Sometimes one has to swim against the tide to win. It is surely counter-intuitive but knowledge, experience and good research about the ambient conditions can make a winner emerge.

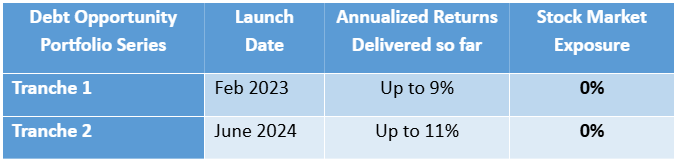

This is precisely what happened when, in February 2023, we launched the Debt Opportunity Portfolio (DOP) – Tranche 1, to take advantage of anticipated interest rate cuts in the economy. This was followed by Tranche 2 in June 2024.

What seemed like a bold move a year ago has now matured into a textbook example of intelligent financial planning.

DOP had a single point objective: To harness the potential of an anticipated declining interest rate regime for our investors — securely and strategically – to give them very safe and high returns over a 3–5 year period.

Did we achieve it?

The table below explains it adequately:

How much equity market exposure is there in DOP-1 and DOP-2? ZERO

How much risky assets does the portfolio invest in? ZERO

Will the returns go down as markets go down or Up? DOP has nothing to do with the stock markets. The interest rate cycle is turning and we’re tapping this phenomenon to get safe, great returns to those who subscribed to DOP.

Why didn’t other financial advisors do such a thing? Debt markets are very complex. 100% of the financial advisors understand equity markets and literally 0% of them understand debt markets.

Can I also subscribe to DOP now? Sorry, we do not recommend getting into the Debt markets now. Our DOP-2 was closed on 28th Feb 2025, just before the RBI gave out its second rate cut.

Can I still make my money work in safe investments? Yes, very much. As interest rates go down, you will find your bank FDs giving lesser returns over the next few years. This is the time to get into longer term bond funds – as interest rates go down, your returns go UP! The more down the rates go, the better returns your bond funds earn for you.

Did you see what we’ve done for our DOP investors? Creating an opportunity to earn, an opportunity which 99% of other financial advisors do not even understand.

It is a testament to informed decision-making and opportunity-grabbing by us, a 15 year old, armed forces focused company, which has only your well-being at its heart.

Amidst global uncertainties and heightened market volatility, our DOP clients benefited from steady, market-independent returns.

These DOP have portfolios which have delivered – and continue to deliver – robust, high-quality returns while maintaining complete insulation from stock market fluctuations.

What Made It Work? Our Strategic Edge:

- Macroeconomic Foresight

Our research team accurately anticipated the interest rate reversal, positioning the portfolio well ahead of the curve. - Thoughtful Diversification

We implemented a carefully balanced allocation across debt mutual funds to maximize gains from falling yields.

- Capital Preservation Focus

With a risk-averse approach, the portfolio was built to prioritise stability and capital protection over market-linked volatility.

Our clients are now reaping the rewards of patience and precision — with returns that beat traditional savings avenues, and without any stress of market volatility.

At Hum Fauji Initiatives, we pride ourselves on anticipating market trends rather than merely reacting to them.

What’s Next?

With continued focus on macro trends and capital protection, we are committed to delivering strategies that work — not just in theory, but in your portfolio.

💬 “True financial planning is not about timing the market; it’s about designing timeless strategies.”

If you’re ready for stability, strategy, and superior results, connect with us and discover how we can help build your wealth — the smart way.

Hum Fauji Initiatives

Strategic. Secure. Successful.

By the way, an interesting fact – Do you know why did President Trump announce a 90-day tariff moratorium recently?

Not when equity markets tumbled, but when Debt markets tumbled and told him that he’s on a dangerous path for his country.

Leave a Reply