What should the Investors do for Profitable Investing in 2026?

2025 has been a year that has tested every investor’s patience. A part of what markets are doing now was always on the cards, and a part has genuinely surprised even seasoned experts. Yet beneath the current volatility, the bigger story is intact: India’s economy is strong, earnings are expected to improve, and 2026 is shaping up to be a much better year for equity investors than 2025. What really happened in 2025 Headline indices like the Nifty and Sensex have held up reasonably well, but that headline strength hides deep pain in the broader markets, especially small and midcaps. Overvaluation in select pockets, frothy IPOs at high valuations and the unwinding of leveraged positions have triggered sharp corrections, even in otherwise sound businesses. Add to this delayed growth in some sectors due to weather disruptions, policy timing, and global trade frictions, and you get the kind of choppy, confusing ...

The NRI’s Guide to Investing in ETFs: Building a Borderless Portfolio in Indian & Global ETFs

Whether you are an NRI by choice, an OCI in the UK, or an Indian Defence Forces child working across the globe, investing in India is a wise decision and always a preferred wealth management choice for good reason. For many NRIs, especially those who belong to India’s Defence Forces community, maintaining a financial footprint in India is not just a strategy; it’s a sentiment. Among the top investment plans for NRIs, one underrated yet powerful option is the Exchange-Traded Fund (ETF). It offers the perfect blend of cost-efficiency, diversification, and flexibility, especially for those who want to avoid the stress of tracking individual stocks or timing the market. Why are ETFs a game-changer for NRI investments in India? Gone are the days when NRIs had to choose between investing in India or abroad. Today, with the right blend of Indian and global ETFs, you can truly have the best ...

Is this Diamond worth your money?

Life Insurance Corporation of India (LIC) is aggressively marketing its insurance policy, LIC Bima Diamond Plan, as a ‘Diamond for Life’. Let’s see if this ‘Diamond’ is worth your money? LIC Bima Diamond Plan is a typical non-linked, with-profit, limited premium payment money-back life insurance plan. Non-linked means it is not ULIP or your money will not be linked to equity market movements. With-profit means, it is like investment product where you get returns on your investment based on the product feature. Money back means at a different interval of the policy term, you will receive some money from this policy. Highlights of the policy It is a fixed tenure insurance policy. There are three tenure options - 16 years, 20 years and 24 years. The premium paying term is less than the tenure of the policy e. g. for a 16-year policy you have to pay only for 12 years.Money-Back (Survival Benefits)every 4th year. The premium rate ...

Liquid Funds- 4% more Interest without you doing anything….

Col Sher Khan is a go-getter infantry officer, known for his professional acumen and is a sought-after party animal. He and his family live life to the full. His only Achilles Heel is finance. He routinely has a large amount – anything from Rs 75,000 to even 2-3 Lakhs lying in his savings bank account at any given time, earning 4% savings bank interest. And just because it was lying there, unimportant expenditures would come up and suddenly become urgent and the most important ones to be done then and there. He was fully aware that bank interest is fully taxable and he being in 30% bracket, it practically earned him a mere 4% - (30% of 4%) = 4% - 1.2% = 2.8% interest. He wanted to do something about it but didn’t know what and how. That’s the time he got introduced to Liquid Funds by a friend ...

Great times to increase your market exposure

Stock Markets have been unrelenting for the past one year and, it has only intensified in Jan 2016. Most of the retail investors have not understood the reason why it is so – Acche Din to Aane Wale The! They’re told that China is slowing down, so the world is slowing down. But the US of A, the world’s largest economy, is on an acknowledged growth path now. They’re told that Oil prices drop is affecting the world growth. But cheap oil results in India saving about 60-70 Billion USD a year – how can that be bad for us? Same is the case with other commodity price drops the world over. They’re told that Govt’s policies have not delivered and the economy is not doing well. But everybody can see that the structural reforms being undertaken will cure the ills of past so many decades. It all becomes very ...

Gift to a loved one? How about a Mutual Fund SIP?

