The year 2020 was a depressing one for a large part. Thankfully, 2021 is looking significantly better financially though the covid scenario has turned grim again, though hopefully temporarily. The most important concern that most of us have right now is getting addressed as vaccination is picking up pace globally. On the economic front too, things are improving.

The Indian economy, for instance is expected to grow at a double-digit pace in 2021 after a long time. This is also reflected in the way the stock markets are behaving. The benchmark BSE Sensex has been buoyant. It is difficult to comprehend that the same market, which is around 49,000 points now was around 27,000 a year back, in March 2020.

However, the sharp rise in equity markets should also caution us a little. While being optimistic and hopeful for positive developments is good, it should not lead us in to hubris. When it comes to money, personal finance and financial planning, it is critical that we do not lose sight of the fundamentals. One such thing to revisit from time to time is asset allocation.

What is asset allocation?

While our regular readers must be aware about this terminology, we have also had many people who have joined us only in the last few months on their financial planning journey. With the sharp rise in markets, there has been a renewed interest among all the sections to tap in to equity investments. Many of our readers have also reached out to us for this and we are aware that many more are contemplating entering the markets right now. Hence, it is imperative that we revisit this time-tested concept of asset allocation.

In simple words, or as we like to refer it, as grandma’s wisdom, asset allocation is nothing but the strategy of not putting all your eggs in the same basket. The logic is simple. If all eggs are in the same basket and something hits the basket, it is likely that all the eggs will be damaged. On the other hand, if the eggs are spread across different baskets, the eggs in the other baskets will remain safe.

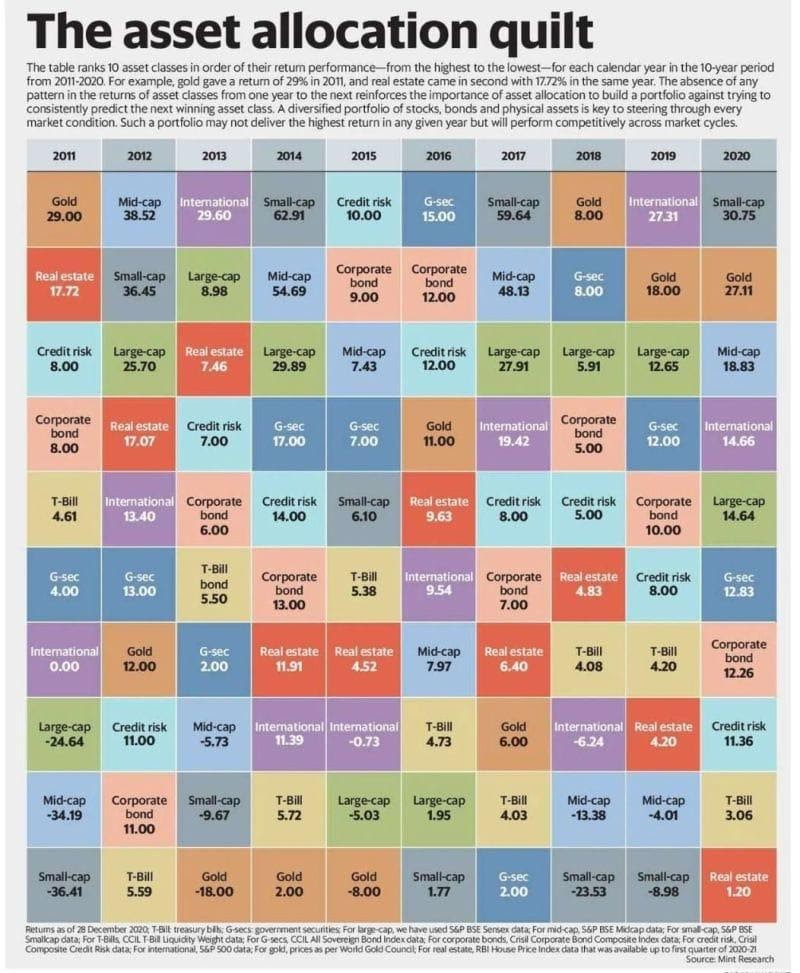

We should be aware for sure that no asset class ever performs consistently well for a very long period of time.

See the chart below (1990 till Jun 2020), made out for 30 years.

Now extrapolate this situation on your investments, where equity, debt, real estate, gold are the different baskets, or asset classes. Traditionally, if one asset class performs poorly, the other asset classes may not follow suit and may behave differently. For example, when the equity markets were in a downward spiral in early 2020, gold prices were firming up.

If we extend the above argument to Indian asset classes (various types of equity, safer investments, Gold, Real estate) etc and over a shorter 10-year period, even then the aspect of asset allocation holds good.

The idea is that even if a part of your investments performs poorly, there will be other investments that will balance out the negativity to some extent, thereby protecting your investment corpus if you have adequate diversification in your portfolio.

What needs to be understood is that asset allocation needs to be revisited and rebalanced from time to time as your life situation changes, your financial goals’ time horizon changes and also because of the changes in the market.

How to rebalance your portfolio?

To be sure, it is important to understand that asset allocation could be very different for two different people. So, for simplicity, we would only consider equity, debt and gold here. If someone has his ideal asset allocation of 60:30:10 for the three asset classes respectively, it is possible that it has skewed in favour of equity due to the sharp rise in valuation in recent months. Accordingly, that person would need to reduce exposure to equity to rebalance their allocation, by moving some money from investments in equity to debt or gold.

While this might appear to be an innocuous or simple adjustment to some, it can act as a major hedge for the value of your portfolio. The surging valuation of the equity bucket of your portfolio might appear exciting right now. However, you also need to take control of your emotions of greed, particularly in a bullish market environment.

Leave a Reply