Your children working in the corporate world will not have any pension from the employer. It is an urgent requirement that you get their retirement savings started NOW, however modest a contribution it would be, to ensure that they remember you for suggesting this step even when they are in their retirement years!

In the classic fable of the Ant and the Grasshopper, the Ant diligently saves for the winter while the Grasshopper lives in the moment without planning for the future. And when the harsh winter comes, the Ant is living as good a life as ever while the Grasshopper is begging around for food for survival.

As we relate this story to retirement planning, the Ant representing the wise investor, diligently works during the summer (working years) to accumulate resources for the winter (retirement). It emphasizes the importance of early savings, echoing the sentiment that time is a valuable asset in wealth accumulation.

Conversely, the Grasshopper represents those who live for the present without considering future needs. This serves as a cautionary tale for individuals who overlook the significance of retirement planning, potentially facing financial challenges in later years.

Moral of the Story for Retirement Planning: Retirement planning, like the Ant’s preparation for winter, is about building a financial nest egg during one’s working years. It’s a call to action, urging individuals to adopt a proactive approach, save diligently, and invest wisely to ensure a comfortable and secure retirement

Retirement is the reward for those who diligently save, invest wisely, and make financial decisions today that echo in the tranquility of tomorrow.

However, most still ignore it because retirement simply seems too far away to matter today. It seems important but not urgent and hence, doesn’t get priritised till it is too late.

Yes, that’s the story of retirement-related goals. If you ask anyone, the priority is today… today’s expenses, this year’s tax savings, next year’s vacation, etc.

Retirement … a big silence.

And, we all know what will be the result. There will be a shortfall in retirement corpus. This shortfall is one of the biggest retirement challenges retirees face. And the lack of knowledge or its acceptance is the next biggest challenge…

Then all that is left during retirement is to live within means … cut on essentials like lifestyle, medical treatment, or even children’s education. In short, cut back on life and keep increasing this cut back as one grows older. Please remember that one can get a loan for almost everything nowadays but not for retirement living 😟

We have close to 9 crore people working in the organized sector, with about 10% in Govt service (approx 93 Lakhs) and the rest in the private sector. Only the former will get some sort of contributory or non-contributory pension from the employer (the Govt), and the balance 8 Crore will not get any pension. The rest of the workforce of about 44 Crore people in the unorganized sector do not even think of how will they live once they no longer work.

Based on the demography, around 50% of the working population is in the age range of 25 to 45 years; in that sense, we are a young nation. And since young normally do not look beyond the next year, how many of them would be planning for their retirement years can be easily imagined. And out of those who have done some planning, we know that a majority of them would not stick to the plan till their retirement age to really benefit them.

Retirement Challenges

The biggest challenge to Retirement is, of course, to realize that it is the biggest financial challenge of life that anybody without a formal pension will ever face. So firstly, it is a behavioral problem and then a ‘starting’ problem.

Coming down to more real issues, without complicating, we would put them across as four important things that a young person today (or you as the parent) has to understand concerning planning for a great, Golden retirement:

1. Avoiding Inflation: Inflation has risen at a rapid rate in recent years and is a global phenomenon. It’s all too common for parents to recall a golden era of modest expenses. Every year you spend more to have pretty much the same things. We have people aiming to have a pension of Rs 1 Lakh per month because it seems like a good amount to have today. But they do not realize that, if they are 35 years today and aim to retire at 60, then a monthly income of Rs 1 Lakh on retirement will buy them what Rs 21,300 can buy today if we consider inflation of 6% per year. So aiming for Rs 1 Lkah of retirement pension is aiming for a really low practical pension 25 years later. Taking life expectancy to be 90 years, if they expect a standard of living equivalent to spending Rs 1 Lakh today, they would be required to accumulate Rs 12-14 Crore by the age of 60 years just for retirement living! And this is without counting the bulk expenses on vacations, car changes, charity, children’s marriages, etc!

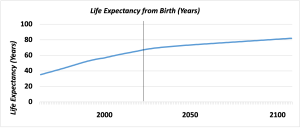

2. Underestimating how long would one live: India’s life expectancy in 1950 was 35.21, but by 2022 it had zoomed to 70.19; as per the UN, it will be about 82 years by 2100. Over the years, better medical care, better diets, and healthier lives have contributed to these higher life expectancy statistics. But paradoxically, people living longer will face the big challenge of funding longer retirement periods. This makes it necessary for them to accumulate more savings to sustain their lifestyle in their retirement years when they won’t have a steady income. You see, for retirement living, a longer life span is also a life challenge!