Divesh Kumar has recently retired as a contended man. He hasfulfilled his duties as a devoted father, caring son and loving husband all his life. He now wants to gift something long lasting for his two lovely grandchildren which he and his wife fondly dote on. They both decided to contribute for higher studies for them by contributing some money every month. Their first impulse was to save in a bank Recurring Deposit (RD) but wanted their decision to be validated by us. We heard them out and asked them, “Have you thought of mutual funds for this purpose?” They never had thought so. We explained to them that they had a long time frame for their gift. The gift should actually work for the recipients to create value as they have planned and not be lost to inflation and taxes. In case of any emergent requirement some time later, ...

The benefits of having a financial planner

In a country where event managers are paid for organising weddings and nutritionists are paid for making diet plans, financial advisors struggle to make a case for earning a fee. Only a small segment has managed to break through the resistance. Investors continue to save, invest, and borrow without any framework or process in place and assume they can manage their money. Why does one need a financial advisor at all? There was a time when getting a job meant meeting "commitments." There were siblings who needed college education; there were marriage expenses; and, there were elderly parents to take care of. Today, a young earner begins financial life on a firm footing - a regular surplus income. He acquires a bank account and a debit card with the job. By the end of his first year of earning, he has bought some tax saving products and applied for loans ...

Common Investment Mistakes and How to Avoid Them

Investing is an essential aspect of financial planning and wealth-building. However, many individuals fall prey to common investment mistakes that can hinder their long-term financial success. As a financial advisor, it is crucial to educate clients about these pitfalls and guide them toward making informed investment decisions. Here are some common investment mistakes and strategies to avoid them: 1. Lack of Proper Research: One of the most significant mistakes investors make is jumping into investments without conducting thorough research. It is vital to understand the investment product, assess its potential risks and returns, and evaluate how it aligns with your financial goals. Conducting due diligence, reading prospectuses, and seeking professional advice can help make more informed investment choices. 2. Emotional Decision-Making: Allowing emotions to drive investment decisions can lead to poor outcomes. Fear and greed often push investors to make impulsive decisions, such as panic selling during market downturns or ...

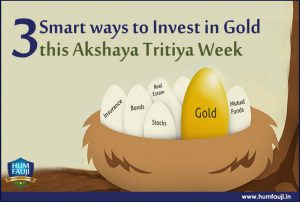

Three Smart ways to Invest in Gold this Akshaya Tritiya Week

Indians have always considered Gold as a safer option to invest vis-a-vis other investment opportunities like equities, fixed income, real estate etc. Gold’s ability to act as a hedge in times of financial emergencies is one of the main reasons for the yellow metal to find a favour with Indians. Gold is also believed to be auspicious and in addition to this has proved to be a prudent investment option for a long time now. In the last few years, we have been seeing a trend wherein young and savvy investors are looking at gold as more of an investment instrument rather than a commodity to be passed onto posterity. Hence, they prefer to invest their surplus into gold via instruments which are hassle-free and are more viable than investing in physical Gold. The mutual fund industry offers multiple alternatives to physical gold if investors wish to take an exposure ...

Importance of Asset Allocation

Introduction: When it comes to achieving long-term financial success, asset allocation plays a crucial role. The concept of asset allocation entails a deliberate and tactical allocation of investments among diverse asset classes, encompassing stocks, bonds, real estate, and cash equivalents. This approach aims to balance risk and reward, optimize returns, and protect against market volatility. In this article, we will explore the importance of asset allocation and provide data to support its effectiveness. Diversification and Risk Management: Asset allocation allows you to diversify your investments across various asset classes and sectors. Diversifying your investments effectively lessens the influence of an individual investment's performance on the overall performance of your portfolio. This diversification helps mitigate risk and protect against potential losses. Studies have shown that asset allocation, specifically diversification across asset classes, can reduce portfolio volatility and improve risk-adjusted returns over the long term. Data: A study conducted by Brinson, Hood, ...