Dear Sir/Madam,

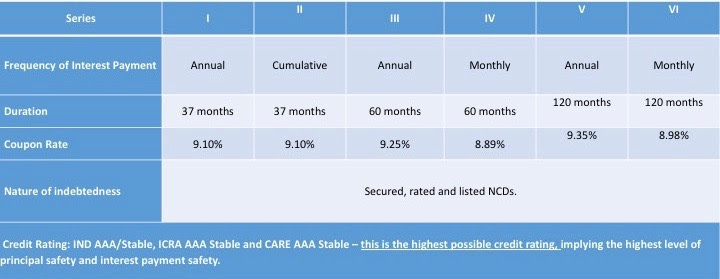

L&T Finance Limited (L&TFL), an L&T (Larsen & Toubro) group company, is coming out with an offer of Secured Redeemable Non-Convertible Debenture (NCDs) Public issue offering very attractive rates of interest rates in the range of 8.89% – 9.35%.

Who is it meant for?

They are meant as a superior, higher interest bearing alternative to other safe investments like bank FDs, Post Office deposits and even most of the corporate FDs for a period ranging from 37 months – 120 months. Along with the high interest rates on offer, there is also the flexibility of choosing the frequency of interest payment in the form of monthly, annual and cumulative interest pay-outs. So, if you’re looking for a safe, high interest bearing and flexible FD, these NCDs by an L&T Group company could be a good alternative to your bank FDs.

Further Details

- L&TFL is offering NCDs with a face value of Rs 1000 with minimum application to be made for 10 NCDs (implying minimum Rs 10,000/- of investment) and in multiples of 1 NCD thereon.

- These NCDs will have tenures of 37 months, 60 months and 120 months with interest rates in the range of 8.89% – 9.35%.

The bond details are as follows:-

- Allotment will be in demat mode only on ‘First come, First Served’ basis.

- Issue is open for subscription from 06 March 2019 to 20 March 2019. However, it can close before the last date if over-subscribed earlier.

- The NCDs will be listed on BSE and NSE within 12 Working Days from the date of Issue Closure. However, going by our previous experience, do not bet on selling these NCDs on stock exchanges since there may not be adequate buyers when you want to sell.

- The issue is rated IND/AAA-Stable by IRR, ICRA AAA Stable by ICRA and CARE/AAA-Stable by CARE. The ratings of the NCDs indicate highest degree of safety regarding timely servicing of financial obligations.

Excellent Rating, well known investor friendly L&T group, lucrative coupon rates and flexible pay out options make this offer a worthy option for investors looking for long term fixed income. Investment in this debt offer may be considered for medium to long term.

So, how can you subscribe to them?

The process will be as follows:-

- You let us know that you wish to go ahead with investing in the bonds. Please reply on this mail itself received by you.

- We generate a unique numbered application form and send it to you by return mail along with detailed instructions on how to fill it.

- You download it, print it and fill up the form.

- Send a scanned copy of the Application form. Alternately, the same can also be sent as a correctly positioned WhatsApp picture on phone number 9999 053 522. Please keep the application form safely with you since it is required to be submitted later.

- We will bid the number of bonds that you’ve asked for. If your bid is successful, we will inform you along with the details of the bank where you have to deposit the application form.

- The amount of money of the application amount will be frozen in your account automatically and will be debited from your account on the date of final allotment.

- You will subsequently be allotted the bonds which will start getting reflected in your Demat account within 12 working days.

Please note that:-

- The bonds will only be allotted through Demat account. If you do not have a demat account, you cannot apply for the bonds.

- In the application form, the applicants have to be mentioned in the same order in which it is there in the Demat account. E.g., if the demat account is in joint name of A + B, then application also has to be in A + B applicant order and cannot be B + A.

- Only the same application form will be accepted by the company for final deposit which had been sent to us on scan or WhatsApp.

Please let us know if you wish to invest in these securities along with the amount and tenure. Kindly contact Aayush Sharma on our landline 011-4081 4681 or WhatsApp to phone number 9999 053 522 if you have any queries. You can also mark email to services@humfauji.in

Leave a Reply