When it comes to investing, trust and safety are top priorities — especially for those who’ve dedicated their lives to the service of our nation. Among the array of available investment options, bond investments for armed forces officers have quietly emerged as a dependable choice.

These are also the most popular fixed income investments for armed forces officers because of the steady and stable returns they provide.

Bonds, particularly AAA-rated bonds, offer a simple, secure, and steady path to wealth preservation and income generation.

Bond investments for veterans and safe instruments for defence personnel aren’t just about playing safe; they are about playing smart.

When picked wisely, Bonds are not only the safest money instruments, they also offer predictable returns, low risk, and peace of mind. Whether you’re building a retirement plan or creating a stable income source, bonds deserve a strong place in your financial arsenal.

At Hum Fauji Initiatives (HFI), we exclusively offer top-rated AAA bonds, ensuring high credit quality and the least default risk, because we understand the need for financial peace of mind among defence personnel and extended fauji families.

Why Bonds are the preferred Safe Investment options for Armed Forces Personnel

- Capital Preservation with Predictability: Bonds provide stable returns over a fixed tenure. For veterans or serving officers in the Indian armed forces planning for retirement or recurring income needs, they offer a predictable cash flow.

- Regular Income: Most bonds offer periodic interest payouts (monthly, quarterly, semi-annually, or annually). This is perfect for officers who want a steady stream of income post-retirement—making them a strong option in the category of regular income for armed forces officers.

- Low Risk, High Trust: AAA-rated investment bonds are issued by reputed corporates, PSUs, or financial institutions. These carry negligible default risk, an important factor when you’re investing hard-earned money.

- Diversification Beyond Equity and FDs: Investment Bonds act as a balancing factor in your portfolio, especially when equity markets turn volatile. They’re also superior to traditional FDs in terms of post-tax returns.

- Tax Efficiency: Depending on the bond type, tax implications can be optimized through strategic selection.

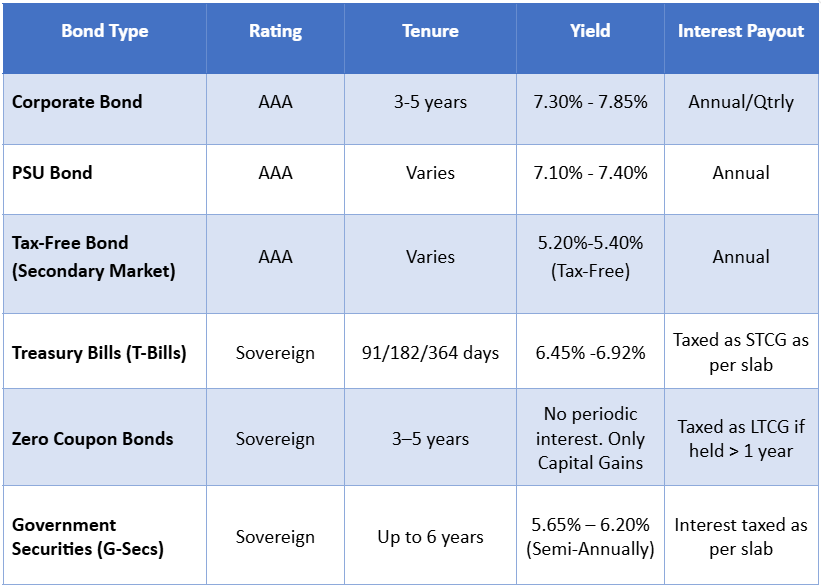

Top Rated Bond Investments, Ratings and Tenure:

Snapshot of a few top-rated AAA and Sovereign bonds currently available through us:

Rates are indicative and subject to market conditions.

Investments in Bonds and who among the armed forces families should consider it for?

- Serving officers with surplus salary or arrears

- Officers planning for early retirement (PMR)

- Veterans looking for safe monthly income

- Anyone with a low-to-moderate risk appetite

What makes Investments in Bonds Suitabile Across Life Stages of Armed Forces Officers

Serving Officers (Ages 30–40):

- Allocate a portion of your corpus to bonds for diversification.

- Use short-term bonds for planned expenses (e.g. child’s education).

Pre-Retirement (Ages 45–54):

- Shift 20–30% of risky assets to AAA bonds for capital preservation.

Veterans & Retirees:

- Opt for monthly/quarterly payout bonds for a steady income.

- Tax-Free Bonds work well for those in higher tax brackets.

These make them ideal debt instruments for defence personnel or safe investments for veterans.

How We Help You Choose the Right Bond Investments?

We don’t just provide a list—we guide you on:

- Tenure matching to your goals

- Interest payout frequency

- Tax efficiency

- Risk profile compatibility

Only AAA-rated and top-tier issuers are considered. We don’t deal in unlisted, lower-rated, or non-transparent structures. Our goal: match safety with returns.

FAQs – Bond Investments for Veterans in Indian Armed Forces

Q1. What is a AAA-rated bond?

AAA rating denotes the highest level of safety. The issuer is considered extremely unlikely to default. We only deal in such instruments.

Q2. Are bonds safer than mutual funds?

Yes. Bonds (especially AAA-rated) are less volatile and offer predictable income compared to equity or hybrid mutual funds.

Q3. Are these bonds taxable?

Yes, most interest is taxed at your slab rate. However, Tax-Free Bonds (issued by PSUs like NHAI, IRFC) offer interest that is fully tax-exempt under Section 10(15)(iv)(h).

Q4. What happens on maturity?

Your invested amount is credited back to your account, and there are no exit charges unless specified.

Q5. Can NRIs invest in these bonds?

Yes, certain bonds are NRI-eligible. However, specific documentation and FEMA compliance is needed.

Q6. What’s the minimum investment in AAA rated Bonds?

Minimum investment through HFI typically starts from Rs. 10 Lakhs.

Q7. How liquid are these bonds?

Secondary market liquidity is limited but improving. For early exit, you can consult us for suitable buyers or exit strategies.

Q8. Are these listed on stock exchanges?

Yes, most are listed on NSE/BSE, providing price transparency and exit options.

Q9. Is TDS applicable?

Yes, if annual interest exceeds ₹5,000, TDS is deducted. PAN submission helps reduce or avoid this.

Q10. What is the risk involved?

AAA bonds carry very low credit risk. However, market-linked bonds may involve interest rate and liquidity risk. Interest rate risk (if sold before maturity), reinvestment risk, and credit risk (mitigated by sticking to AAA-rated issuers).

Q11. Can I reinvest maturity proceeds?

Yes. We provide a rollover strategy aligned with current market rates.

Why Choose Hum Fauji Initiatives for your Fixed Income Investments?

- We deal only in AAA-rated or sovereign-backed bonds / instruments.

- We recommend it based on a deep understanding of the Defence lifestyle, pension flows, and risk appetites of armed forces families.

- Dedicated financial advisory to align bond selection with life stage goals.

If you are unsure which route to take, talk to our expert financial planners. We will tailor a fixed-income plan that’s disciplined, structured, and aligned with your service values.

Connect with us to find the safest bond options tailored towards the prosperity management for your fauji family’s future.

Leave a Reply