Tired of stagnant returns on your bank FDs?

In today’s dynamic investment landscape, ditch the drag of fixed deposits and unlock the potential of corporate bonds, corporate FDs, Government Securities (G-Secs) issued by the RBI – Reserve Bank of India, and PSU tax-free bonds!

Why so, you may ask when bank FDs have stood the test of time for decades, are very safe, and giving a high rate of interest at the moment?

Before anything then, let us list out three main issues with the bank FDs that hamper the process of your safe wealth creation hugely:-

- Since there is a perceived sense of safety, the interest rates at all times are always quite low compared to the interest rates in similarly safe instruments which most investors do not know exist.

- In the era of decreasing interest rates as right now, once your current FD matures, you have no option but to renew it at lower rates which the bank will be offering. Please remember that we are about to see the interest rates going down in general from now onwards in India.

- You get low rates of interest in the bank FDs – and nothing else! You may ask what else is possible? What if we give you the country’s SAFEST instrument which gives better rates of interest and also gives you additional capital gains!! Yes, we are referring to Government Securities (G-Secs) issued by the Reserve Bank of India. And G-Secs can be sold very easily in the open market.

Please go through the tables given below which give a large variety of very safe investment options that are suitable for anybody who wishes to invest in high-yielding safe instruments of duration as per their own choice and requirement.

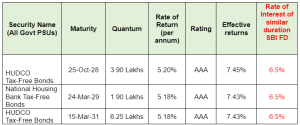

G-Sec (Government Securities issued by the RBI – Reserve Bank of India)

Note: These bonds are available in the open market through us. The above is just an indicative selection. A large number of such bonds are available all the time for various durations and various amounts, and they keep changing subject to availability in the open market. In general, G-Secs typically require a minimum of Rs 10 Lakhs of investment though at times, G-Secs of lower duration become available. A Demat account is required for these bonds.

One additional advantage of G-Secs is that, as the interest rates in the economy go down (which is expected within the next 3-4 months onwards), the market price of higher interest G-Secs rises. Thus, if you sell the G-Secs, you could be making good gains apart from getting the mandated half-yearly interest.

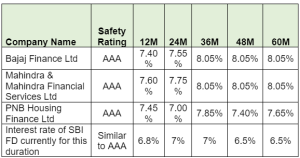

Corporate FDs (all with the highest possible safety rating of AAA)

PSU Tax-free Bonds (Interest fully Tax-free)

Note:- Effective Returns imply taking tax advantage into account if you’re in the 30% tax bracket. The interest received in these bonds is fully tax-free.

A large number of such bonds are available all the time for various durations and various amounts, and they keep changing subject to availability in the open market.

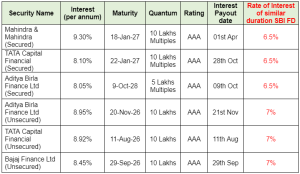

Corporate Bonds (highest-rated bonds with high rates of interest)

In case you opt for cumulative rates of interest, the returns will be even more attractive.

So, don’t put your hard-earned money in low-earning bank FDs anymore!

Don’t settle for mediocrity! Make your money work harder with the flexibility and potential for higher returns offered by corporate bonds, corporate FDs, G-Secs, and tax-free bonds. With careful selection and professional guidance, you can unlock a diversified portfolio that weathers market fluctuations and thrives in the long run.

Invest in your future, contact us today about diversifying your portfolio beyond bank FDs!

Leave a Reply