When the markets are going down, the value of people’s market related investments like stocks, equity mutual funds and ULIPs also go down. This has probably been the case for most investors who started investing within the last 2 years and now see their investments in the red after the markets started their downturn sometime in 2018.

So why have the such investments been disappointing lately and what should an investor do now? We’ll explain with the example of equity mutual funds.

Markets work in cycles

The answer, of course, is to deal with volatility. Over a period of 5 or 6 years, the returns are often great but the variability is high. In any given short period, you could face poor returns, or even losses. There’s another way to look at it. The equity markets move in cycles, and often it takes five to seven years to go through a full cycle of steep rise, fall, stagnation and back. To get the right level of returns, we need to invest through the whole cycle. That won’t happen in a year or even two.

There’s yet another way of looking at it, which was the subject of a study conducted by Value Research about a couple of years ago. It was found that on an average, if one invests through an SIP (Systematic Investment Plan) over four years, then the risk of a loss is negligible. For a typical fund with a multi-decade history, over all possible one year periods, the maximum returns were 160% and the minimum -57%. Over two years, it became 82% and -34%. Over three, 63% and -18%. Over five, 54% and 4%, meaning never any loss. Over ten years, the maximum is 30% and the minimum 13%. These are all annualized figures. The trade-off is absolutely clear – the shorter the period, the higher the potential gain but the worse the possible risk. This evidence squarely puts long-term at five years and above.

Don’t panic and redeem

Many investors actually buy when the markets are performing well, the prices are high and euphoria is even higher and quickly sell after panicking when the markets go down. One shouldn’t take his money out from equity mutual funds the moment he sees the markets go down. This is down to a few reasons:

- Equity mutual funds that are redeemed before a year attract exit-loads of 1% in most cases.

- Even after that, Long Term Capital Gains (LTCG) may be applicable if the interest earned is more than Rs 1 Lakh.

- It should also be noted that the perceived loss when the markets go down is only notional. One should not convert notional loss into a real loss by redeeming his investments.

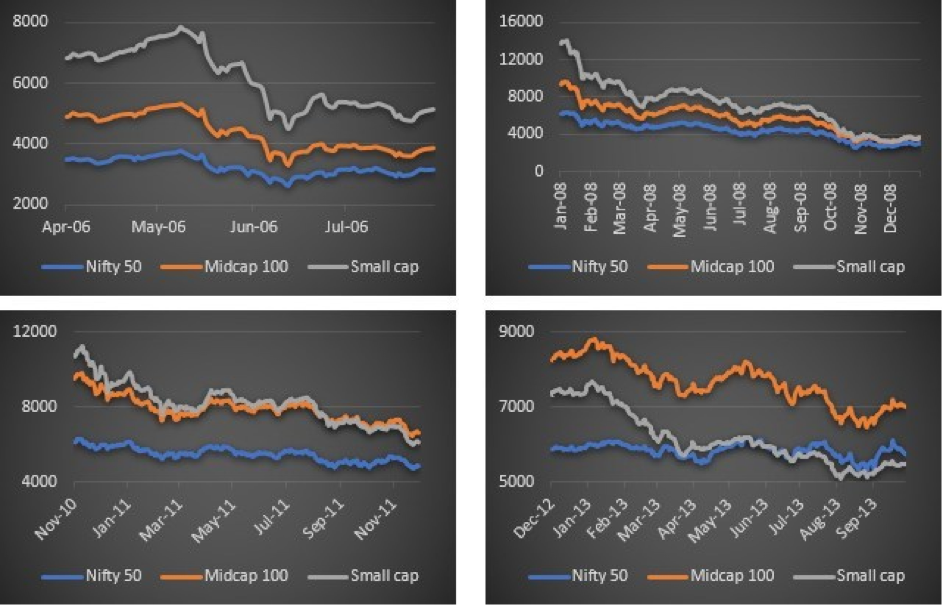

To illustrate this point further, here are a few instances from the past 15 years when the markets went down.

In each of these instances, the market – especially the small and mid-cap segment- fell by a large percentage within the span of just a few months. However, these are only specific periods of decline. When we put the entire 15 year performance on a graph, we get this:

Here, it can be clearly seen that even though there might be certain periods of downward performance, the general trend of the market remains upwards. While the market will go through its ups and downs, if you stay invested in it for the long run, you will generate higher and inflation-beating returns.

Perfect opportunity to buy

The best part is yet to come though. The downturns are not periods when one should just hold tight, sit back and wait it out. These are periods when the market is trading at a discount than what its value was before the downturn started. This presents you with the opportunity to buy more units of the same security at a lower price which means that when the markets eventually go up, you earn a higher return than if you had just waited it out and done nothing.

This is precisely why we recommend investing through the SIP route. By investing regularly, one buys more units at a lower NAV when such a fall occurs, thereby bringing down his/her average cost which eventually earns him/her a higher return.

So, to answer the earlier question, the returns from equity mutual funds have been disappointing lately in large part because that is the nature of markets. The only thing that a wise investor should do in such a scenario is to continue investing and wait it out. Given a long enough time-frame, such a strategy is bound to produce healthy and inflation-beating returns.

Comments (2)

While you have talked about equity MF, what about Debt Funds ?!! Of late few have gone down, have defaulted, segregated and losses incurred. Resultatingly many investors have lost big. Some more are in pipeline it seems eg L & T Debt Funds.

Is it time to move out of Debt Funds and invest in Corporate FDs/ Bank FDs or such instruments ?

Dear Sir,

Thank you for posting your comment on our website.

Traditionally, equity funds have been seen as the ‘risky’ ones which can go down while debt funds have always been seen as the ‘stable’ ones, equivalent to bank FDs. However, the recent events have proved that even the debt funds can sometimes have chinks in their armour. This is more true in case of Credit risk funds or funds where a debt paper is downgraded in its credit rating or, in the worst case, defaulted on its payments.

The kind of defaults seen in the past since Aug 2018 have never ever been seen in the Indian debt markets earlier. There are many reasons for this phenomenon and the recent liquidity issues in the Indian economy have brought this phenomenon further to the fore. Some debt market experts are of the opinion that the worst is now over for the Indian debt markets and the NPAs, liquidity issues etc are now getting sorted out and stabilised.

Your observation on L&T debt funds seems to have originated due to the notice given by L&T AMC yesterday (14th Feb 2020) for introducing the facility of segregation in its debt and hybrid schemes. This is a routine process and does not have any bearing or connection with future defaults happening in any of this AMC’s schemes.

Equity markets going down do not mean selling all equity products. Same way, real estate has been languishing for about 7 years now but one doesn’t just sell all his properties. Similalry, defaults have taken place just in a minuscule percentage of debt funds out of the complete Indian debt fund universe. It does not make the product category bad as such. All the intrinsic advantages of debt funds over corporate / bank FDs remain very much. Sometimes some investors have a significant part of their debt portfolio facing the default brunt – this is just unfortunate but if one is invested in good funds, such reverses get made up over a period of time. Hence, our recommendation is to simply tide over this lean phase and maintain your faith in the mutual funds which have proved their mettle over the past many decades.