3. Underestimating the Power of Compounding: If you don’t start investing early, you will end up with an inadequate corpus even if you increase the investment amount substantially every month later nearer to retirement. This is simply the power of compounding at work. Just consider this:

| Early Start (at Age 35 to retire at 60) | Late Start (at Age 45 to retire at 60) | |

| Monthly Investment | 30,000 | 90,000 |

| Total Investment done | 90 Lakhs | 1.62 Crores |

| Expected Annual Return | 12% | 12% |

| Amount Accumulated | 3.077 Crores | |

Just a delay of 10 years implies that thrice the amount is required to be invested for 15 years to accumulate the same amount of retirement corpus. Financially preparing for retirement is like planting a tree; the earlier you start, the more shade it will provide in your golden years. And if your child can start at 25 or 30 years of age, the challenges of retirement funding will go down dramatically…

4. Relying on Wrong Investments: Remember your insurance agent who has one solution for all ailments – an LIC policy. In the same way, many people have gotten stuck with inadequate corpus and poor returns in annuity plans, real estate projects, and gold schemes in the chase for their dream of a good retirement corpus. These assets either give low returns or are illiquid. One has to choose and diversify assets carefully. In the table above, if one had stuck to a traditional avenue like FDs, insurance policies, PPF, etc for planning a retirement corpus over a long period, the corpus created would have been lower by about Rs 1 Crore, not counting the huge tax that also would have been paid over the journey.

So, the question remains – how should one guide own working children to plan for a Golden Retirement?

Here’s the roadmap of what you can tell him/her:

1. Plan as soon as possible! Beginning your retirement planning and investment journey at a young age allows you to stay ahead of inflation. Inflation erodes the purchasing power of money, so it is essential to ensure that your savings grow at a rate that keeps up with rising living costs. As already illustrated, Compounding is another powerful concept that works wonders for retirement savings. Contributions made early and consistently generate substantial growth over time due to compounding.

2. Adequate Health Insurance Cover: Generally, old age is associated with health problems. In your golden age, a health insurance plan will take care of your medical expenses and leave your retirement corpus alone to enable you to enjoy your retirement life to its fullest. Many health insurance plans come with an option of lifelong renewal thus providing continuous coverage irrespective of age.

3. Determine your desired retirement lifestyle/needs and timeline: One may believe that expenses after retirement will be much less than the present. However, owing to the increased life expectancy, improved living standards, and the now-constant urge to get the best out of life at any age, the converse may happen. It has always happened in developed countries and is very visible in India too in middle-class families now.

4. How to plan for Retirement: The first step in retirement planning is to set goals. Ask yourself several important questions, such as:

- At what age do I want to retire?

- What kind of lifestyle do I want to live in retirement?

- How much money will living this lifestyle require?

- What kinds of retirement investment starting from now can best help me accumulate this much money?

- How much money should I contribute to these accounts each month?

- How should the withdrawal of my investments take place when I retire?

Do read this article by our CEO, Col Sanjeev Govila (Retd) in ‘MoneyControl’ a year back, available at this link: https://www.moneycontrol.com/news/business/personal-finance/bucket-strategies-to-plan-income-from-retirement-corpus-9541101.html

5. Evaluating the investment vehicle (scheme(s)) to choose: Be very clear, the investment avenue chosen should beat inflation and be tax-efficient; no compromises be there on it since we’re discussing very long-term investments. Having a good amount of equity (stock-related) products is unavoidable. In fact, in the initial years of investing, it should preferably be 80-100% equity. Other avenues like PPF, NPS, etc can be an add-on to it if desired. Understanding these schemes, their tax benefits, and contribution limits can significantly impact your retirement corpus.

6. Most Importantly: Patience, regular investing, and shunning the desire to keep switching between the flavour-of-the-day avenues are the final cement that will build your beautiful Citadel.

Retirement Planning in India requires meticulous preparation and informed decision-making. By understanding your financial situation, setting clear goals, diversifying investments, and embracing the right mindset, you can secure a comfortable and fulfilling retirement.

Leave a Reply