The past year has been extremely volatile for most people. Many people lost their loved ones. Many others lost their jobs or other sources of livelihood. Two friends many of us have in common – Mr Hardcore FD (HFD) and Mr Growth Bhai (GB) – also faced some challenges in their own lives.

Before the pandemic struck, they lived in the same city, but as with many of us, they too relocated to their hometowns in the last one year due to the facility of working from home. They did keep in touch over calls and texts, often sharing news with each other they found mutually interesting.

In March 2020, when the equity market was tumbling down each passing day, HFD kept prodding GB to sell-off his equity holdings and move to safer asset classes like bank deposits (FDs)! GB did feel the stress but held on to his horses. Over time, his faith in equities was strengthened as the equity markets almost doubled over the next one year.

BSE Sensex movement from 1 Jan, 2020 to 1 April, 2021. Source: BSE

In March 2021, the markets again witnessed some volatility and took a fall of almost 10%. As HFD again started sending signals to GB to get out, the latter decided to have a detailed discussion instead to try and change his friend’s thought process.

“You need to stop panicking all the time, HFD. It is fine that you are a little conservative in your investment approach, but have you tried understanding the other side?” GB asked HFD.

HFD replied with conviction, “GB, I have learnt my finance lessons from the elders in my family and have trust in instruments like FDs that have implicit sovereign guarantee. I know what you are saying, but my elder brother tried his luck in equity till 2008 and burnt his fingers badly. Hence, I am even more cautious.”

GB was aware of such a mindset as he had had similar conversations with many people in the past. “Your brother burnt his fingers because he was trying to make fast bucks without a solid understanding of stock markets. When markets tanked, he panicked. You need to understand some basics of stock markets before you close out this excellent avenue from your investment basket,” he started.

Those who sell in panic, lose out much more. The market crashed in 2008, and then sharply recovered.

BSE Sensex between 1 April 2008 and 1 April 2010. Source: BSE

“But people like me who invested in safe instruments like FDs did not lose out!” HFD retorted.

“At what cost? Look at the long-term trend. Time and again, several analyses have proven that long-term returns in equity are in double digits. On the other hand, FDs, though safer, always give a low return,” GB said.

“But still I count more on safety of capital,” HFD said.

To this, GB replied, “But HFD, when inflation and taxes are taken in to account, which anyway you cannot avoid, the returns from FD comes down even further. In fact, your FDs then become ‘assured risk’ – do you realise that?”

“Hope you are aware that the current FD returns are around 5% and the inflation is higher than that. This means that you are actually losing money. Add the tax that you have to pay on interest income at your slab rate, and your real returns go heavily negative. On the other hand, long-term returns from equity, implying what you invest for just more than 365 days, are not taxed up to Rs 1 lakh in a year, and even beyond that the tax is only 10%,” he said.

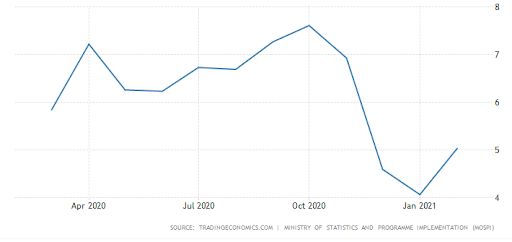

India Retail Inflation. Source: tradingeconomics.com

These numbers made HFD uncomfortable and he came back with the comfort and convenience argument. “It is a hassle to keep track of the equity market and understand when to invest and when not to invest or when to exit.”

“I would agree with you if you were talking about direct equity investment. However, we now have very convenient options like Mutual Fund that take care of all those aspects,” GB said, explaining how mutual fund managers take care of most of the aspects of equity investing. The rupee cost averaging through SIP investments, and investors being able to increase or decrease investments as per their own comfort and cash-flow, being some other big advantages.

“But a fall of 40-50% in a matter of weeks, like the one in March last year, still haunts me. What about safety of investment?” HFD asked.

“You are right, there should be some element of safety. For that you need asset allocation and invest some amount in safer investments like FDs or debt mutual funds. But putting all the money in FDs is actually a disservice to your hard-earned money. You are losing out on the growth in equity markets. The fall you referred to was mainly because of panic among investors, just like your brother in 2008. When so many people sell something, it is obvious that its price will crash. Anybody who looked it at that time as an excellent investment opportunity is right now smiling all the way to his bank” he said.

“Does it mean that I stop using FDs?” HFD asked.

“Not at all, HFD. This does not mean that you put all your money in equity or a large amount in equity all of a sudden. But certainly, it deserves some more attention in your portfolio even if you are conservative” GB said.

HFD promised GB that he will think about the discussion.

Both agreed to discuss the details again next time, with some more real numbers from their own experiences.

Leave a Reply