The importance of timely investments

This is something that is talked about quite often but still requires reminding time and again. It is only prudent that everyone starts saving and investing early on in his or her career. Investing in early years help you understand market dynamics as you have more time for your investments to fructify, and more energy to work harder if things do not go as expected. Hence, it is always a pleasure when a Lt or a Capt or a Flt Lt knocks our door to enquire about ‘investing’!

Mutual fund investments, especially through Systematic Investment Plans (SIPs), are the best way to start, maintain, and then scale-up your investments as you progress in your career. You will discover and get comfortable with the rise-fall-rise again, and so on of the markets while your corpus is still small. You will realise how a fall and rise in the markets is a part of the investing journey. Well, the key here is also to not panic and take hasty decisions but develop the investing discipline. This also has the potential to provide you with a regular income in times of need, or during retirement.

However, this article not merely about investing when you are young, but about the best way to get a regular income from investments.

SIP is fine but Is Regular income from mutual funds possible?

When we talk of a regular income from investments, in most cases, this discussion is in the context of retirement planning. The idea is to have a stable and a regular income whether it is supplementing your existing pension or simply to get that pension, if you don’t have one.

It becomes important that the corpus from where this income is coming should also remain safe. Hence, most people gravitate towards FDs in banks or other government-backed schemes like the Senior Citizens Savings Scheme (SCSS), Post Office Monthly Income Schemes (POMIS) or even Pradhan Mantri Vyaya Vandana Yojana (PMVVY).

The merits and demerits of these schemes deserve a dedicated discussion by itself. What we want to highlight today is that these might not be the best option for you to get a regular and stable income when we take into account some realistic variables.

Most of these schemes need you to lock-in your corpus for at least a few years, while they pay the returns from time to time, as per THEIR TIMELINE. What if you suddenly need a large part of the corpus for some reason? Well, there are provisions to get that, but with layers of complications.

Another very important factor to consider is taxation. Some of these schemes, not all, do allow you a tax benefit at the time of investments under Section 80C of the Income Tax Act. But the income from these investments is fully taxed as per your tax slab.

What if you could reduce your tax by at least 15 times!!

What? 15 Times – you may ask incredulously.

If you want this, look at the Systematic Withdrawal Plans (SWP) from mutual funds.

What is a Systematic Withdrawal Plan?

To be sure, taxes will remain in the picture even in SWPs of mutual funds but in an extremely benign manner.

A SWP is in a way the exact opposite of a SIP. In SWP, the regular money, as determined by you, flows directly from your invested corpus to your bank account, on your pre-determined dates, regularly. Just like market lows and highs are averaged out in a SIP investment because you are not investing all at once, the same thing is applicable in SWPs too.

Since safety is a pre-requisite for most of SWPs, we are only talking about a SWP from the safe Debt Mutual Fund, though there is no bar on a SWP from an equity Mutual Fund also.

While most of the safe, Govt offered instruments mentioned earlier force you to lock-in your hard-earned money for years at length, there is no such lock-in when it comes to SWP in debt mutual funds. This maintains complete liquidity of your investments and that too in your control. You do not need to furnish a reason and fill an extra form to withdraw your own money! And in case you wish to increase, decrease, temporarily or permanently stop the withdrawal – you can do what you wish.

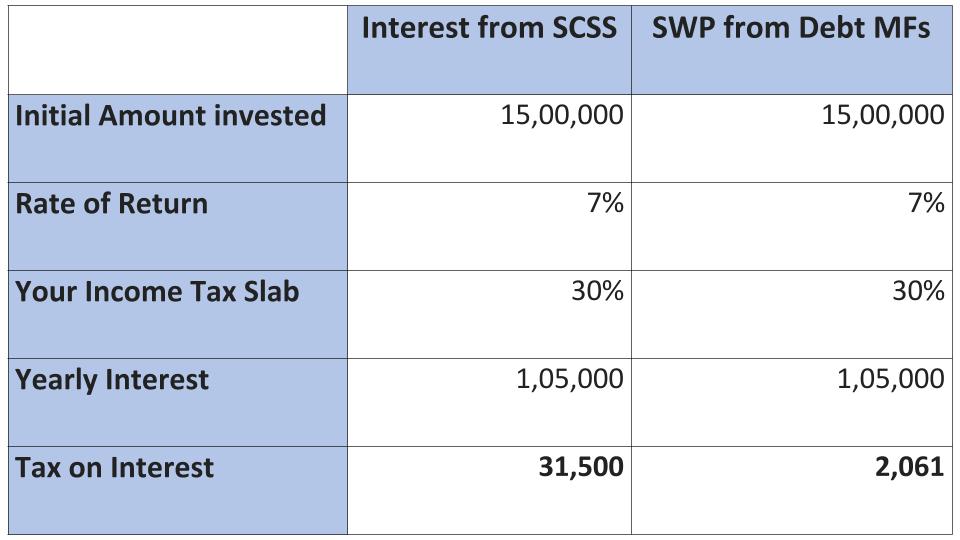

Coming down to a big surprise of Tax. Let us illustrate it with an example. Say you wish to invest Rs 15 Lakhs either in Senior Citizens Savings Scheme (SCSS), or Debt Mutual Funds. How would your monthly income be taxed?

Let us say, both give 7% interest per annum. See the big surprise in taxation below:-

Surprised? Kicking yourself for paying 15 times more tax all these years!

Why didn’t anybody tell you this?

Because you asked those who themselves didn’t know!

There must be a catch? Yes, there is.

The catch is that, like most other good things in life, you need to do some amount of research yourself or contact the right financial advisor to guide you.

Is it that Debt MFs are not safe? No. They can be as safe as you want. Invest in ‘Banking & PSU Debt Funds’ which primarily invest in Bank and PSU papers. Or go in for ‘Money Market Funds’ which only invest in Govt bonds, PSU bonds or highly rated corporate bonds of short maturity. And start SWP from there.

And there’s more – if you continue with SWP in Debt Funds for more than 3 years, your tax will further go down by at least 50%, generally more!

Contrast this with bank FDs, SCSS, PMVVY, PO MIS and the likes, where tax will never go down.

Hence SWPs of Mutual Funds give you Regular income of the amount that you want which can be varied as per your wish, at a frequency that you want and with tax at least 15 times lesser than other avenues. No need to tell you that tax saved is money earned… And all this while, you retain the flexibility to withdraw a bulk if you wish so.

Found the magic trick to get the best flexibility and tax saving on your regular income Now!

Leave a Reply