDFC Tax Saver Fund (Growth Option). Like in the previous example, let us now see how much corpus one would have accumulated in the last 15 years by investing upto the maximum 80C investment limit in the ELSS fund. The chart below shows the cumulative investment amount and value of the investment in ELSS.

The blue line shows the cumulative deposits made by the investor in the ELSS fund every year. The total investment made by the investor from 2000 – 2015, is Rs15,20,000 ( 15.2 lacs), the same amount deposited in PPF in the previous example. The orange line shows the value of the ELSS investment based on prevailing NAVs. As we can see from the chart above, the ELSS returns are of a very different order of magnitude compared to PPF. In fact, the current value of the first two ELSS investments made in 2000 and 2001 itself is much more than the total maturity amount accumulated in PPF in the previous example. The value of the ELSS investment as on Apr 2, 2015 is over Rs1.15 crores, nearly four times the PPF maturity amount.

Fund selection plays an important role in getting better investment returns

As discussed earlier, we chose HDFC Tax Saver fund at random from ELSS funds which completed 15 years. However, the HDFC Tax Saver fund has been underperforming relative to its peers for the past few years. The ELSS investor could have got even better returns than in the above example, by monitoring his investment portfolio from time to time and shifting to better performing funds. For example, if in 2010, the investor switched to Franklin India Taxshield fund, which was one of the better performing ELSS funds back then and even now, and continued to make 80C investments in the Franklin India Taxshield fund, the accumulated investment value of the investor would be over Rs1.3 crores. This means that, through portfolio reviews and better fund selection, the investor could have got 13% higher returns over 5 years. There can be a number of other possibilities through which the investor could have got better returns. We have just shown an example of why it is important that, investors should do review their portfolio from time to time and make appropriate adjustments to get better returns. Investors should seek the advice of their financial advisors from time to time, to make necessary adjustments to their portfolio, as and when required.

Is ELSS better than NPS?

The only 80C investment option that has the potential to give returns somewhat comparable to ELSS is the National Pension Scheme (NPS). In this budget the Government has provided additional tax savings for investment in NPS. Investors can get an additional tax benefit of Rs50,000 over and above the 80C limit of Rs1.5 lacs, under Section 80CCD by investing in NPS. This makes NPS an attractive investment option for tax payers. However, a major disadvantage of NPS versus ELSS is the tax treatment on maturity. While capital gains in ELSS are tax free, NPS maturity amount is taxable on withdrawal. The other problem is that, under the current rules, 40% of the NPS maturity amount must compulsorily be used to purchase annuities and the annuity income is taxable. There are also limits on equity allocations in NPS, which younger investors may find too conservative relative to their risk profile. However, NPS has certain advantages too. The fund management cost of NPS is lower than that of ELSS. While we will not get into a comprehensive evaluation of NPS in the article, it suffices to say that, pros and cons notwithstanding, NPS is also a good investment option for younger investors, though with many restrictions and tax-inefficiencies on the corpus finally created.

Our Final Take

ELSS, or Tax Saving Mutual Funds, are the very best way to save tax under Section 80C due to their tremendous wealth creation potential, flexibility, a very small lock-in and track record. Further, to get the best out of them, as the new financial year has just started, one should do choose the Systematic Investment Plan (SIP) route so as to minimise the equity market volatilities and avoid a lump sum outgo. To know more about mutual funds and how they can create real wealth for you, see this link at our website: https://humfauji.in/mutual-funds-can-be-your-financial-supermarket/

(Source: Dwaipayan Bose, www.advisorkhoj.com, 8th Apr 2015)

Visit our Blog, https://humfauji.in/blog or facebook page http://www.facebook.com/HumFaujiInitiatives or follow us on Twitter https://twitter.com/#!/humfauji to get latest insight on matters financial

You can either call us on 9999 022 033 or write to us at contactus@humfauji.in to schedule a tele meeting with our financial planner and investment advisor.

Leave a Reply